Tax Considerations for Gross-Up Payments: What You Need to Know

Explore the tax implications of gross-up payments and understand their taxable nature. Get clarity on how gross-up payments are treated from a taxation perspective.

Browse all articles published in 2024. Total of 609 articles.

Explore the tax implications of gross-up payments and understand their taxable nature. Get clarity on how gross-up payments are treated from a taxation perspective.

Discover an easy method for calculating gross-up wages. This guide provides step-by-step instructions to help you accurately determine gross-up amounts for your employees.

Discover proven techniques to relieve discomfort caused by a dry, tickly cough. Learn simple yet effective strategies to soothe your throat and minimize coughing episodes.

Investigate how language is shaped by cultural factors. This article examines the intricate relationship between language and culture, highlighting the various ways culture influences linguistic expression.

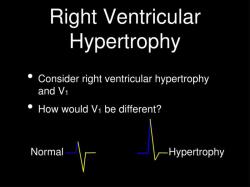

Explore the meaning behind the term "right ventricular hypertrophy" in the context of medical terminology. Gain a clearer understanding of this cardiac condition and its implications.

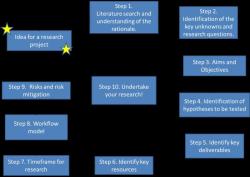

Gain insight into the systematic process of conducting a research study. This comprehensive guide outlines each step involved, from formulating a research question to presenting findings.

Learn about the earliest signs that could indicate the presence of cancer. This article highlights key symptoms to be aware of and emphasizes the importance of early detection.

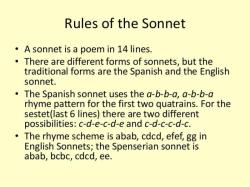

Delve into the poetic rules governing Shakespearean sonnets. Explore the structure, rhyme scheme, and thematic elements characteristic of these timeless literary works.

Learn the fundamental steps involved in calculating the cost of revenue. This guide provides insights into determining the expenses associated with generating revenue for your business.

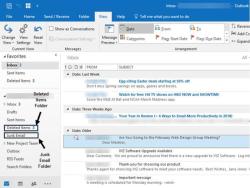

Follow this step-by-step guide to easily locate and access your email on your computer. Learn efficient methods for managing your email accounts and staying organized.