How do I apply for a federal student loan?

Applying for a federal student loan involves several steps, and the process can vary slightly depending on whether you're an undergraduate student, a graduate student, or a parent applying for a Parent PLUS loan. Here's a step-by-step guide for applying for federal student loans as an undergraduate student:

Complete the Free Application for Federal Student Aid (FAFSA):

- The first step in applying for federal student loans is to fill out the FAFSA. You can do this online at the FAFSA website (fafsa.gov). The FAFSA is used to determine your eligibility for federal grants, work-study, and loans, and it collects information about your family's financial situation.

Gather Required Information:

- Before you start the FAFSA, make sure you have your Social Security Number, federal income tax returns, W-2 forms, and other financial documents on hand. You will also need information about the schools to which you want your FAFSA information sent.

Complete the FAFSA:

- Create an FSA ID (Federal Student Aid ID) if you haven't already. You'll use this ID to sign your FAFSA electronically.

- Fill out the FAFSA form online, providing accurate and up-to-date information. Be sure to list the schools you're interested in attending. You can list multiple schools, and the FAFSA results will be sent to each of them.

Review and Confirm Information:

- Review your FAFSA carefully to ensure accuracy. Double-check that you've listed the correct schools and that your financial information is accurate.

Submit the FAFSA:

- Sign and submit your FAFSA using your FSA ID. Keep a record of your submission confirmation for your records.

Receive Your Student Aid Report (SAR):

- After submitting your FAFSA, you'll receive a Student Aid Report (SAR). Review this report for accuracy and make corrections if necessary. The SAR will also indicate your Expected Family Contribution (EFC).

Receive Financial Aid Award Letters:

- Once your schools have received your FAFSA information, they will send you financial aid award letters detailing the types and amounts of aid you're eligible to receive, including federal student loans.

Accept or Decline the Loans:

- Review the award letters and decide which types of aid you want to accept. You're not required to accept all the aid offered to you.

Complete Entrance Counseling:

- If you're a first-time borrower of federal student loans, you will need to complete entrance counseling, which provides information about your rights and responsibilities as a borrower. This can usually be done online.

Sign a Master Promissory Note (MPN):

- To officially accept federal student loans, you'll need to sign a Master Promissory Note (MPN) for each loan type (e.g., Direct Subsidized, Direct Unsubsidized). This is a legal document that outlines the terms and conditions of the loan.

Receive Loan Disbursement:

- The school will disburse the loan funds directly to your account to cover your educational expenses. Typically, this is done at the beginning of each semester or quarter.

It's important to note that the process for graduate students and parents applying for Parent PLUS loans is slightly different. Graduate students will typically complete a FAFSA, receive financial aid award letters, and may be eligible for Direct Unsubsidized Loans and Grad PLUS Loans. Parents applying for Parent PLUS Loans will need to complete a separate application and credit check.

Be sure to follow the instructions provided by your school's financial aid office and the federal student aid website for specific guidance and deadlines related to your application.

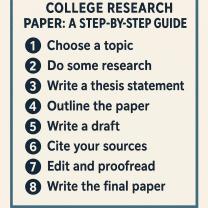

A Step-by-Step Guide to Applying for Federal Student Loans

Step 1: Gather your information. You will need to provide basic information about yourself and your family on the FAFSA, such as your name, date of birth, and Social Security number. You will also need to provide information about your financial situation, including your income and assets.

Step 2: Complete the Free Application for Federal Student Aid (FAFSA). The FAFSA is the application that you will use to apply for federal student loans. You can complete the FAFSA online or by mail.

Step 3: Review your financial aid offer. Once you have completed the FAFSA, you will receive a financial aid offer from your college. This offer will list the types of financial aid that you are eligible for, including federal student loans.

Step 4: Accept your federal student loans. If you decide to accept your federal student loans, you will need to sign a master promissory note. This is a legal agreement that states that you are responsible for repaying your loans.

Step 5: Get your loans disbursed. Once you have signed the master promissory note, your loans will be disbursed to your college. Your college will then use the loan proceeds to pay your tuition and other fees.

Eligibility Criteria and Requirements for Federal Student Loans

To be eligible for federal student loans, you must meet the following criteria:

- You must be a U.S. citizen or eligible noncitizen.

- You must have a valid Social Security number.

- You must be enrolled in an eligible college or university.

- You must maintain satisfactory academic progress.

- You must not be in default on any federal student loans.

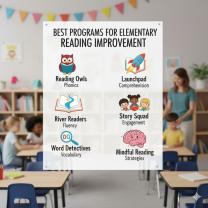

Types of Federal Student Loans and Their Features

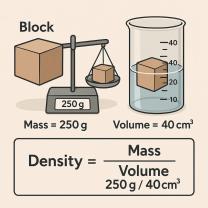

There are two main types of federal student loans: subsidized and unsubsidized.

Subsidized loans are awarded to students with financial need. The government pays the interest on subsidized loans while the student is enrolled in school and during certain grace periods.

Unsubsidized loans are available to all students, regardless of financial need. The student is responsible for paying the interest on unsubsidized loans from the time they are disbursed.

In addition to subsidized and unsubsidized loans, there are a number of other types of federal student loans available, such as PLUS loans and Perkins loans.

Completing the FAFSA: The First Step in the Application Process

The FAFSA, or Free Application for Federal Student Aid, is the first step in the application process for federal student loans. You can complete the FAFSA online or by mail.

The FAFSA asks you for information about your financial situation, including your income and assets. It also asks you for information about your family's financial situation.

You can use the IRS Data Retrieval Tool to automatically transfer your tax information from your previous year's tax return to your FAFSA. This can save you a lot of time and effort.

Tips for Managing Federal Student Loans Responsibly

Here are a few tips for managing federal student loans responsibly:

- Make your payments on time and in full. Even if you can only make a small payment, it is important to make a payment on time. This will help you to avoid late fees and damage to your credit score.

- Consider setting up automatic payments. This will help you to avoid missing any payments.

- If you are struggling to make your payments, you may be eligible for a forbearance or deferment. Contact your loan servicer to learn more about these options.

- Be aware of your repayment options. Once you graduate, you will have a variety of repayment options available to you, including income-driven repayment plans. Choose a repayment plan that works for your budget and financial situation.

Managing federal student loans can be challenging, but it is important to remember that you are not alone. There are a number of resources available to help you succeed.