What is the argument for exclusion of unfair prices?

The exclusion of unfair prices in market practices is an ethical argument rooted in the principles of fairness, transparency, and integrity within financial markets. This argument revolves around the idea that market participants should not engage in practices that result in prices that are deemed unfair or unjust. Here are some key points related to this ethical argument:

1. Fairness and Equity: At the core of this argument is the concept of fairness. Unfair prices can disadvantage certain market participants, such as individual investors, small traders, or less sophisticated market players, leading to unequal outcomes.

2. Transparency: Fair and transparent markets are essential for investor confidence. Unfair pricing practices can erode trust and confidence in the financial markets, potentially deterring participants and reducing market efficiency.

3. Market Integrity: Market integrity is a fundamental principle in finance. Unfair pricing practices, such as price manipulation or insider trading, can compromise the integrity of the market.

4. Regulatory Framework: Many regulatory bodies exist to enforce rules and regulations that promote fair pricing practices. Violating these rules can lead to legal consequences and fines.

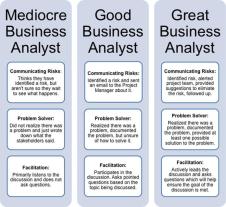

5. Ethical Responsibility: Market participants, including traders, brokers, and financial institutions, have an ethical responsibility to ensure that their actions do not result in unfair prices that harm others.

6. Insider Trading: One of the most widely recognized forms of unfair pricing practices is insider trading, where individuals with non-public information use it to their advantage, disadvantaging others in the market.

7. Price Manipulation: Another unethical practice is price manipulation, which involves artificially inflating or deflating the price of a security to create a false or misleading impression.

8. Impact on Society: Unfair pricing practices not only harm individual investors but can also have broader economic and societal consequences, eroding trust in financial markets and impacting economic stability.

9. Legal and Regulatory Frameworks: To combat unfair pricing practices, legal and regulatory frameworks exist in most developed financial markets. These frameworks set rules and standards that market participants must adhere to.

10. Compliance and Ethics Programs: Many financial institutions and market participants have established compliance and ethics programs to ensure that employees understand and adhere to ethical standards related to pricing and trading practices.

11. Ethical Dilemmas: Traders and financial professionals often face ethical dilemmas in their work, such as balancing the pursuit of profit with ethical behavior. Ethical decision-making is crucial in maintaining market integrity.

In conclusion, the exclusion of unfair prices in market practices is not just a legal or regulatory requirement; it's an ethical imperative. Fair and transparent markets are essential for the functioning of the global financial system, and unethical pricing practices can undermine the integrity of these markets. Market participants, regulators, and society as a whole have a shared interest in upholding ethical standards that promote fairness, transparency, and trust in financial markets.