Should the government forgive student loans?

The debate on whether the government should forgive student loans is complex, with valid arguments on both sides. Let's explore the pros and cons of student loan forgiveness:

Pros:

Debt Relief for Borrowers:

- Student loan forgiveness provides immediate relief for borrowers who may be struggling with substantial student debt. It can improve their financial well-being and provide a fresh start for those facing significant financial challenges.

Economic Stimulus:

- Forgiving student loans can stimulate the economy by freeing up funds that borrowers would have otherwise spent on loan repayments. This additional disposable income could be used for consumer spending, contributing to economic growth.

Reduced Inequality:

- Student loan forgiveness addresses the issue of inequality by providing relief to individuals who may have taken on higher education debt but face barriers to repayment. This can help bridge socioeconomic gaps and promote equal opportunities for all.

Encourages Education and Entrepreneurship:

- The prospect of student loan forgiveness may encourage more individuals to pursue higher education or entrepreneurship without the fear of overwhelming debt. This can lead to a more educated and innovative workforce.

Stimulates Housing Market:

- With reduced student loan debt, individuals may be more likely to qualify for mortgages and become homeowners. This can positively impact the housing market and contribute to increased homeownership rates.

Cons:

Cost to Taxpayers:

- Implementing widespread student loan forgiveness comes with a significant cost to taxpayers. The government would need to allocate substantial funds to cover the forgiven debt, potentially leading to increased taxes or reallocation of resources from other important programs.

Unintended Consequences:

- Student loan forgiveness may have unintended consequences, such as encouraging risky borrowing behavior. If individuals believe their debt will be forgiven, they might be less inclined to carefully consider the costs and benefits of their education choices.

Fairness Concerns:

- Some argue that widespread student loan forgiveness is unfair to those who have already paid off their student loans or chose not to take on significant debt for education. It raises questions about whether it is equitable to provide relief to some individuals but not others.

Impact on Credit Markets:

- Large-scale student loan forgiveness could impact credit markets, as lenders may become more cautious about issuing loans if there is uncertainty about the government's willingness to enforce repayment agreements.

Shifts Responsibility from Borrowers to Taxpayers:

- Critics argue that student loan forgiveness shifts the responsibility of repaying loans from borrowers to taxpayers. Those who did not attend college or did not take on substantial student debt may question why they should bear the burden of repaying others' loans.

The debate on student loan forgiveness involves weighing the potential benefits for borrowers against the financial and societal implications for the broader population. Policymakers must carefully consider the economic, social, and ethical dimensions before making decisions on this issue.

Addressing the student loan crisis: Should the government forgive student loans?

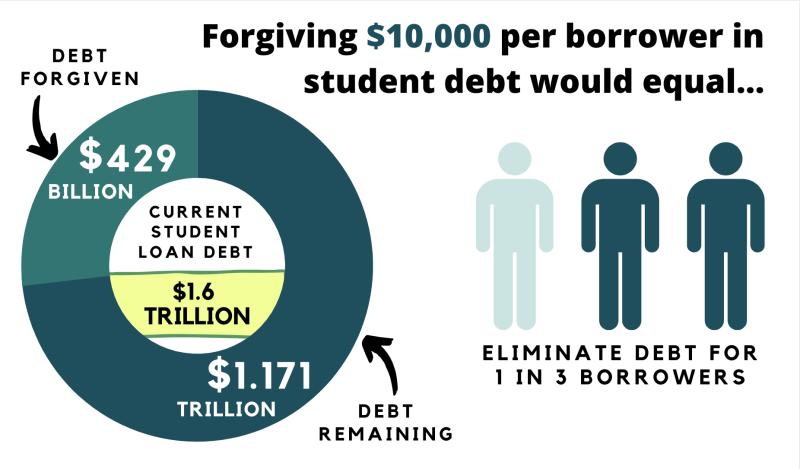

The student loan crisis in the United States has reached a critical juncture, with over 43 million borrowers collectively owing $1.75 trillion in student debt. This mounting debt burden has significant ramifications for individuals, families, and the overall economy.

At the heart of the debate lies the question of whether the government should forgive student loans. Proponents of student loan forgiveness argue that it would provide much-needed relief to struggling borrowers, boost the economy by increasing consumer spending, and promote social equity by reducing the financial burden on borrowers from disadvantaged backgrounds.

Opponents of student loan forgiveness raise concerns about the potential impact on taxpayers, the fairness of forgiving debt incurred by past borrowers, and the moral hazard of encouraging excessive borrowing in the future.

Exploring arguments for and against student loan forgiveness

Arguments for Student Loan Forgiveness:

Provides relief to struggling borrowers: Student loan forgiveness would alleviate the financial strain on millions of borrowers who are struggling to repay their debts. This could improve their overall well-being, allowing them to afford housing, save for retirement, and contribute more fully to the economy.

Stimulates the economy: By reducing the debt burden on borrowers, student loan forgiveness could increase consumer spending and boost economic activity. This could lead to job creation and economic growth.

Promotes social equity: Student loan debt disproportionately affects borrowers from low-income and minority backgrounds. Forgiveness could help address these disparities and promote social mobility.

Arguments Against Student Loan Forgiveness:

Burden on taxpayers: Forgiveness would shift the burden of student loan debt from borrowers to taxpayers. This could raise concerns about the fairness of asking taxpayers to shoulder the responsibility for debt incurred by individuals.

Fairness to past borrowers: Forgiveness could be seen as unfair to borrowers who have already repaid their debts. It could also create incentives for future borrowers to expect forgiveness, potentially leading to increased borrowing.

Moral hazard: Forgiveness could encourage excessive borrowing in the future, as students may anticipate that their debts will be forgiven. This could lead to a cycle of debt accumulation and increased costs for higher education.

Assessing the potential economic and social impacts of government forgiveness policies

The potential economic and social impacts of government student loan forgiveness policies are complex and multifaceted. While there are potential benefits, there are also concerns about the impact on taxpayers, fairness, and moral hazard.

Economic Impacts:

Increased consumer spending: Forgiven borrowers may have more disposable income to spend on goods and services, which could stimulate the economy.

Reduced loan defaults: Forgiveness could reduce the likelihood of loan defaults, which would benefit lenders and potentially lower interest rates for future borrowers.

Impact on higher education costs: Forgiveness could lead to increased demand for higher education, which could put upward pressure on tuition fees.

Social Impacts:

Improved well-being of borrowers: Forgiven borrowers may experience reduced stress, improved mental health, and increased financial stability.

Reduced income inequality: Forgiveness could help reduce income inequality by alleviating the financial burden on borrowers from disadvantaged backgrounds.

Impact on educational choices: Forgiveness could influence students' decisions regarding higher education, potentially leading to more students pursuing degrees in high-demand fields.

The overall impact of student loan forgiveness policies would depend on various factors, including the scope of forgiveness, the design of the program, and the broader economic and social context. Careful consideration and analysis are necessary to evaluate the potential benefits and drawbacks of such policies.