What are skills I can put on a resume?

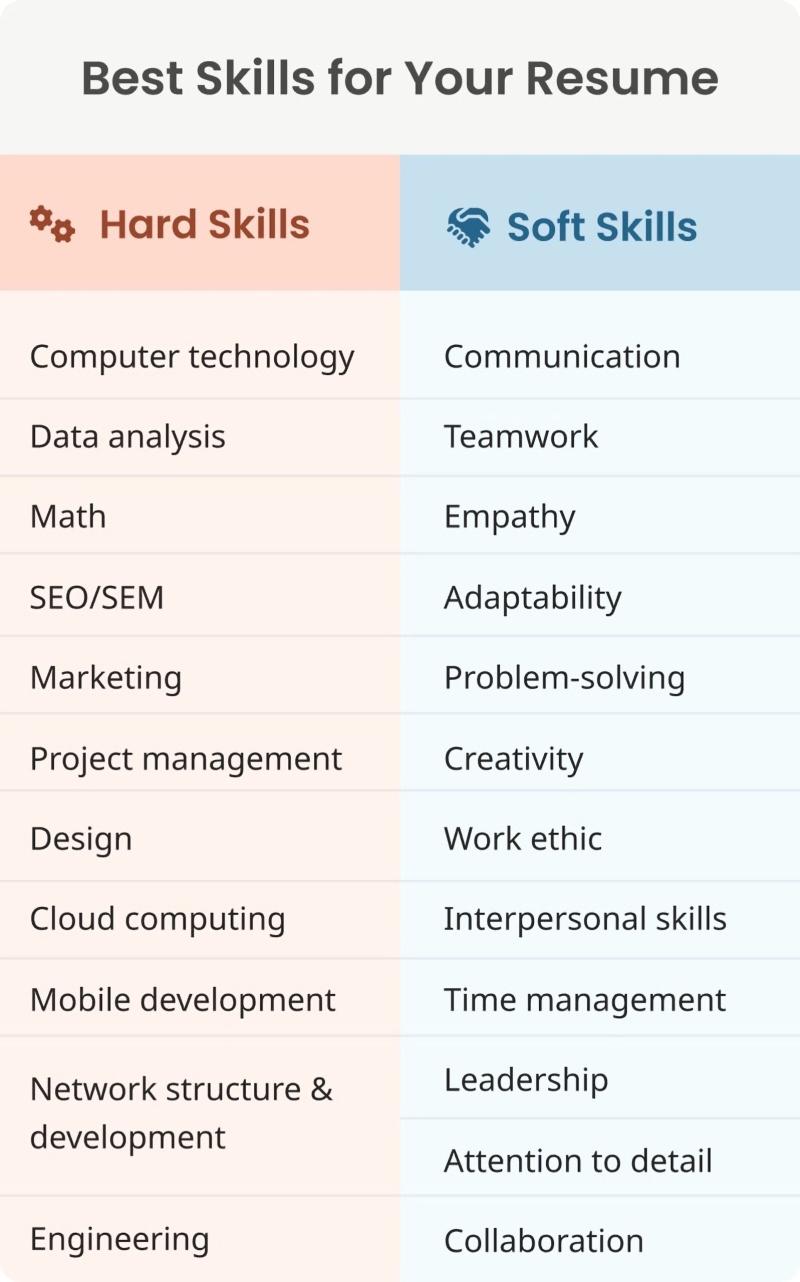

When crafting your resume, it's essential to showcase a mix of hard and soft skills that align with the specific job and industry. Here is a list of skills you can consider including on your resume:

Hard Skills:

Technical Proficiencies:

- Programming Languages (e.g., Java, Python)

- Data Analysis (e.g., Excel, SQL)

- Web Development (e.g., HTML, CSS, JavaScript)

- Graphic Design (e.g., Adobe Creative Suite)

Project Management:

- Agile Methodology

- Scrum

- Project Scheduling (e.g., Gantt charts)

Industry-Specific Knowledge:

- Healthcare Terminology

- Legal Research

- Financial Modeling

Language Skills:

- Proficiency in Languages (e.g., Spanish, Mandarin)

- Translation and Interpretation

Certifications:

- Relevant Certifications (e.g., PMP, AWS Certified Developer)

Data Management:

- Database Management (e.g., MySQL, MongoDB)

- Data Warehousing

Quality Assurance:

- Software Testing

- QA Automation (e.g., Selenium)

Operating Systems:

- Windows, macOS, Linux

- Server Administration

Soft Skills:

Communication:

- Verbal and Written Communication

- Presentation Skills

Problem Solving:

- Analytical Thinking

- Critical Thinking

Teamwork:

- Collaboration

- Relationship Building

Adaptability:

- Flexibility

- Willingness to Learn

Time Management:

- Prioritization

- Meeting Deadlines

Leadership:

- Decision Making

- Delegation

Creativity:

- Innovation

- Design Thinking

Customer Service:

- Client Relationship Management

- Conflict Resolution

Organizational Skills:

- Planning and Coordination

- Multitasking

Emotional Intelligence:

- Empathy

- Self-Awareness

Industry-Specific Skills:

Marketing:

- Social Media Marketing

- SEO Optimization

Sales:

- Relationship Selling

- Cold Calling

Human Resources:

- Employee Relations

- Recruitment and Selection

Education:

- Classroom Management

- Curriculum Development

Healthcare:

- Electronic Health Records (EHR)

- Patient Care

Tailor the skills on your resume to match the requirements of the job you're applying for. Use keywords from the job description to make your resume more relevant to the specific position. Additionally, provide specific examples of how you've applied these skills in your previous roles to demonstrate your proficiency.

What are some skills that can be included on a resume?

Whether or not credit cards are advisable for individuals with low credit scores depends on several factors and there's no one-size-fits-all answer. Here's a breakdown of both the potential benefits and drawbacks to consider:

Potential benefits:

- Building credit: Using a credit card responsibly and paying your bills on time can actually help improve your credit score over time. This is because regular, on-time payments demonstrate your ability to handle credit responsibly.

- Access to emergency funds: Having a credit card can provide a safety net in case of unexpected expenses.

- Convenience and purchase protection: Credit cards offer convenient payment options and often come with purchase protection benefits, such as extended warranties or theft protection.

- Travel benefits: Some travel-oriented credit cards offer perks like airport lounge access, travel insurance, and rewards points that can be redeemed for flights or hotels.

Potential drawbacks:

- High interest rates: Individuals with low credit scores typically qualify for higher interest rates on credit cards, which can lead to significant debt if not managed carefully.

- Temptation to overspend: It's easy to overspend with a credit card, especially if you are not used to budgeting and tracking your finances. This can lead to debt accumulation and financial strain.

- Annual fees: Some credit cards, particularly those with rewards programs, charge annual fees. Make sure the benefits outweigh the cost of the annual fee before applying.

- Predatory lending: Be wary of lenders offering "easy credit" to individuals with bad credit. These loans often have very high interest rates and hidden fees, and can trap you in a cycle of debt.

Alternatives to consider:

- Secured credit card: This type of card requires a refundable security deposit that is equal to your credit limit. Using a secured card responsibly can help build your credit score.

- Debit card: A debit card uses your own money, so you can't overspend. This can be a good option for individuals who struggle with budgeting or overspending.

- Cash: Using cash can help you stay mindful of your spending and avoid debt.

Ultimately, the decision of whether or not to get a credit card with a low credit score is a personal one. Weigh the potential benefits and drawbacks carefully, and consider alternative options before making a decision. If you decide to get a credit card, be sure to choose one with a low interest rate and no annual fees. It's also important to develop healthy credit habits, such as paying your bills on time and keeping your credit utilization ratio low.

Remember, building good credit takes time and effort. There is no quick fix, and it's important to be patient and responsible with your credit card use.

I hope this information helps you make an informed decision!