What are Treasury responsibilities?

The Treasury Department of a government typically handles a wide array of financial duties and responsibilities. These responsibilities can vary slightly between countries, but generally, the key functions of a Treasury Department include:

Managing Government Finances: The Treasury manages the government's finances, including budgeting, accounting, and financial reporting. It oversees the collection of revenue, such as taxes, and manages government spending.

Issuing and Managing Debt: The Treasury is often responsible for issuing government debt, including bonds and securities, to finance government operations and manage deficits. It monitors and manages the national debt, aiming to ensure fiscal sustainability.

Cash Management: It manages the government's cash flow, ensuring that there is enough liquidity to meet financial obligations without holding excess cash that could be invested more effectively.

Overseeing Banking and Financial Institutions: The Treasury often plays a role in regulating and overseeing banks and financial institutions to ensure stability within the financial system. This includes implementing policies to promote stability and monitoring financial markets.

Currency and Coinage: In many countries, the Treasury oversees the production and distribution of currency and coinage, working closely with the central bank to manage the nation's money supply.

Economic Policy Development: The Treasury Department often plays a significant role in formulating economic policies, advising the government on fiscal matters, and developing strategies to promote economic growth, stability, and prosperity.

International Financial Relations: Managing international financial relations, negotiating financial agreements, and representing the government in international financial organizations are often part of the Treasury's responsibilities.

Enforcing Financial Laws and Regulations: The Treasury Department enforces financial laws and regulations, including combating financial crimes such as money laundering, terrorism financing, and tax evasion.

Treasury Auctions: Conducting auctions for government securities to finance government operations and meet financial obligations is another crucial function.

Risk Management: Assessing and managing financial risks, including market risks, interest rate risks, and currency risks, to protect the government's financial interests.

The Treasury Department plays a pivotal role in managing a country's financial health, overseeing fiscal policies, and ensuring the efficient and effective use of financial resources to support the government's operations and economic stability.

The U.S. Department of the Treasury is a critical government agency responsible for managing the nation's finances, enforcing tax laws, overseeing government spending, and safeguarding the financial system. Its diverse functions play a crucial role in maintaining economic stability and prosperity for the United States.

Key Functions of the U.S. Department of the Treasury

Managing the Nation's Finances: The Treasury is the steward of the federal government's finances. It oversees the collection and disbursement of trillions of dollars annually, ensuring that the government has the funds to fulfill its obligations and meet its fiscal goals.

Economic Policy Formulation: The Treasury plays a central role in shaping economic policy. It analyzes economic trends, advises the President and Congress on economic matters, and implements fiscal policies that promote economic growth, stability, and employment.

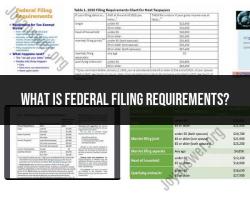

Tax Laws and Revenue Collection: The Treasury is responsible for enforcing tax laws and collecting revenue from individuals, businesses, and corporations. It also oversees the Internal Revenue Service (IRS), the agency responsible for administering the tax code.

Government Spending and Financial Regulations: The Treasury oversees federal spending, ensuring that taxpayer dollars are used efficiently and effectively. It also regulates financial institutions, such as banks and insurance companies, to protect consumers and maintain the stability of the financial system.

Monetary Policy Coordination: The Treasury works closely with the Federal Reserve, the nation's central bank, to coordinate monetary policy. This collaboration aims to maintain low inflation, stable interest rates, and a strong economy.

Debt Management and Borrowing: The Treasury manages the federal government's debt, which is the money borrowed to finance deficits. It issues Treasury bonds and other securities to raise funds and ensures that the government can meet its financial obligations.

International Financial Relations: The Treasury represents the United States in international financial matters, negotiating trade agreements, managing international debt, and promoting global financial stability.

Financial Crimes Enforcement Network (FinCEN): FinCEN, a bureau within the Treasury Department, collects and analyzes financial data to combat money laundering, terrorist financing, and other financial crimes.

Financial Education and Public Outreach: The Treasury provides financial education resources to the public, helping individuals make informed financial decisions and understand the role of government in the economy.

In summary, the U.S. Department of the Treasury plays a multifaceted and essential role in the nation's economic well-being. Its diverse functions, ranging from managing federal finances to enforcing tax laws and ensuring financial stability, contribute to the overall prosperity and economic security of the United States.