What is a good IRR for a rental property?

The Internal Rate of Return (IRR) is a critical metric used to assess the potential profitability of an investment, including rental properties. The "good" IRR for a rental property can vary widely based on several factors, including your investment goals, location, property type, financing terms, and risk tolerance. Here are some general guidelines to consider when evaluating the IRR for a rental property:

Investment Goals: Your investment objectives play a significant role in determining what constitutes a good IRR. If your primary goal is consistent cash flow and long-term appreciation, you may be content with a lower IRR. On the other hand, if you're seeking higher returns and are willing to accept more risk, you might aim for a higher IRR.

Market Conditions: Real estate markets vary widely, and what is considered a good IRR can differ based on location and current market conditions. In competitive, high-demand markets with rising property values, you might find lower IRRs compared to markets with lower property prices and higher potential rental income.

Risk Tolerance: Your willingness to take on risk can impact your acceptable IRR threshold. Higher-risk investments often offer the potential for higher IRRs, but they also come with greater uncertainty and downside risk. Conservative investors may favor lower-risk, lower-IRR properties.

Property Type: The type of rental property you're considering can influence the expected IRR. For example, commercial properties may offer higher potential IRRs but can also involve more complexity and risk compared to residential properties.

Financing Terms: The terms of your financing, including interest rates and loan terms, can significantly affect the IRR. Favorable financing terms can boost your IRR, while less favorable terms can lower it.

Exit Strategy: Your investment horizon and exit strategy also impact the IRR. If you plan to hold the property for the long term and benefit from appreciation, you may be satisfied with a lower IRR. Conversely, if you plan to sell the property relatively soon, you might seek a higher IRR to justify the shorter investment horizon.

Local Regulations and Taxes: Local property regulations and tax laws can have implications for the IRR. Consider property taxes, income taxes, and any potential changes in regulations that could affect your returns.

Competitive Analysis: Evaluate the IRR in the context of similar properties in the area. A good IRR should be competitive with other investments in the local market.

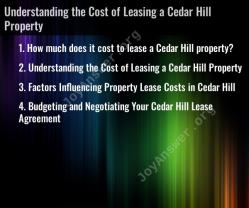

As a general guideline, many real estate investors consider an IRR of 10% or higher to be a good target for a rental property. However, it's essential to remember that what constitutes a "good" IRR is subjective and depends on your individual circumstances and preferences.

Ultimately, the IRR should align with your financial goals, risk tolerance, and the specific characteristics of the rental property and market in which you're investing. It's advisable to conduct a thorough financial analysis and consult with financial advisors or real estate professionals to help you assess the IRR and overall investment potential of a rental property based on your unique situation.

Determining a Good IRR for Rental Property Investments

A good IRR for a rental property investment is one that is higher than the investor's cost of capital and that meets the investor's individual investment goals.

The cost of capital is the minimum return that an investor expects to receive on their investment. It can be calculated using a variety of methods, such as the weighted average cost of capital (WACC).

In general, an IRR of 10% or higher is considered to be a good return on investment for rental properties. However, the desired IRR will vary depending on the investor's individual risk tolerance and investment goals.

For example, an investor who is saving for retirement may have a lower desired IRR than an investor who is looking to generate short-term income.

Rental Property IRR: What's Considered Favorable?

A favorable IRR for a rental property investment is one that is higher than the investor's cost of capital and that meets the investor's individual investment goals.

For example, if an investor's cost of capital is 8%, then a favorable IRR for a rental property investment would be 10% or higher. This would mean that the investor is expected to earn a return on their investment that is greater than their cost of capital.

The investor's individual investment goals will also play a role in determining what is considered a favorable IRR. For example, an investor who is saving for retirement may have a lower desired IRR than an investor who is looking to generate short-term income.

Interpreting IRR in Rental Property Analysis

IRR is a powerful tool for evaluating rental property investments. It can be used to compare different investment opportunities and to determine which investment is expected to generate the highest return.

However, it is important to note that IRR is just one factor to consider when making a rental property investment decision. Other factors, such as the location of the property, the condition of the property, and the potential for appreciation, should also be considered.

Here are some tips for interpreting IRR in rental property analysis:

- Compare the IRR of different investment opportunities to determine which investment is expected to generate the highest return.

- Consider your cost of capital when evaluating the IRR of a rental property investment.

- Keep in mind that IRR is just one factor to consider when making a rental property investment decision. Other factors, such as the location of the property, the condition of the property, and the potential for appreciation, should also be considered.

Additional Factors to Consider

In addition to IRR, there are a number of other factors that investors should consider when evaluating rental property investments, including:

- Location: The location of the property is a key factor that will affect its value and rental potential.

- Condition: The condition of the property will also affect its value and rental potential. Investors should consider the cost of any repairs or maintenance that may be needed.

- Potential for appreciation: Investors should also consider the potential for appreciation in the value of the property. This will depend on a number of factors, such as the location of the property, the condition of the property, and the overall housing market.

Conclusion

IRR is a useful tool for evaluating rental property investments. However, it is important to consider other factors, such as the location of the property, the condition of the property, and the potential for appreciation, when making an investment decision.