How do you calculate return on investment property?

Calculating the return on investment (ROI) for a property involves assessing the potential profitability of the investment. ROI is typically expressed as a percentage and reflects the return you expect to earn relative to the initial investment cost. To calculate ROI for a property, follow these steps:

Determine the Initial Investment Cost:

- Include the purchase price of the property.

- Add any upfront acquisition costs, such as real estate agent fees, closing costs, legal fees, and inspection expenses.

- Include any renovation or improvement costs that are necessary to make the property rentable or saleable.

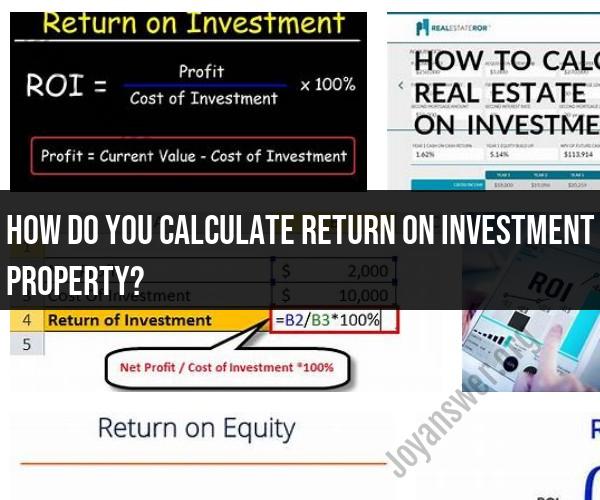

Formula:

Calculate the Net Operating Income (NOI):NOI represents the property's annual income minus its operating expenses. To calculate NOI, consider the following:

- Rental income: The total annual rent you expect to receive from the property.

- Other income: Additional income sources, such as parking fees, laundry revenue, or pet fees.

- Operating expenses: Include property taxes, insurance, property management fees, maintenance costs, utilities, and any other recurring expenses.

Formula:

Determine the Annual Cash Flow:Cash flow is the money you have left after paying all operating expenses and debt service (if applicable). Debt service includes mortgage payments, if you have financed the property.

Formula:

Calculate the ROI:The ROI is the return you receive on your initial investment, expressed as a percentage. Divide the annual cash flow by the initial investment cost and multiply by 100 to get the ROI percentage.

Formula:

Consider Other Factors:While ROI is a crucial metric, it's essential to consider other factors when assessing the profitability of a property investment. These include property appreciation, tax implications, financing terms, and market conditions.

Keep in mind that ROI is just one metric to evaluate the potential of a property investment. It doesn't account for factors like property appreciation, changes in market conditions, or tax implications. It's important to conduct a comprehensive analysis, including a feasibility study, to assess whether a property investment aligns with your financial goals and risk tolerance.

Additionally, ROI calculations can vary based on individual circumstances and assumptions, so consider consulting with a financial advisor or real estate professional for a more detailed analysis tailored to your specific investment scenario.

Calculating Return on Investment for Property: Key Factors

There are a number of key factors to consider when calculating the return on investment (ROI) for property:

- Purchase price: The purchase price is the amount of money you paid for the property.

- Closing costs: Closing costs are the additional fees and expenses that you pay when you purchase a property, such as title insurance, appraisal fees, and loan origination fees.

- Financing costs: If you finance your purchase, you will need to factor in the cost of your mortgage payments, including interest and principal.

- Repairs and maintenance: Properties require ongoing repairs and maintenance, so you will need to budget for these costs.

- Property taxes: You will need to pay property taxes on your investment property.

- Insurance: You will need to purchase insurance to protect your investment property from damage and liability.

- Rental income: If you are renting out your investment property, you will need to factor in the rental income that you expect to receive.

- Appreciation: Appreciation is the increase in the value of your property over time.

ROI Calculation for Real Estate: Insights and Formulas

The most common formula for calculating ROI for property is:

ROI = (Net Profit / Investment Cost) * 100

where:

- Net profit is the difference between your rental income and all of your expenses, including mortgage payments, property taxes, insurance, and repairs and maintenance.

- Investment cost is the sum of your purchase price, closing costs, and financing costs.

For example, if you purchase an investment property for $100,000 and your annual net profit is $10,000, your ROI would be 10%.

Property Investment ROI: Crunching the Numbers

When crunching the numbers for your property investment ROI, it is important to be realistic about your expenses and rental income. You should also factor in the time it will take you to sell the property if you plan to do so in the future.

Here is an example of how to calculate ROI for a property investment:

- Purchase price: $100,000

- Closing costs: $2,000

- Financing costs: $5,000

- Total investment cost: $107,000

- Annual rental income: $12,000

- Annual expenses: $2,000 (property taxes, insurance, and repairs and maintenance)

- Annual net profit: $10,000

ROI = (Net Profit / Investment Cost) * 100

ROI = ($10,000 / $107,000) * 100

ROI = 9.35%

Based on this calculation, the ROI for this property investment would be 9.35%.

It is important to note that ROI is just one factor to consider when making a property investment decision. You should also consider other factors, such as the location of the property, the condition of the property, and the potential for appreciation.