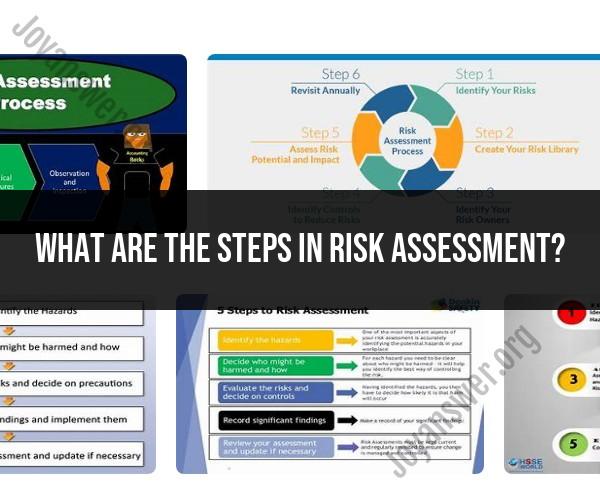

What are the steps in risk assessment?

Navigating the Steps in Risk Assessment: From Identification to Mitigation

Risk assessment is a systematic process used to identify, analyze, and mitigate potential risks and uncertainties that can impact individuals, businesses, or projects. Here's a breakdown of the steps involved in risk assessment:

1. Risk Identification:

Begin by identifying potential risks that could affect the desired outcome. These risks can be internal or external to the system being assessed. Brainstorm and list as many risks as possible to ensure comprehensive coverage.

2. Risk Analysis:

Once risks are identified, analyze each risk's potential impact and likelihood of occurrence. This analysis helps prioritize risks based on their severity and the likelihood of them materializing. Use qualitative or quantitative methods for analysis.

3. Risk Evaluation:

Assess the significance of each identified risk by considering the combined impact of its likelihood and consequences. Determine which risks are acceptable and which require further attention.

4. Risk Mitigation:

Develop strategies to mitigate or reduce the impact of identified risks. This could involve implementing preventive measures, transferring risk through insurance, developing contingency plans, or allocating resources to address potential issues.

5. Risk Monitoring:

Continuously monitor the identified risks and the effectiveness of mitigation strategies. Regularly assess if new risks have emerged and if existing risks have changed in severity or likelihood.

6. Communication and Reporting:

Effective communication is crucial throughout the risk assessment process. Report findings, identified risks, mitigation strategies, and their progress to stakeholders, decision-makers, and relevant parties.

7. Adaptation and Review:

Risk assessment is an iterative process. As circumstances change, reevaluate and adapt the risk assessment to ensure its relevance. Regularly review and update the assessment based on new information.

Risk assessment allows individuals and organizations to proactively address potential challenges and uncertainties, ultimately enhancing decision-making and minimizing negative impacts.