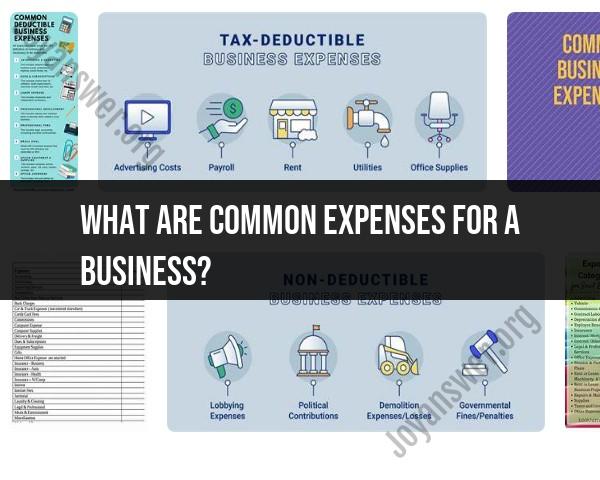

What are common expenses for a business?

Navigating business finances effectively involves understanding and managing common expenses that every business incurs. These expenses can be categorized into various types, such as fixed, variable, operational, and capital expenses. Here’s a comprehensive list of common business expenses:

1. Operational Expenses

Rent and Utilities

- Office Space Rent: Monthly payments for leasing office, retail, or warehouse space.

- Utilities: Costs for electricity, water, gas, internet, and telephone services.

Employee Salaries and Benefits

- Salaries and Wages: Regular payments to employees for their work.

- Benefits: Health insurance, retirement plans, paid time off, and other employee benefits.

- Payroll Taxes: Employer’s share of Social Security, Medicare, and other payroll-related taxes.

Office Supplies and Equipment

- Office Supplies: Items such as paper, pens, printer ink, and other consumables.

- Office Equipment: Computers, printers, desks, chairs, and other necessary office equipment.

2. Marketing and Advertising Expenses

Marketing Materials

- Printing Costs: Brochures, business cards, flyers, and other promotional materials.

- Digital Marketing: Costs associated with online advertising, such as Google Ads, social media ads, and email marketing campaigns.

Public Relations and Branding

- Public Relations Services: Fees for PR agencies or consultants.

- Branding: Expenses for logo design, website development, and other branding activities.

3. Professional Services

Legal and Accounting Fees

- Legal Fees: Costs for legal advice, contract drafting, and other legal services.

- Accounting Services: Fees for bookkeeping, tax preparation, and financial consulting.

Consulting Services

- Business Consultants: Fees for strategic, operational, or technical advice.

4. Insurance

Business Insurance

- Liability Insurance: Coverage for legal liabilities.

- Property Insurance: Protection for business property against theft, fire, and other risks.

- Workers' Compensation: Insurance to cover employees in case of work-related injuries.

5. Technology and Software

Software Subscriptions

- Software Licenses: Costs for essential business software, such as accounting, CRM, and project management tools.

- Cloud Services: Fees for cloud storage, hosting, and other online services.

IT Support and Maintenance

- IT Support: Costs for maintaining and troubleshooting computer systems and networks.

- Hardware Maintenance: Expenses for repairing and upgrading computers and other equipment.

6. Production and Operational Costs

Raw Materials and Inventory

- Raw Materials: Costs for materials needed for manufacturing or production.

- Inventory: Purchase of products or components for resale.

Shipping and Logistics

- Shipping Costs: Expenses for delivering products to customers or receiving supplies.

- Warehousing: Costs for storing inventory and goods.

7. Miscellaneous Expenses

Travel and Entertainment

- Business Travel: Costs for flights, accommodations, and meals during business trips.

- Entertainment: Expenses for client meetings, meals, and entertainment.

Training and Development

- Employee Training: Costs for professional development courses, seminars, and workshops.

Summary

Understanding these common expenses is crucial for budgeting, forecasting, and managing the financial health of your business. Regularly reviewing and controlling these costs can help ensure your business remains profitable and sustainable.

What are some common operational expenses incurred by businesses?

Businesses incur a variety of operational expenses to keep their day-to-day operations running smoothly. These expenses can be broadly categorized into two main types: fixed costs and variable costs.

Fixed Costs: These remain relatively constant regardless of the business's activity level (production volume or sales). They are essential for maintaining the basic infrastructure and functionality of the business. Here are some common examples:

- Rent: Lease payments for office space, warehouses, or retail storefronts.

- Salaries and benefits: Compensation for employees, including payroll taxes and health insurance.

- Utilities: Costs associated with electricity, water, gas, and internet for running the facilities.

- Insurance: Premiums for property insurance, liability insurance, and other business insurance policies.

- Loan payments: Repayments for any business loans taken out.

- Accounting and legal fees: Professional service fees for accounting, legal advice, and other necessary consultations.

Variable Costs: These fluctuate in proportion to the business's activity level. As production or sales increase, variable costs tend to go up, and vice versa. Here are some common examples:

- Cost of goods sold (COGS): The direct costs associated with producing the goods or services the business sells, including raw materials, labor directly involved in production, and supplies.

- Marketing and advertising: Expenses related to promoting the business and its products or services, such as online advertising, social media marketing, and printing promotional materials.

- Sales commissions: Commissions paid to salespeople based on their sales performance.

- Shipping and delivery: Costs associated with transporting goods to customers.

- Inventory storage: Costs associated with warehousing and storing inventory.

- Travel and entertainment: Expenses incurred for business travel, meals with clients, or attending industry events.

Other Operational Expenses:

- Office supplies: Stationery, printer cartridges, and other everyday office supplies.

- Maintenance and repairs: Costs associated with maintaining equipment, machinery, and facilities.

- Property taxes: Taxes levied on the business's real estate property.

- Depreciation: The gradual decrease in the value of tangible assets like equipment or buildings over time.

Understanding and managing these operational expenses is crucial for any business. By keeping them in check, businesses can optimize their spending, improve profitability, and achieve their financial goals.