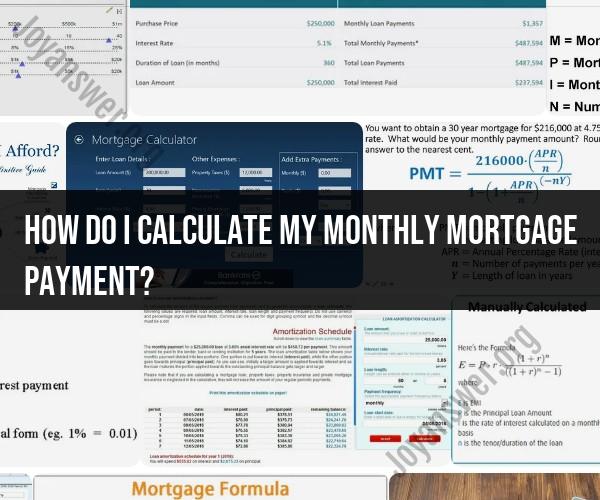

How do I calculate my monthly mortgage payment?

To calculate your monthly mortgage payment, you can use the following formula:

M = P[r(1+r)^n] / [(1+r)^n-1]

Where:

- M = Monthly Payment

- P = Principal Loan Amount (the initial loan balance)

- r = Monthly Interest Rate (annual interest rate divided by 12, and then expressed as a decimal)

- n = Total Number of Payments (loan term in months)

Here's a step-by-step guide to calculating your monthly mortgage payment:

Determine the Loan Amount (Principal):

- This is the initial amount of money you're borrowing to purchase the property.

Find the Monthly Interest Rate (r):

- Divide your annual interest rate (in percentage form) by 12 to get the monthly interest rate.

- Convert the annual interest rate to a decimal by dividing it by 100.

Calculate the Total Number of Payments (n):

- Multiply the number of years in your loan term by 12 to convert it into months.

- For example, if you have a 30-year mortgage, n would be 30 years x 12 months/year = 360 months.

Plug the Values into the Formula:

- Insert the principal amount, monthly interest rate (as a decimal), and total number of payments (in months) into the formula.

Calculate the Monthly Payment (M):

- Use the formula to calculate your monthly mortgage payment.

Here's a simplified example:

- Principal Loan Amount (P): $200,000

- Annual Interest Rate: 4.5%

- Loan Term: 30 years (360 months)

Monthly Interest Rate (r):r = (4.5% / 12) = 0.375% per month or 0.00375 as a decimal.

Total Number of Payments (n): 360 months

Now, plug these values into the formula:

M = 200,000[0.00375(1+0.00375)^360] / [(1+0.00375)^360-1]

Using a calculator or spreadsheet software to perform the calculations, you'll find your monthly mortgage payment (M). In this example, the monthly payment is approximately $1,013.37.

It's important to note that your monthly payment may also include property taxes, homeowner's insurance, and private mortgage insurance (PMI) if applicable. To get a more accurate estimate of your total monthly housing expenses, you should consider these additional costs in your budget.