What is the local tax rate in PA?

Pennsylvania has a complex system of local taxes that can vary widely depending on your specific location within the state. Local tax rates can include local income taxes, property taxes, and sales taxes. These rates are typically set by local municipalities, school districts, and counties. Here's a brief overview of the various local taxes you might encounter in Pennsylvania:

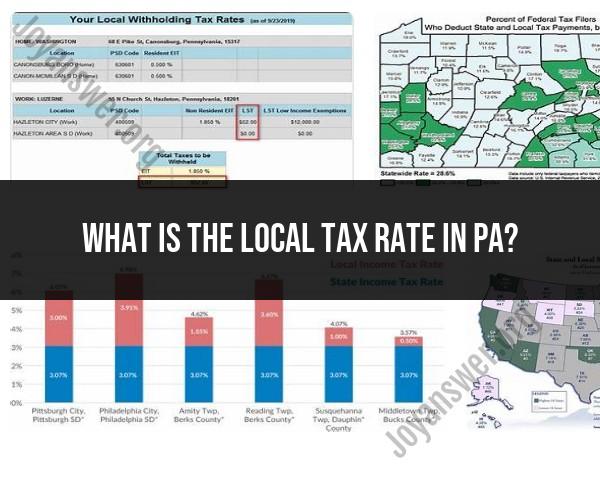

Local Income Taxes: Many municipalities in Pennsylvania impose a local income tax on residents' earned income and, in some cases, on non-residents who work within the municipality. These local income tax rates can vary significantly from one location to another. Rates are often expressed as a percentage of your earned income. The specific rate for a particular location can be obtained from the local tax authority.

Property Taxes: Property tax rates in Pennsylvania are primarily set by school districts and local governments. The rates can vary widely based on your property's location. These taxes are assessed on the assessed value of your property and are used to fund local schools and municipal services.

Sales Taxes: Pennsylvania has a state sales tax rate of 6%, but local jurisdictions may add an additional local sales tax, resulting in varying total sales tax rates throughout the state. The local sales tax rate can be as high as 2% in addition to the state's 6% rate.

It's important to note that local tax rates can change, and new taxes may be introduced, so it's essential to check with your local tax authority or government to determine the specific local tax rates that apply to your area. Local tax rates can also vary depending on whether you live in a city, borough, township, or county. Additionally, local tax regulations may change, so it's advisable to consult with a tax professional or visit the Pennsylvania Department of Revenue's website for the most up-to-date information.

What is the local tax rate in Pennsylvania, and how does it vary by location?

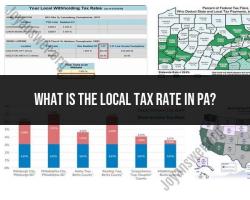

The local tax rate in Pennsylvania varies by location. The average local tax rate in Pennsylvania is 3.4%, but it can range from as low as 1% to as high as 6%.

Here are some examples of local tax rates in different Pennsylvania counties:

- Allegheny County: 1%

- Philadelphia County: 2%

- Delaware County: 3.5%

- Montgomery County: 3.5%

- Chester County: 3.4%

- Lancaster County: 3.3%

- Bucks County: 3.2%

- Dauphin County: 3.1%

- Erie County: 3.0%

- Lehigh County: 2.9%

- Northampton County: 2.8%

How to find information on local taxes and tax rates within the state of Pennsylvania?

There are a few ways to find information on local taxes and tax rates within the state of Pennsylvania.

One way is to visit the website of the Pennsylvania Department of Revenue. The department's website has a section dedicated to local taxes, which includes information on tax rates, exemptions, and deadlines.

Another way to find information on local taxes and tax rates is to contact the local tax assessor's office. The tax assessor's office can provide you with information on the specific taxes that are levied in your area, as well as the rates at which those taxes are assessed.

What are the implications of local taxation for residents and businesses in PA?

Local taxes can have a significant impact on residents and businesses in Pennsylvania. For residents, local taxes can affect the cost of housing, goods, and services. For businesses, local taxes can affect the cost of doing business and can make it more difficult to attract and retain employees.

Here are some specific implications of local taxation for residents and businesses in Pennsylvania:

Residents:

- Local taxes can affect the cost of housing. Property taxes are one of the main sources of revenue for local governments in Pennsylvania. As a result, high property taxes can make it more expensive to buy or rent a home.

- Local taxes can affect the cost of goods and services. Local sales taxes are another major source of revenue for local governments in Pennsylvania. As a result, high sales taxes can make it more expensive to buy goods and services.

- Local taxes can affect the quality of public services. Local governments use tax revenue to fund a variety of public services, such as schools, roads, and libraries. As a result, high local taxes can lead to better public services, while low local taxes can lead to lower-quality public services.

Businesses:

- Local taxes can affect the cost of doing business. Local governments in Pennsylvania levy a variety of taxes on businesses, including property taxes, business income taxes, and sales taxes. As a result, high local taxes can make it more expensive to operate a business in Pennsylvania.

- Local taxes can make it more difficult to attract and retain employees. High local taxes can make it more expensive for businesses to pay their employees a competitive wage. As a result, businesses in high-tax areas may have more difficulty attracting and retaining qualified employees.

Overall, local taxation can have a significant impact on residents and businesses in Pennsylvania. Residents should be aware of the local tax rates in the areas where they live and work, as these rates can affect their cost of living and the quality of public services. Businesses should also be aware of the local tax rates in the areas where they operate, as these rates can affect the cost of doing business and the ability to attract and retain employees.