Is leasing a car really better than buying?

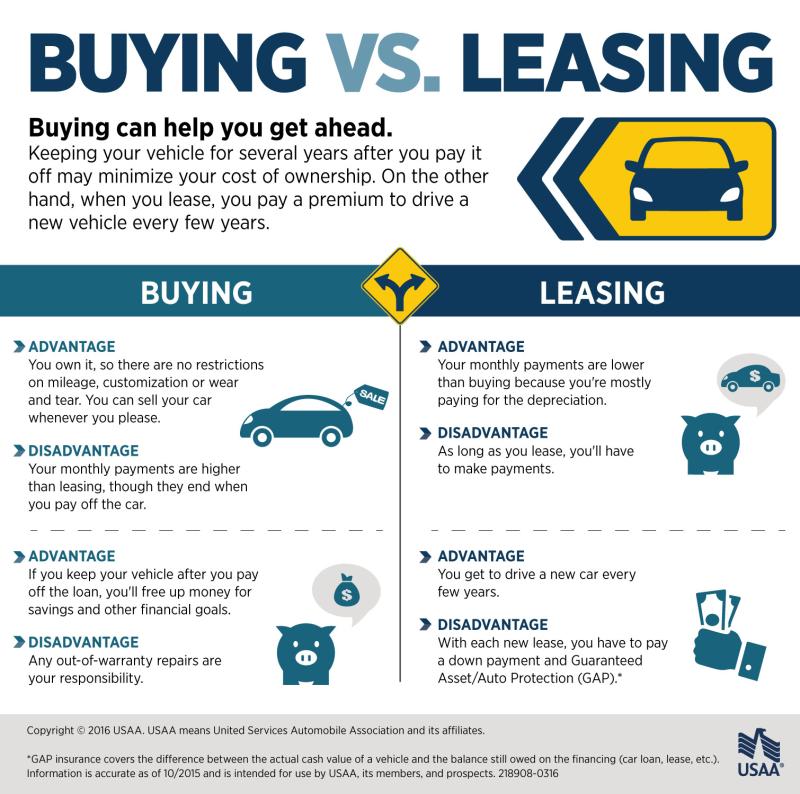

The decision between leasing and buying a car depends on various factors, and there isn't a one-size-fits-all answer. Both options have their advantages and disadvantages, and the best choice for you will depend on your personal preferences, financial situation, and driving habits. Let's explore some key factors to consider:

Leasing:

Lower Monthly Payments: Lease payments are typically lower than loan payments because you're essentially renting the car for a fixed period.

Newer Models: Leasing allows you to drive a new car more frequently, as leases usually last for 2-4 years. This means you can enjoy the latest features and technology.

Lower Repair Costs: Since you're typically under the manufacturer's warranty during the lease period, many repair costs are covered.

No Long-Term Commitment: Leasing gives you the flexibility to change cars more frequently without the long-term commitment of owning a vehicle.

Buying:

Ownership: When you buy a car, you own it outright once you've paid off the loan. This can be advantageous in the long run as you won't have monthly payments once the loan is complete.

Unlimited Mileage: Leases often come with mileage restrictions. If you drive a lot, buying might be a better option since you won't be penalized for exceeding mileage limits.

Customization: If you own a car, you can modify or customize it as you see fit. Leased vehicles typically need to be returned in their original condition.

Long-Term Savings: While monthly payments for buying a car are usually higher than leasing, in the long run, you won't have continuous payments once the loan is paid off.

Considerations for Both:

Depreciation: Cars generally depreciate in value over time. With leasing, you don't bear the full brunt of this depreciation, but you also don't own an asset at the end of the term.

Financial Situation: Leasing often requires a lower initial financial commitment, making it more accessible for those with budget constraints. However, buying can be financially advantageous in the long term.

Usage Patterns: If you plan to keep a car for a long time and put a lot of miles on it, buying might be a better option. If you enjoy driving a new car every few years and don't drive excessively, leasing could be more appealing.

In conclusion, the decision between leasing and buying depends on your individual priorities and circumstances. Evaluate your budget, driving habits, and preferences to determine which option aligns best with your needs. It may also be beneficial to consult with a financial advisor to make an informed decision based on your specific situation.

Deciphering the car dilemma: Is leasing a car really better than buying?

Leasing and buying a car are two different ways to get behind the wheel of a new vehicle. Each option has its own pros and cons, so it's important to weigh them carefully before making a decision.

One of the biggest advantages of leasing is the lower upfront cost. When you lease a car, you typically only have to put down a small down payment, or none at all. This can make leasing a more affordable option for people with limited savings.

Another advantage of leasing is that the monthly payments are often lower than they would be if you were buying the car. This is because you're only paying for the depreciation of the car during the lease term, rather than the full purchase price.

However, there are also some disadvantages to leasing. One of the biggest is that you never actually own the car. At the end of the lease term, you have to return the car to the dealership. You also have to be careful not to exceed the mileage limit on your lease, or you'll be charged additional fees.

Another disadvantage of leasing is that you may not be able to customize the car to your liking. Many leases have restrictions on modifications, such as adding window tint or aftermarket wheels.

Analyzing the pros and cons of leasing versus buying a car and making informed decisions

When deciding whether to lease or buy a car, there are a few key factors to consider:

- Your budget: Leasing can be a more affordable option upfront, but the monthly payments may be higher in the long run. Buying a car requires a larger down payment, but the monthly payments may be lower.

- Your driving habits: If you drive a lot of miles, leasing may not be the best option for you. Many leases have mileage limits, and exceeding them can result in additional fees.

- How long you want to keep the car: If you want to keep the car for more than three years, buying may be a better option in the long run. Leasing typically has terms of two to four years.

- Your lifestyle: If you like to customize your car or drive it for long periods of time, buying may be a better option for you. Leasing typically has restrictions on modifications and mileage.

Tips for individuals in determining the most suitable option based on their preferences and financial situation

Here are a few tips for determining the most suitable option for you, based on your preferences and financial situation:

- Consider your budget and driving habits. If you have a limited budget and don't drive a lot of miles, leasing may be a good option for you. If you need a car for the long term or drive a lot of miles, buying may be a better option.

- Think about how long you want to keep the car. If you want to keep the car for more than three years, buying may be a better option in the long run. Leasing typically has terms of two to four years.

- Consider your lifestyle. If you like to customize your car or drive it for long periods of time, buying may be a better option for you. Leasing typically has restrictions on modifications and mileage.

- Get quotes from multiple dealerships. This will help you get the best possible deal on a lease or purchase.

- Read the fine print carefully before signing any contracts. Make sure you understand all of the terms and conditions of the lease or purchase agreement.

Ultimately, the decision of whether to lease or buy a car is a personal one. There is no right or wrong answer, and the best option for you will depend on your individual circumstances. By carefully considering the pros and cons of each option, you can make an informed decision that is right for you.