Which is less expensive, buying or leasing a car?

Whether buying or leasing a car is less expensive depends on various factors, including your financial situation, driving habits, and priorities. Here's a cost comparison to help you understand the financial implications of buying vs. leasing:

Buying a Car:

Upfront Costs:

- Pros: Down payment and other upfront costs can be higher, but you build equity in the vehicle.

- Cons: Higher initial cash outlay compared to leasing.

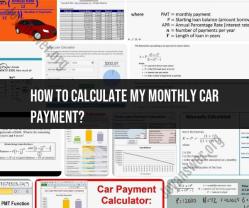

Monthly Payments:

- Pros: Monthly loan payments may be higher than lease payments, but you're paying towards ownership.

- Cons: Higher monthly payments can impact cash flow.

Long-Term Costs:

- Pros: Over the long term, owning a car may be more cost-effective, especially if you keep the car for many years.

- Cons: Higher upfront and monthly costs initially.

Mileage:

- Pros: No mileage restrictions.

- Cons: Higher mileage may lead to increased maintenance costs and a faster depreciation of the car's value.

Customization:

- Pros: You can customize the car as you see fit.

- Cons: Customizations may not add significant resale value, and some modifications could affect warranty coverage.

End-of-Term Value:

- Pros: You have ownership and can keep or sell the car at the end of its useful life.

- Cons: Resale value can be influenced by factors like market conditions and the car's condition.

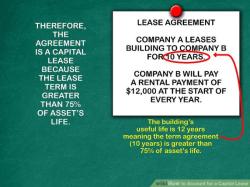

Leasing a Car:

Upfront Costs:

- Pros: Down payment and upfront costs are usually lower than buying.

- Cons: You don't build equity, and at the end of the lease, you don't own the car.

Monthly Payments:

- Pros: Monthly lease payments are typically lower than loan payments, making it more affordable to drive a new car.

- Cons: You're always making payments, and the car is never fully yours.

Long-Term Costs:

- Pros: Lower upfront and monthly costs initially.

- Cons: Over the long term, leasing may be more expensive than buying if you consistently lease new cars.

Mileage:

- Pros: Lease agreements often have mileage limits, but if you stay within those limits, you won't incur excess mileage fees.

- Cons: Exceeding mileage limits can result in additional charges.

Customization:

- Pros: Limited customization options, but you don't have to worry about the impact on resale value.

- Cons: You can't make significant modifications, and any excessive wear and tear can result in additional charges.

End-of-Term Value:

- Pros: At the end of the lease, you have the option to buy the car or lease a new one.

- Cons: No ownership stake in the vehicle unless you choose to buy it at the end of the lease.

Considerations:

Short-Term vs. Long-Term:

- Leasing may be more cost-effective in the short term, while buying may offer better value over the long term.

Ownership Priority:

- If ownership is a priority and you plan to keep the car for many years, buying may be preferable.

Budget Considerations:

- Evaluate your monthly budget and financial goals to determine what fits your financial situation.

Mileage Needs:

- If you have high mileage needs, buying may be more suitable to avoid excess mileage charges.

New Car Preferences:

- If you prefer driving a new car every few years with the latest features, leasing might be more attractive.

Customization Desire:

- If customizing the vehicle is important to you, buying is the better option.

Resale Value Awareness:

- If you're concerned about depreciation and want to build equity, buying may be more appealing.

Financial Flexibility:

- Leasing often offers lower upfront and monthly costs, providing greater financial flexibility in the short term.

In summary, whether buying or leasing is less expensive depends on your individual circumstances and priorities. It's important to carefully evaluate your budget, driving habits, and preferences before making a decision. Consider consulting with a financial advisor or an automotive expert to get personalized advice based on your specific situation.

Financial considerations: Which is less expensive, buying or leasing a car?

Whether buying or leasing a car is less expensive depends on a number of factors, including the type of car you buy, the lease term, and your driving habits. In general, leasing a car is often less expensive in the short term, but it can be more expensive in the long term.

Here is a breakdown of the main costs associated with buying and leasing a car:

Buying a car:

- Upfront cost: Purchase price of the car, down payment, and taxes and fees

- Monthly payments: Car loan payment, insurance, and gas

- Maintenance and repairs: Cost of regular maintenance and unexpected repairs

- Depreciation: Value of the car decreases over time

Leasing a car:

- Upfront cost: Down payment, lease acquisition fee, and taxes and fees

- Monthly payments: Lease payment and insurance

- Mileage overage fees: If you exceed the mileage limit in your lease agreement, you will be charged a fee for each additional mile

- Wear and tear fees: If the car is returned in poor condition, you may be charged a fee

- Disposition fee: Fee charged at the end of the lease term

Evaluating the overall costs and financial implications of buying versus leasing a car

To determine which option is more cost-effective for you, you need to compare the total cost of ownership for both buying and leasing the car you want. This includes considering all of the costs listed above, as well as the following factors:

- Lease term: The longer the lease term, the lower the monthly payments will be, but you will end up paying more for the car in the long run.

- Interest rate: If you are financing the purchase of the car, the interest rate will affect your monthly payments and the total cost of the loan.

- Depreciation: The car will depreciate over time, and the depreciation rate will vary depending on the make, model, and year of the car.

Tips for budget-conscious consumers in making cost-effective decisions about car ownership

If you are on a budget, here are some tips for making cost-effective decisions about car ownership:

- Consider buying a used car: Used cars are typically much less expensive than new cars.

- Shop around for the best deal: Compare prices from different dealerships and lenders before you buy or lease a car.

- Negotiate on the price: Don't be afraid to negotiate on the price of the car or the lease terms.

- Get pre-approved for a loan: This will give you an idea of how much you can afford to borrow and what your monthly payments will be.

- Choose a car that fits your budget: Don't overspend on a car that you can't afford.

- Maintain your car regularly: This will help to extend the life of your car and reduce the cost of repairs.

By following these tips, you can make a cost-effective decision about car ownership.