What is federal filing requirements?

Federal filing requirements refer to the obligations and criteria established by the U.S. government that determine when individuals, businesses, or entities are required to submit specific forms, documents, or tax returns to federal agencies, primarily the Internal Revenue Service (IRS). These requirements vary depending on factors such as your income, tax status, and the type of entity you are.

Here are some common examples of federal filing requirements:

Income Tax Filing:

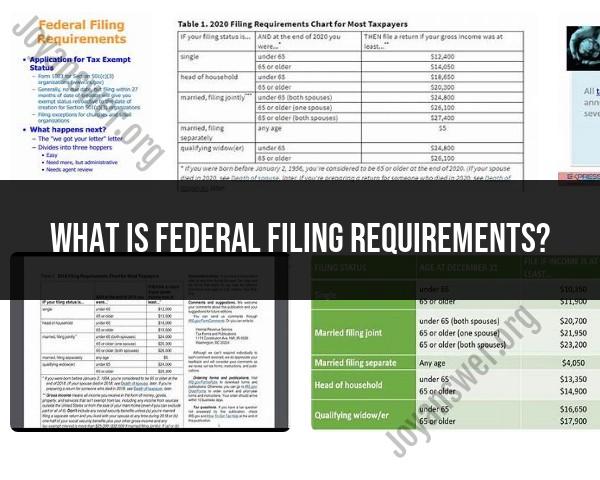

- Individuals are required to file federal income tax returns with the IRS if their income exceeds a certain threshold. The specific income thresholds are based on factors like filing status and age. Businesses and other entities may also be required to file income tax returns, such as corporations (Form 1120) and partnerships (Form 1065).

Employment Taxes:

- Employers are required to file federal employment tax returns, such as Form 941 for quarterly federal tax returns and Form 940 for the annual federal unemployment tax return.

Information Returns:

- Certain entities and businesses must file information returns to report payments to individuals and vendors, such as Form 1099 series forms.

Filing for Social Security and Medicare Taxes:

- Employers and employees are required to contribute to Social Security and Medicare through payroll taxes. Employers must file Form W-2 for employees, while self-employed individuals may need to file Schedule SE.

Corporate Filings:

- Corporations and other business entities may have specific federal filing requirements related to their structure and activities. For example, S corporations file Form 1120-S, while partnerships file Form 1065.

Nonprofit Organizations:

- Nonprofit organizations may need to file various forms, such as Form 990, to report their financial and operational activities to the IRS.

Excise Taxes:

- Some businesses are required to file excise tax returns to report and pay excise taxes on certain activities, such as the sale of alcohol, tobacco, or gasoline.

Foreign Reporting Requirements:

- U.S. citizens and residents with financial interests in foreign accounts or assets may have federal filing requirements for reporting foreign income and financial accounts. Forms such as the FBAR (FinCEN Form 114) and Form 8938 may be required.

Estate and Gift Taxes:

- Executors of estates and individuals making large gifts may have federal filing requirements related to estate and gift taxes.

It's important to be aware of these requirements, as failure to meet federal filing obligations can lead to penalties and legal consequences. The specific forms and deadlines can change from year to year, so it's advisable to consult the IRS website or a tax professional to ensure you are in compliance with federal filing requirements.

Federal Filing Requirements: Understanding the Basics

Federal filing requirements are the laws and regulations that govern the submission of certain types of information to the federal government. These requirements can vary depending on the type of information being submitted and the purpose of the filing.

The most common types of federal filings include tax returns, business registration documents, and regulatory compliance reports.

Types of Federal Filings and Their Significance

There are a variety of different types of federal filings, but some of the most common include:

- Tax returns: Tax returns must be filed by individuals and businesses to report their income and pay taxes to the federal government.

- Business registration documents: Businesses must register with the federal government to obtain a business tax ID number and to comply with certain regulations.

- Regulatory compliance reports: Businesses and other organizations must file reports with the federal government to comply with various regulations, such as environmental regulations, workplace safety regulations, and financial reporting requirements.

Federal filings are important because they help the government to collect taxes, enforce regulations, and gather data. The information collected from federal filings is used to make informed decisions about public policy and to ensure that businesses and individuals are complying with the law.

Regulatory Compliance and Reporting Obligations

Businesses and other organizations are subject to a variety of federal regulations. These regulations are designed to protect consumers, workers, the environment, and other important interests.

Businesses and other organizations must comply with these regulations and file reports with the federal government on a regular basis. The specific reporting requirements vary depending on the industry and the type of regulation.

Tax-Related Filing Requirements and Deadlines

Individuals and businesses must file tax returns with the Internal Revenue Service (IRS) on a regular basis. The specific filing requirements and deadlines vary depending on the taxpayer's status.

For example, individuals must generally file a tax return if their income is above a certain threshold. Businesses must generally file a tax return each year, regardless of their income.

Streamlining Federal Filings for Individuals and Businesses

The federal government is working to streamline federal filings for individuals and businesses. This includes making it easier to file online and to comply with regulations.

For example, the IRS offers a variety of online tools and resources to help taxpayers file their returns. The IRS also offers a number of programs to help businesses comply with tax laws and regulations.

In addition, the federal government has established a number of initiatives to reduce the regulatory burden on businesses. These initiatives include reducing the number of regulations, streamlining existing regulations, and making it easier for businesses to comply with regulations.

Conclusion

Federal filing requirements can be complex, but it is important for individuals and businesses to understand and comply with these requirements. Failure to comply with federal filing requirements can result in penalties and other consequences.

If you have questions about federal filing requirements, you should consult with a tax advisor or attorney.