What do you need to become a home buyer?

Becoming a home buyer involves several essential requirements and steps to ensure a successful home purchase. Here are the key requirements and considerations:

1. Financial Preparation:

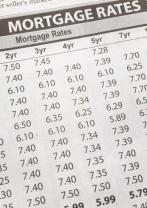

- Good Credit Score: A strong credit score (typically above 650) is essential. A higher credit score can help you qualify for a mortgage with a lower interest rate.

- Down Payment: Save for a down payment, which is typically a percentage of the home's purchase price (e.g., 10%, 20%, or more). The exact amount will depend on the type of mortgage you choose.

- Stable Income: Lenders want to see that you have a stable source of income to make mortgage payments. Consistent employment and income history are important.

2. Budget and Financial Planning:

- Create a budget to understand how much home you can afford, taking into account your income, expenses, and savings goals.

3. Pre-approval for a Mortgage:

- Get pre-approved for a mortgage from a reputable lender. This involves a credit check and a detailed financial review. Pre-approval helps you know how much you can afford and strengthens your offer when you find a home you want to buy.

4. Real Estate Agent:

- Work with a qualified real estate agent who can help you navigate the home-buying process, find suitable properties, and negotiate on your behalf.

5. Research and Property Search:

- Conduct thorough research on the housing market in the areas you're interested in. Identify your needs and preferences in a home (size, location, features) to guide your property search.

6. Home Inspection and Appraisal:

- After finding a home you like, arrange for a home inspection to uncover any potential issues. Additionally, the lender will order an appraisal to determine the home's value.

7. Offer and Negotiation:

- Make an offer on the home through your real estate agent. Negotiate the terms, price, and other details with the seller.

8. Purchase Agreement:

- Once the seller accepts your offer, you'll enter into a purchase agreement, which outlines the terms and conditions of the sale.

9. Mortgage Application:

- Complete the mortgage application process with your lender, providing all required documentation and information.

10. Home Insurance:

- Secure homeowners insurance to protect your investment.

11. Closing Costs:

- Be prepared for closing costs, which include various fees, taxes, and expenses associated with the home purchase.

12. Final Walk-Through:

- Conduct a final walk-through of the property to ensure it's in the agreed-upon condition before closing.

13. Closing and Settlement:

- Attend the closing meeting, where you'll sign the necessary documents and officially become the owner of the home.

14. Moving and Home Maintenance:

- Plan and execute your move to your new home. Prepare for ongoing home maintenance and expenses associated with homeownership.

15. Repayment of Mortgage:

- Begin making regular mortgage payments, including principal and interest, over the life of the loan.

Becoming a home buyer is a significant financial decision and requires careful planning and consideration. It's important to work with professionals, such as a real estate agent and a mortgage lender, to guide you through the process and ensure a successful home purchase.

What You Need to Become a Home Buyer: A Complete Checklist

Here is a complete checklist of what you need to become a home buyer:

- Financial readiness: Get pre-approved for a mortgage before you start shopping for a home. This will give you an idea of how much money you can borrow and what your monthly payments will be.

- Credit score: A good credit score will help you get a mortgage with a lower interest rate. Aim for a credit score of at least 620.

- Down payment: Most lenders require a down payment of at least 3% of the purchase price of the home. However, you may want to put down more to reduce your monthly payments and build equity in your home faster.

- Closing costs: Closing costs are fees associated with buying a home, such as title insurance, appraisal fees, and attorney fees. Closing costs can range from 2% to 5% of the purchase price of the home.

Preparing for Homeownership: Essential Steps for Buyers

Here are some essential steps for buyers to prepare for homeownership:

- Educate yourself about the home buying process. There are a lot of things to learn about buying a home, such as different types of mortgages, the home inspection process, and closing costs. Take some time to learn about the process so that you can make informed decisions.

- Get pre-approved for a mortgage. This will give you an idea of how much money you can borrow and what your monthly payments will be. It will also make you more competitive as a buyer.

- Find a real estate agent. A good real estate agent can help you find homes that meet your needs and budget. They can also help you negotiate with sellers and navigate the home buying process.

- Shop for a home. Take your time and look at different homes to find one that you love. Be sure to consider factors such as location, price, size, and condition.

- Make an offer. Once you find a home that you want to buy, you will need to make an offer. The offer should include the purchase price, the down payment amount, and the closing date.

- Get a home inspection. Once your offer is accepted, you will need to get a home inspection. A home inspection will identify any potential problems with the home.

- Close on the home. Once the home inspection is complete and you are satisfied with the results, you will be ready to close on the home. This is when you will sign the paperwork and officially become the owner of the home.

Navigating the Home Buying Process Successfully

Here are some tips for navigating the home buying process successfully:

- Be patient. Buying a home can be a long and complicated process. Don't get discouraged if it takes longer than you expected.

- Be organized. Keep all of your paperwork in order, such as your pre-approval letter, home inspection report, and closing documents. This will make the process go more smoothly.

- Be flexible. Things don't always go according to plan when you're buying a home. Be prepared to be flexible and to make adjustments as needed.

- Communicate with your real estate agent. Your real estate agent is there to help you. Communicate with them regularly and let them know any questions or concerns you have.

Buying a home is a big decision, but it can also be a very rewarding experience. By following these tips, you can navigate the home buying process successfully and find the perfect home for you and your family.