How to determine financial projections?

Determining financial projections involves forecasting a company's future financial performance based on various factors, assumptions, and historical data. Here's a comprehensive guide on how to determine financial projections:

1. Understand Your Business:

- Business Model: Have a clear understanding of your business model, including how you generate revenue, your cost structure, and key operational aspects.

2. Define the Time Frame:

- Determine the period your financial projections will cover (e.g., monthly, quarterly, annually).

3. Gather Historical Data:

- Collect historical financial statements, including income statements, balance sheets, and cash flow statements.

4. Identify Key Assumptions:

- Clearly outline the assumptions that will drive your projections, including sales growth, pricing strategy, and expense trends.

5. Sales Forecast:

- Market Research: Conduct market research to understand industry trends, demand, and potential market share.

- Sales Volume: Estimate the number of units or services you expect to sell.

- Pricing: Determine the pricing strategy for your products or services.

6. Expense Projections:

- Operating Expenses: Estimate costs related to day-to-day operations, including salaries, rent, utilities, and other variable and fixed costs.

- Cost of Goods Sold (COGS): Calculate the direct costs associated with producing goods or services.

- Capital Expenditures: Plan for major investments in assets, equipment, or technology.

7. Profit and Loss (P&L) Statement:

- Calculate gross profit by subtracting COGS from total revenue.

- Deduct operating expenses and taxes to arrive at net profit.

8. Cash Flow Statement:

- Project cash inflows and outflows, including operating activities, investing activities, and financing activities.

9. Balance Sheet:

- Outline assets, liabilities, and equity. Ensure the balance sheet balances (Assets = Liabilities + Equity).

10. Break-Even Analysis:

- Identify the break-even point where total revenue equals total costs.

11. Financial Ratios:

- Calculate key financial ratios such as liquidity ratios, profitability ratios, and solvency ratios.

12. Sales and Revenue Growth Projections:

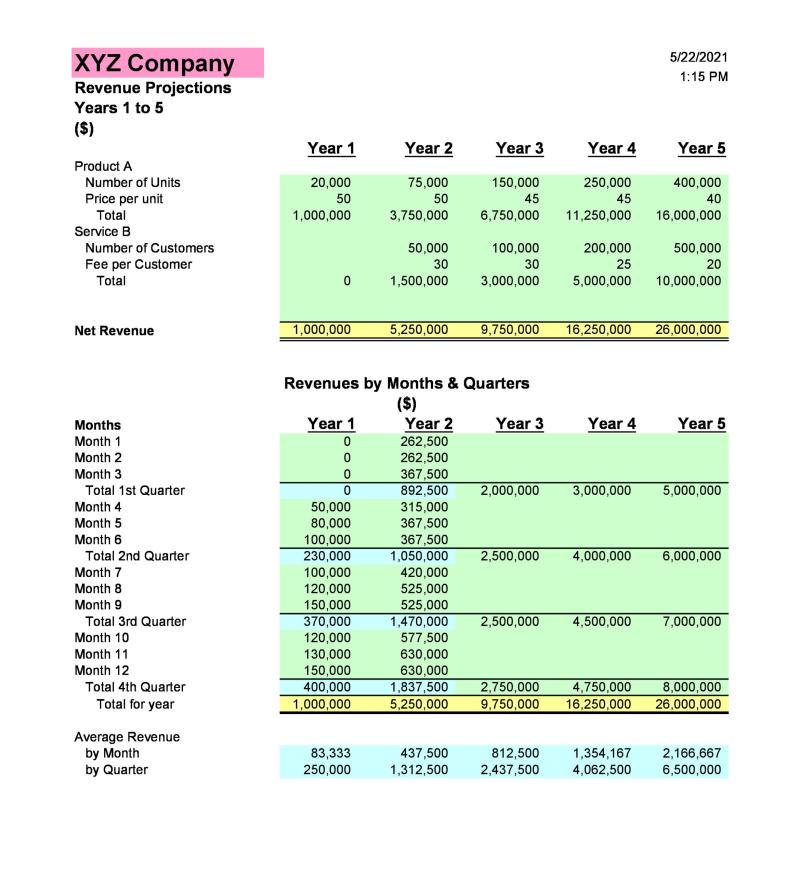

- Estimate year-over-year growth in sales and revenue.

- Break down growth projections on a monthly, quarterly, or yearly basis.

13. Assumptions Review:

- Regularly review and update assumptions based on changing market conditions or business performance.

14. Scenario Analysis:

- Develop multiple scenarios (best-case, worst-case, and most likely) to assess the range of potential outcomes.

15. Cash Reserve Planning:

- Plan for maintaining an adequate cash reserve to cover unexpected expenses.

16. Funding Requirements:

- Identify the need for external funding and specify the amount and purpose of funding required.

17. Use of Funds:

- If seeking funding, outline how the funds will be used to support business operations or expansion.

18. Financial Key Performance Indicators (KPIs):

- Include relevant financial KPIs, such as return on investment (ROI), net profit margin, and current ratio.

19. Regular Updates:

- Regularly update your financial projections based on actual performance and changing market conditions.

20. Communicate the Forecast:

- Share your financial projections with relevant stakeholders, such as business partners, investors, or your financial advisor.

21. Narrative Explanation:

- Accompany your financial projections with a narrative that explains the assumptions, risks, and strategic considerations influencing your forecast.

Remember, financial projections are dynamic and should be revisited regularly to reflect actual performance and changes in your business environment. Seek input from financial experts or mentors, and be prepared to adjust your projections as circumstances evolve.

Financial forecasting: How to determine financial projections?

Financial projections are estimates of a company's future financial performance, such as revenue, expenses, and cash flow. They are used by businesses of all sizes to make informed decisions about their financial future, such as budgeting, investing, and raising capital.

There are a number of different factors that can impact financial projections, including:

- Historical financial performance: This includes the company's revenue, expenses, and cash flow from previous periods.

- Industry trends: This includes the overall growth rate of the industry and the performance of the company's competitors.

- Economic conditions: This includes the overall economic growth rate, interest rates, and inflation.

- Management assumptions: This includes the company's management's expectations for future growth, profitability, and market share.

Factors and methodologies for calculating and interpreting financial projections

There are a number of different methodologies for calculating and interpreting financial projections. Some of the most common methodologies include:

- Top-down forecasting: This methodology starts with the company's overall revenue projection and then breaks it down into more specific projections for different product lines, customer segments, and geographic regions.

- Bottom-up forecasting: This methodology starts with the company's individual cost items and then adds them up to arrive at a total expense projection.

- Scenario planning: This methodology involves developing multiple financial projections based on different assumptions about the future. This can be useful for assessing the risks and opportunities associated with different business strategies.

Once financial projections have been calculated, they need to be interpreted carefully. It is important to consider the factors that could impact the accuracy of the projections, such as the company's historical performance, industry trends, and economic conditions. It is also important to consider the management assumptions that were used to develop the projections.

Tips for making informed decisions based on accurate financial projections

Here are some tips for making informed decisions based on accurate financial projections:

- Use financial projections to inform your business strategy. Your financial projections should be used to help you make decisions about where to allocate resources, how to invest in new products and services, and how to expand into new markets.

- Regularly review and update your financial projections. Your financial projections should be reviewed and updated regularly to reflect changes in your business, industry, and the economy.

- Use financial projections to make informed decisions about budgeting and forecasting. Your financial projections should be used to create budgets and forecasts that are realistic and achievable.

- Use financial projections to communicate with investors and other stakeholders. Your financial projections can be used to communicate your company's financial goals and prospects to investors and other stakeholders.

By following these tips, you can use financial projections to make informed decisions that will help your business achieve its financial goals.