What are the three advantages of corporations?

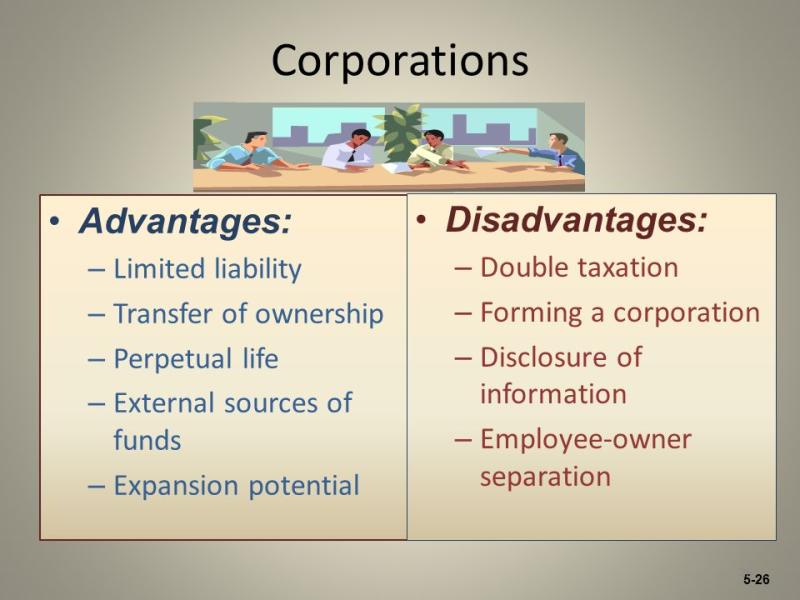

Certainly! Corporations offer several advantages that make them an attractive business structure. Here are three key advantages:

1. Limited Liability:

- Personal Asset Protection: Shareholders in a corporation have limited liability, meaning their personal assets are generally protected from business debts and liabilities. If the corporation faces financial issues or lawsuits, shareholders' personal assets are typically not at risk beyond their investment in the company.

2. Access to Capital:

- Ability to Raise Funds: Corporations have various avenues to raise capital. They can issue stocks to investors or go public through an Initial Public Offering (IPO), allowing them to raise substantial amounts of money by selling shares of ownership in the company. Additionally, corporations can also issue bonds or take loans to raise capital.

3. Perpetual Existence:

- Continuous Life: Corporations have a perpetual existence independent of their shareholders. Even if shareholders change or transfer ownership, the corporation continues to exist. This continuity ensures stability and longevity, which can be advantageous for business planning, investments, and long-term strategies.

These advantages contribute to the appeal of the corporate structure for businesses seeking protection, access to funding, and longevity. However, corporations also have complexities in terms of compliance, regulations, and administrative requirements, which should be considered when choosing a business structure.

Corporations offer several distinct advantages over other business forms, making them a popular choice for businesses of all sizes. Here are three key advantages of corporations:

1. Limited Liability Protection: One of the most significant advantages of corporations is that shareholders have limited liability, meaning their personal assets are protected from business debts. This protection is crucial for business owners, as it shields them from personal financial ruin if their business fails.

2. Ease of Capital Acquisition: Corporations can raise capital more easily than other business forms. They can issue shares of stock, which can be purchased by investors, and they can also take out loans from banks or other lenders. This ability to raise capital is essential for businesses that want to grow and expand.

3. Perpetual Existence: Unlike other business forms, such as partnerships or sole proprietorships, corporations have perpetual existence. This means that the corporation can continue to operate even after the death or retirement of its owners or shareholders. This continuity provides stability and allows the corporation to plan for the long term.

Organizational Structure of Corporations

The organizational structure of a corporation typically consists of three main components:

Shareholders: Shareholders are the owners of the corporation and are entitled to a share of the profits. They also have the right to vote on important decisions affecting the corporation.

Board of Directors: The board of directors is elected by the shareholders and is responsible for overseeing the management of the corporation. The board appoints the CEO and other senior executives and makes decisions about the corporation's strategic direction.

Officers: The officers of the corporation are responsible for the day-to-day operations of the business. The CEO is the chief executive officer and is responsible for leading the corporation and making sure it achieves its goals.

Competitive Edges of Corporations

Corporations possess several competitive edges over other business forms, including:

Access to Capital: Corporations have greater access to capital than other business forms, allowing them to invest in growth opportunities and expand their operations.

Limited Liability Protection: Limited liability protection shields shareholders from personal liability, making it an attractive option for investors seeking to minimize their financial risk.

Transferability of Ownership: Shares of stock in a corporation can be easily transferred from one owner to another, facilitating the sale of a business or the introduction of new investors.

Tax Advantages: Corporations often enjoy tax advantages over other business forms, such as lower tax rates and the ability to deduct certain expenses.

Access to Talent: Large corporations can attract and retain top talent by offering competitive salaries, benefits, and career development opportunities.

These competitive edges have contributed to the widespread adoption of corporations as the preferred business structure for many organizations. Corporations play a significant role in the global economy, driving innovation, job creation, and economic growth.