Can you change your government repayment plan for student loans?

Yes, you can change your government repayment plan for federal student loans through a process called "student loan repayment plan consolidation" or by simply enrolling in a different federal repayment plan. Federal student loans offer several repayment plans to accommodate various financial situations, and you can switch between them if your circumstances change or if you find a plan that better suits your needs.

Here are some common federal student loan repayment plans you can consider switching to:

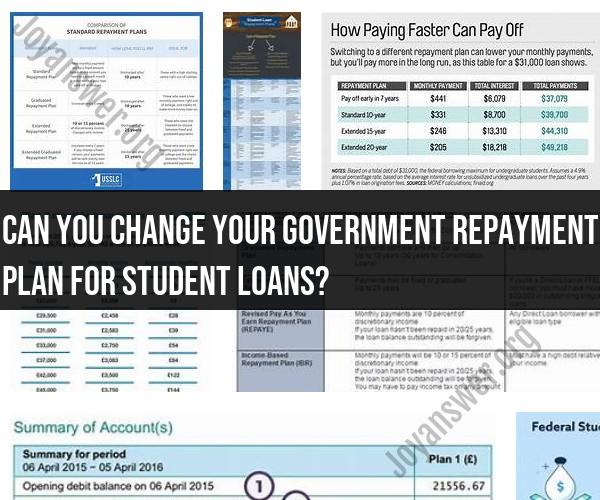

Standard Repayment Plan: This plan offers fixed monthly payments over a 10-year term. It's the default plan for federal loans, but you can choose it if you prefer to pay off your loans relatively quickly.

Graduated Repayment Plan: With this plan, your monthly payments start lower and increase over time, typically every two years. This can be a good option if you expect your income to rise gradually.

Income-Driven Repayment Plans: These plans base your monthly payments on your income and family size. They include:

- Income-Based Repayment (IBR) Plan

- Pay As You Earn (PAYE) Plan

- Revised Pay As You Earn (REPAYE) Plan

- Income-Contingent Repayment (ICR) Plan

Extended Repayment Plan: This plan extends your repayment term to 25 years, allowing for lower monthly payments. It's available for borrowers with high loan balances.

Income-Sensitive Repayment Plan: This plan is available for Federal Family Education Loan (FFEL) Program loans and is based on your annual income. Payments are adjusted annually.

Public Service Loan Forgiveness (PSLF): If you work in a qualifying public service job and make 120 qualifying payments while on an income-driven repayment plan, you may be eligible for loan forgiveness through PSLF.

To change your repayment plan, you can typically do so by contacting your loan servicer, either through their website or by phone. They can guide you through the process and help you choose the most suitable plan based on your financial situation. Keep in mind that some plans may have specific eligibility requirements, so make sure you meet them before switching.

Additionally, it's essential to consider the long-term financial implications of your chosen plan, including the total amount you'll repay over the life of the loan and any potential forgiveness options. It may be wise to consult with a financial advisor or student loan counselor to make an informed decision regarding your repayment plan.

Changing Your Government Repayment Plan for Student Loans

To change your government student loan repayment plan, you can either contact your loan servicer directly or use the Federal Student Aid website.

To contact your loan servicer:

- Find your loan servicer's contact information on the Federal Student Aid website.

- Call your loan servicer and explain that you would like to change your repayment plan.

- The loan servicer will provide you with information about the different repayment plans available and help you choose the one that is right for you.

To change your repayment plan online:

- Go to the Federal Student Aid website and log in to your account.

- Click on the "My Loan Servicer" tab.

- Click on the "Manage My Loans" link.

- Under the "Repayment Plan" section, click on the "Change My Repayment Plan" link.

- Select the repayment plan that you would like to change to and follow the instructions on the screen.

Modifying Your Student Loan Repayment Plan: A Guide

There are a few things to keep in mind when modifying your student loan repayment plan:

- You can change your repayment plan at any time.

- There is no fee for changing your repayment plan.

- Some repayment plans may have income requirements or other eligibility criteria.

- Changing your repayment plan may affect your monthly payment amount, your total repayment amount, and the length of time it takes you to repay your loans.

Exploring Repayment Plan Options for Government Student Loans

There are four main types of government student loan repayment plans:

- Standard Repayment Plan: This is the default repayment plan for most borrowers. It requires borrowers to repay their loans in equal monthly installments over a period of 10 years.

- Graduated Repayment Plan: This plan starts with lower monthly payments that gradually increase over time. The total repayment period is 10 years.

- Extended Repayment Plan: This plan allows borrowers to repay their loans over a period of 12 to 30 years, depending on the borrower's loan balance.

- Income-Driven Repayment (IDR) Plans: These plans cap the borrower's monthly payment at a percentage of their discretionary income. The total repayment period for IDR plans is 20 to 25 years, depending on the plan.

In addition to these four main types of repayment plans, there are also a number of special repayment plans available for borrowers who meet certain criteria. For example, borrowers who have a total and permanent disability may be eligible for the Total and Permanent Disability Discharge program, which forgives all of the borrower's remaining federal student loan debt.

If you are not sure which repayment plan is right for you, you can use the Federal Student Aid Loan Simulator to compare the different plans and see how they would affect your monthly payment amount, your total repayment amount, and the length of time it takes you to repay your loans.

You can also talk to a student loan counselor to get help choosing the right repayment plan for your individual needs.