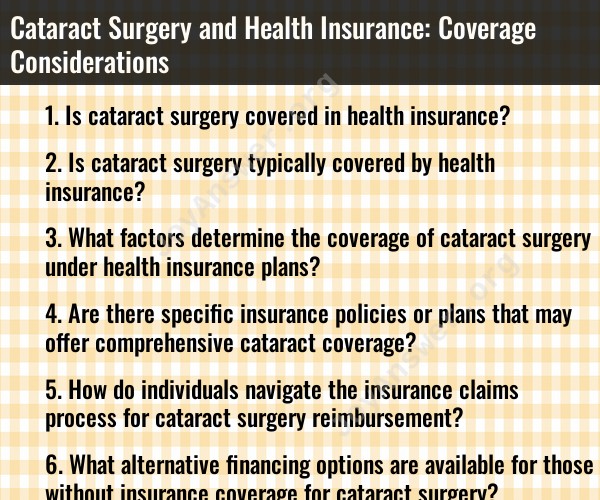

Is cataract surgery covered in health insurance?

Cataract surgery is a common and medically necessary procedure to remove a cloudy lens (cataract) from the eye and replace it with an artificial lens. Whether cataract surgery is covered by health insurance depends on several factors, including the type of insurance plan, the necessity of the procedure, and specific coverage details.

Here are some considerations regarding cataract surgery and health insurance coverage:

Medical Necessity:

- Health insurance is more likely to cover cataract surgery if it is deemed medically necessary. Medical necessity is often determined based on the impact of cataracts on an individual's vision and daily activities.

Vision vs. Medical Insurance:

- Some aspects of cataract surgery may be covered by medical insurance, while others may fall under vision insurance. Vision insurance typically covers routine eye exams and eyewear but may not cover medical procedures. Check the specific coverage of your insurance plan.

Medicare Coverage:

- Medicare, the federal health insurance program for individuals aged 65 and older, generally covers cataract surgery if it is considered medically necessary. Medicare Part B usually covers the surgical procedure and an intraocular lens implant.

Private Health Insurance Plans:

- Private health insurance plans may vary in coverage for cataract surgery. It's important to review your insurance policy documents or contact your insurance provider to understand the specific coverage details, including any copayments, deductibles, or out-of-pocket expenses.

Preauthorization and Referral:

- Some insurance plans may require preauthorization or a referral from an eye care professional before approving cataract surgery. It's important to follow the procedures outlined by your insurance plan to ensure coverage.

Out-of-Network Providers:

- If you choose to have cataract surgery with an out-of-network provider, your insurance coverage may differ. Check with your insurance provider to understand the coverage for out-of-network services.

Supplemental Insurance:

- Some individuals may have supplemental insurance or additional coverage that can help with out-of-pocket costs associated with cataract surgery.

Coverage Limits and Exclusions:

- Review your insurance policy for any coverage limits, exclusions, or specific criteria that must be met for coverage. Some policies may have restrictions on the type of intraocular lens covered or other specific details.

Before scheduling cataract surgery, it's advisable to contact your insurance provider to discuss coverage details, obtain preauthorization if required, and clarify any questions you may have about out-of-pocket costs. Additionally, consulting with your eye care professional can help determine the medical necessity of the procedure and assist in navigating insurance considerations.

Cataract Surgery and Health Insurance Coverage: Your Questions Answered

Is cataract surgery typically covered by health insurance?

Yes, cataract surgery is typically covered, at least partially, by most health insurance plans, including Medicare, Medicaid, and private plans (including Affordable Care Act marketplace plans). However, it's essential to understand that coverage details can vary significantly.

What factors determine the coverage of cataract surgery under health insurance plans?

Several factors affect coverage for cataract surgery:

- Medical necessity: Insurance usually requires the surgery to be deemed "medically necessary," meaning your vision loss significantly impacts daily activities.

- Plan type and limitations: Coverage specifics vary depending on your plan type (e.g., HMO, PPO) and its annual benefits and limitations.

- Pre-authorization: Some plans require pre-authorization for the surgery.

- Specific services: Different aspects of the surgery, like pre-op exams, surgery fees, and lens implants, may have different coverage levels.

3. Are there specific insurance policies or plans that offer comprehensive cataract coverage?

While specific plans can offer broader coverage, it's important to understand that "comprehensive" is relative. Some plans may cover:

- Basic monofocal lens implants: Most plans cover standard lens implants that only correct distance vision.

- Anesthesia: Anesthesia fees might be separate with specific coverage details.

- Follow-up care: Post-operative visits may be covered after the surgery.

However, premium lens options like multifocals or astigmatism-correcting implants often require additional out-of-pocket costs.

How do individuals navigate the insurance claims process for cataract surgery reimbursement?

Here's how you can navigate the claims process:

- Contact your insurance provider: Begin by reaching out to your insurance company to understand your specific coverage details and required pre-authorization steps.

- Obtain pre-authorization if needed: Follow your plan's requirements for pre-authorization, which may involve your doctor submitting documentation justifying the surgery's medical necessity.

- Choose an in-network provider: Opting for an in-network provider typically lowers your out-of-pocket costs.

- Gather documentation: Collect and keep organized all relevant medical records, bills, and receipts related to the surgery.

- Submit claims: Your doctor's office usually handles claim submission, but verify and understand the process to ensure timely processing.

- Appeal denials: If your claim is denied, you have the right to appeal. Familiarize yourself with the appeals process outlined by your insurance company.

What alternative financing options are available for those without insurance coverage for cataract surgery?

Without insurance, cataract surgery can be expensive. Consider these options:

- Health savings account (HSA): If you have an HSA and sufficient funds, you can use it to cover surgery costs.

- Medical financing: Some healthcare providers offer financing options for patients without insurance.

- Charities and assistance programs: Organizations like the Lions Club International offer financial assistance for vision care to eligible individuals.

- Negotiating with the provider: Discuss potential discounts or payment plans with your surgeon or the surgical facility.

It's important to compare costs and terms carefully before selecting any financing option.

Remember, understanding your specific insurance coverage and discussing options with your doctor and insurance provider is crucial before navigating the process of cataract surgery. Don't hesitate to ask questions and advocate for your needs throughout the journey.