How to buy a home with a very low income?

Buying a home with a very low income can be challenging, but it is not impossible. There are several strategies and support options that may help you achieve your goal of homeownership:

Explore Affordable Housing Programs:Many government and nonprofit organizations offer affordable housing programs that provide financial assistance to low-income individuals and families. These programs may include down payment assistance, low-interest mortgages, and reduced closing costs. Check with local housing agencies and nonprofits to see what programs are available in your area.

FHA Loans:The Federal Housing Administration (FHA) provides mortgage insurance for loans with lower down payments and more flexible credit requirements. FHA loans can be an option for low-income individuals, as they often require a down payment as low as 3.5% of the purchase price.

USDA Loans:The U.S. Department of Agriculture (USDA) offers loans for low-income individuals in rural areas. USDA loans are designed to help low-income borrowers purchase homes with no down payment.

VA Loans:If you are a U.S. military veteran, you may be eligible for a VA loan. These loans often require no down payment and have favorable terms, making them accessible for low-income veterans.

Habitat for Humanity:Habitat for Humanity is a nonprofit organization that builds and sells homes to low-income individuals and families at affordable prices. They often offer zero or low-interest mortgages.

Save for a Down Payment:While it may be challenging, saving for a down payment is a critical step in buying a home. Look for opportunities to cut expenses, increase your income, and save diligently. Consider setting up a dedicated savings account for your down payment.

Improve Your Credit Score:A better credit score can help you qualify for more favorable loan terms. Pay down existing debts, make payments on time, and correct any errors on your credit report.

Consider Shared Housing:Co-buying a home with a family member or trusted friend can make homeownership more affordable. Sharing expenses can help you qualify for a larger loan and make monthly payments more manageable.

Explore Rent-to-Own Options:Some sellers offer rent-to-own agreements that allow you to rent a property with the option to purchase it at a later date. These arrangements may give you time to save for a down payment while living in the home.

Seek Financial Counseling:Financial counselors or housing counselors can help you understand your financial situation and develop a plan to achieve homeownership. They can provide guidance on budgeting, credit improvement, and savings strategies.

Shop for Affordable Homes:Focus on homes within your budget. Consider smaller properties, fixer-uppers, or homes in more affordable neighborhoods.

Patience and Persistence:Achieving homeownership on a very low income may take time. Be patient, persistent, and proactive in seeking assistance and opportunities.

Remember that homeownership is a significant financial commitment. Before pursuing a home purchase, assess your financial situation carefully, consider your ability to cover ongoing homeownership costs (mortgage, insurance, property taxes, maintenance), and make sure it's the right choice for your long-term financial stability. Consulting with a housing counselor or financial advisor can provide valuable insights into your specific situation.

Buying a Home with Very Low Income: Strategies and Options

Buying a home can be a challenging financial undertaking for anyone, but it can be especially challenging for people with very low income. However, there are a number of strategies and options available to help low-income buyers achieve their dream of homeownership.

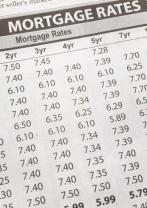

One important step is to get pre-approved for a mortgage. This will give you an idea of how much you can afford to borrow and what your monthly mortgage payments will be. It is also important to shop around for different mortgage lenders to compare rates and terms.

Another important step is to save for a down payment. While it is possible to buy a home with no down payment, having a down payment will lower your monthly mortgage payments and make you a more attractive borrower to lenders. There are a number of down payment assistance programs available to help low-income buyers, so be sure to research your options.

Exploring Affordable Housing Programs for Low-Income Buyers

There are a number of affordable housing programs available to help low-income buyers purchase a home. These programs can provide financial assistance with down payments, closing costs, and monthly mortgage payments.

Some popular affordable housing programs include:

- Federal Housing Administration (FHA) loans: FHA loans allow borrowers to purchase a home with a down payment as low as 3.5%.

- United States Department of Agriculture (USDA) loans: USDA loans allow borrowers to purchase a home in a rural area with no down payment.

- Veteran's Affairs (VA) loans: VA loans allow qualified veterans to purchase a home with no down payment.

Creative Financing and Down Payment Assistance for Home Purchase

In addition to government-sponsored affordable housing programs, there are also a number of creative financing and down payment assistance options available to low-income buyers. Some of these options include:

- Seller financing: Seller financing allows the seller of the home to finance the purchase for the buyer. This can be a good option for buyers with limited credit or down payment.

- Hard money loans: Hard money loans are short-term loans that are typically used to finance the purchase of a home that will be renovated and sold for a profit. Hard money loans can be a good option for buyers who need to close quickly or who have poor credit.

- Down payment assistance programs: There are a number of down payment assistance programs available to help low-income buyers. These programs can provide grants or loans to help buyers cover the cost of their down payment.

Budgeting and Saving Tips for Low-Income Homebuyers

Saving for a down payment and making monthly mortgage payments can be challenging for low-income buyers. However, there are a number of budgeting and saving tips that can help:

- Create a budget: Creating a budget will help you to track your income and expenses and identify areas where you can cut back.

- Pay off debt: High-interest debt can make it difficult to save for a down payment. Make a plan to pay off your debt as quickly as possible.

- Increase your income: Consider getting a part-time job or starting a side hustle to increase your income.

- Reduce your expenses: Look for ways to reduce your expenses, such as eating out less and canceling unused subscriptions.

Navigating the Homebuying Process with Limited Financial Resources

Navigating the homebuying process with limited financial resources can be challenging, but it is possible. Here are a few tips:

- Get pre-approved for a mortgage: This will give you an idea of how much you can afford to borrow and make you a more attractive buyer to sellers.

- Shop around for different mortgage lenders: Compare rates and terms to get the best deal possible.

- Work with a qualified real estate agent: A good real estate agent can help you to find homes that are within your budget and meet your needs.

- Be prepared to negotiate: Don't be afraid to negotiate the price of the home with the seller.

- Be patient: It may take some time to find the right home for you and your budget. Don't get discouraged.

Buying a home with very low income is possible, but it requires careful planning and preparation. By following the tips and strategies above, you can increase your chances of success.