How to find the best mortgage rates?

Finding the best mortgage rates involves careful research, comparison, and consideration of various factors. Here's a step-by-step guide to help you find the best mortgage rates:

Check Your Credit Score:

- Your credit score has a significant impact on the interest rate you'll be offered. Obtain a copy of your credit report and check your score. Take steps to improve your credit if needed.

Understand Your Financial Situation:

- Evaluate your financial situation, including your income, debts, and expenses. Determine how much you can afford to borrow and what type of mortgage (e.g., fixed-rate or adjustable-rate) aligns with your financial goals.

Research Mortgage Types:

- Understand the various types of mortgages available, such as fixed-rate mortgages, adjustable-rate mortgages (ARMs), FHA loans, and VA loans. Each type has different terms and may come with different interest rates.

Compare Lenders:

- Shop around and compare mortgage lenders. Consider traditional banks, credit unions, online lenders, and mortgage brokers. Look for lenders with a reputation for transparency, good customer service, and competitive rates.

Gather Multiple Quotes:

- Obtain quotes from several lenders. Provide each lender with the same information, including loan amount, loan term, and down payment, to ensure accurate comparisons.

Consider Points and Fees:

- Understand the points and fees associated with each loan offer. A lower interest rate might come with higher upfront fees, and vice versa. Calculate the total cost of the loan over its term to make an informed decision.

Negotiate and Ask Questions:

- Don't hesitate to negotiate with lenders. Ask about any available discounts, promotions, or special programs. Also, clarify any terms or conditions you find unclear.

Check for Rate Lock Options:

- Inquire about rate lock options. A rate lock ensures that the interest rate offered to you will be maintained for a specified period, protecting you from potential rate increases during the loan processing period.

Explore Government Programs:

- Investigate government-backed mortgage programs, such as FHA loans or VA loans, which may offer competitive rates and more flexible qualifying criteria.

Consider Referrals:

- Ask friends, family, or colleagues for recommendations based on their mortgage experiences. Personal referrals can provide valuable insights into the lending process.

Review Online Resources:

- Utilize online mortgage comparison tools and websites to get an overview of current mortgage rates and offers. However, keep in mind that the rates you see online may not be tailored to your specific financial situation.

Consult a Mortgage Broker:

- Consider working with a mortgage broker who can help you navigate the lending landscape and connect you with multiple lenders. Brokers may have access to a range of loan products.

Remember that finding the best mortgage involves more than just the interest rate. Consider factors like loan terms, closing costs, customer service, and the overall suitability of the loan for your financial goals. Take your time to make an informed decision and consult with financial professionals if needed.

Where to find and compare the best mortgage rates?

There are several places where you can find and compare mortgage rates. Some of the most popular options include:

Online mortgage lenders: Several online lenders offer transparent and competitive mortgage rates. These lenders typically have lower overhead costs than traditional brick-and-mortar banks, which allows them to offer lower rates.

Bankrate: Bankrate is a popular financial website that aggregates mortgage rates from a variety of lenders. You can use Bankrate's mortgage rate comparison tool to compare rates from different lenders side-by-side.

NerdWallet: NerdWallet is another popular financial website that offers a mortgage rate comparison tool. NerdWallet's tool allows you to compare rates from different lenders based on your specific needs, such as your loan amount, credit score, and down payment.

Mortgage brokers: Mortgage brokers can help you find and compare mortgage rates from a variety of lenders. Brokers typically have access to a wide network of lenders, which can help you find the best rate for your needs.

Word-of-mouth: Talking to friends, family, and colleagues can also be a good way to find reputable mortgage lenders. Ask around for recommendations and get quotes from several lenders before making a decision.

What factors influence mortgage rate comparison?

Several factors can influence the mortgage rate you are offered, including:

Your credit score: Your credit score is a major factor in determining your mortgage rate. The higher your credit score, the lower your interest rate will be.

The loan amount: The amount you borrow will also affect your interest rate. Generally, the larger the loan amount, the higher the interest rate.

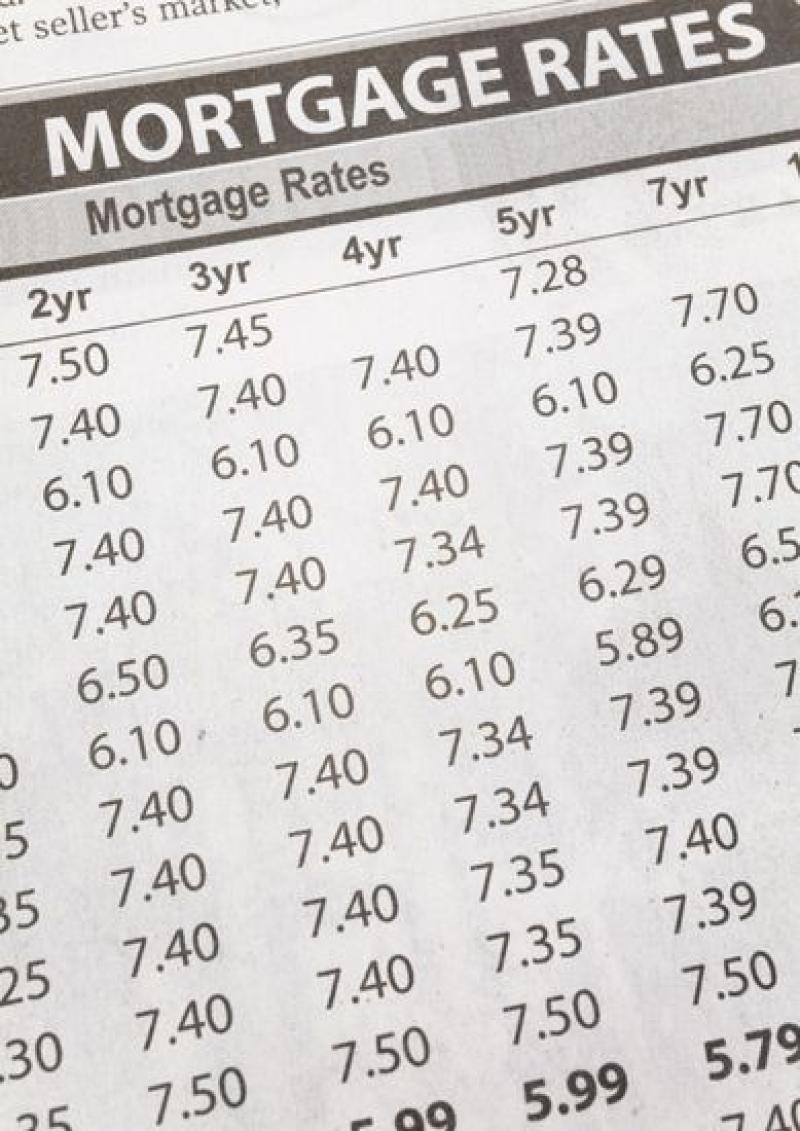

The loan term: The length of your mortgage term will also affect your interest rate. Longer terms typically have higher interest rates than shorter terms.

The type of loan: The type of mortgage you choose will also affect your interest rate. For example, fixed-rate mortgages typically have higher interest rates than adjustable-rate mortgages (ARMs).

The interest rate environment: The overall interest rate environment will also affect your mortgage rate. When interest rates are high, mortgage rates will also be high.

Are there online tools to facilitate finding competitive mortgage rates?

Yes, there are several online tools that can help you find competitive mortgage rates. Some of the most popular tools include:

Bankrate's mortgage rate comparison tool: Bankrate's mortgage rate comparison tool allows you to compare rates from a variety of lenders side-by-side. You can filter your results by loan amount, credit score, and down payment.

NerdWallet's mortgage rate comparison tool: NerdWallet's mortgage rate comparison tool offers a similar functionality to Bankrate's tool. You can compare rates from different lenders based on your specific needs.

LendingTree: LendingTree is an online marketplace that connects borrowers with lenders. You can complete a single application form on LendingTree and receive quotes from multiple lenders.

Rocket Mortgage: Rocket Mortgage is an online mortgage lender that offers a quick and easy application process. You can get pre-approved for a mortgage in as little as 10 minutes.

Guaranteed Rate: Guaranteed Rate is another online mortgage lender that offers competitive rates and a variety of loan options. You can get a free quote from Guaranteed Rate in as little as 30 seconds.

By using these online tools, you can easily compare mortgage rates from a variety of lenders and find the best rate for your needs.

Here are some tips for using online mortgage rate comparison tools:

Be sure to enter accurate information about your loan needs. The more accurate your information, the more accurate the rates you will receive.

Compare rates from multiple lenders. Don't just choose the first rate you see. Get quotes from at least three lenders to make sure you are getting the best deal.

Be aware of closing costs. In addition to the interest rate, closing costs can also add significant expense to your mortgage. Be sure to factor closing costs into your decision-making process.

By following these tips, you can increase your chances of finding the best mortgage rate for your needs.