How much does a new car really cost?

The true cost of a new car goes beyond the initial purchase price. When considering the total cost of owning a new car, you should take into account several factors, including:

Purchase Price: This is the most obvious cost, and it can vary significantly depending on the make, model, features, and location. Make sure to research the price and consider negotiating or looking for special offers.

Financing: If you're not buying the car outright with cash, you'll need to consider the cost of financing. This includes the interest on an auto loan, which can add significantly to the overall cost.

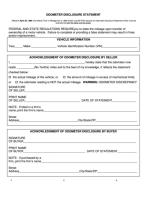

Taxes and Fees: When you buy a new car, you'll typically pay sales tax, registration fees, and possibly other charges like documentation fees. These can add up to a substantial amount.

Insurance: You'll need to pay for auto insurance, which varies depending on the type of car, your driving history, and other factors.

Depreciation: New cars start losing value as soon as you drive them off the lot. Depreciation is a significant cost of car ownership, and it can vary depending on the make and model of the car.

Fuel: You'll need to budget for the cost of gasoline or other fuel sources, which can vary based on your driving habits and the car's fuel efficiency.

Maintenance and Repairs: New cars still require regular maintenance, including oil changes, tire rotations, and potentially more significant repairs over time. This cost can vary based on the car's make and model.

Warranty and Extended Coverage: Consider the cost of any extended warranties or additional coverage you may want to purchase for the car.

Parking and Storage: If you don't have a free parking space, you may need to pay for parking or storage.

License and Registration Renewal: There are ongoing costs for renewing your car's registration and obtaining a new license or plates when needed.

Interest on Loans: If you took out a car loan, the interest payments over the life of the loan should be factored into the total cost.

Opportunity Cost: The money you spend on a car could be invested or used for other purposes, so consider the opportunity cost of tying up your funds in a car.

Trade-In or Resale Value: Consider the potential future value of your car when you decide to sell or trade it in.

The true cost of a new car can vary greatly depending on these factors and your individual circumstances. It's essential to do thorough research and budgeting to understand the total cost of ownership and to make an informed decision about whether a particular car fits your budget. Additionally, it's wise to consider factors like fuel efficiency and depreciation, which can have a long-term impact on the cost of owning a car.

The Real Cost of a New Car: Beyond the Sticker Price

The sticker price is the price of a new car that is displayed on the window. However, this is not the only cost that you will need to consider when purchasing a new car. There are a number of hidden costs and factors that can impact your overall expenses.

Hidden Costs and Factors Impacting New Car Expenses

Some of the hidden costs and factors that can impact new car expenses include:

- Sales tax: Sales tax is a tax that is charged on the purchase of a new car. The sales tax rate varies from state to state.

- Title and registration fees: Title and registration fees are fees that are charged by the state to register your new car. The title and registration fees vary from state to state.

- Dealer fees: Dealer fees are fees that are charged by the car dealership. Dealer fees can vary from dealership to dealership.

- Financing costs: If you finance your new car, you will need to pay interest on the loan. The interest rate will vary depending on your credit score and the terms of the loan.

- Insurance: Insurance costs vary depending on the type of car you purchase, your driving record, and your age.

- Maintenance and repairs: New cars require regular maintenance and repairs. The cost of maintenance and repairs will vary depending on the make and model of your car.

- Depreciation: Depreciation is the decline in value of a car over time. New cars depreciate quickly.

Calculating the Total Cost of Ownership for a New Car

To calculate the total cost of ownership for a new car, you need to consider all of the costs listed above. The total cost of ownership will vary depending on the make and model of your car, your driving habits, and your location.

Financing and Budgeting for a New Car Purchase

If you are financing your new car, it is important to create a budget to ensure that you can afford the monthly payments. You should also consider the total cost of the loan, including the interest.

Making Informed Decisions About New Car Affordability

When making a decision about whether or not you can afford a new car, it is important to consider all of the costs involved. You should also consider your financial situation and your budget.

Here are some tips for making informed decisions about new car affordability:

- Do your research: Before you start shopping for a new car, research the different makes and models to find one that fits your budget and needs.

- Get pre-approved for a loan: Before you visit a car dealership, get pre-approved for a loan from a bank or credit union. This will give you an idea of how much you can afford to borrow and what your monthly payments will be.

- Negotiate the price: Don't be afraid to negotiate the price of the car with the dealer. You should also negotiate the interest rate on your loan.

- Consider buying a used car: Used cars are often much cheaper than new cars. However, it is important to inspect a used car carefully before you buy it.

By following these tips, you can make informed decisions about new car affordability and purchase the car that is right for you.