How does the Il teacher pension work?

The Illinois Teacher Pension System, commonly referred to as the Teachers' Retirement System of the State of Illinois (TRS), is a defined benefit pension plan that provides retirement benefits to eligible public school educators in the state of Illinois. Here's how the Illinois Teacher Pension System works:

Membership: Eligible participants in the TRS include teachers, administrators, and other educational personnel employed by public school districts, community colleges, and universities in Illinois. Membership is typically mandatory for full-time and some part-time public school employees.

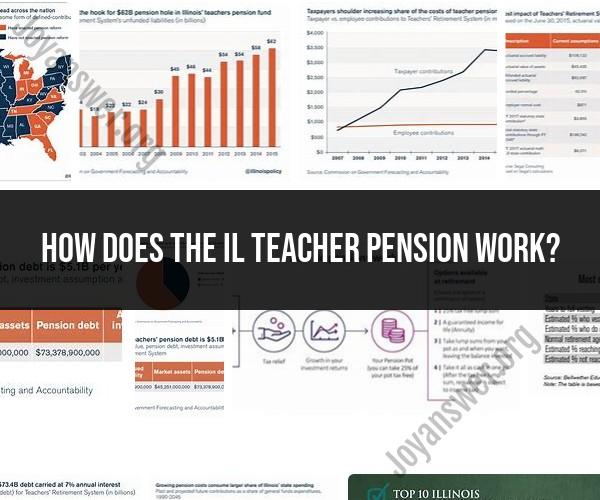

Contributions: Both employees and employers make contributions to the TRS. These contributions are a percentage of the employee's salary. The specific contribution rates can vary based on legislation and collective bargaining agreements but are typically shared between the employee and the employer. The contributions are pooled and invested to generate returns over time.

Accrual of Service Credit: Members of the TRS earn service credit based on their years of employment and the amount of salary on which they contribute to the pension fund. Each year of eligible employment typically accrues one year of service credit. Service credit is a key factor in determining retirement eligibility and benefit calculations.

Vesting: After a specified number of years of service, members become vested in the pension plan. In Illinois, vesting typically occurs after 10 years of service. Once vested, members are entitled to receive a pension benefit upon retirement, even if they leave the public education system before reaching the age of retirement.

Retirement Benefits: Retirement benefits are calculated based on a formula that considers a member's final average salary (typically the average of the highest-paid consecutive years of employment), years of service credit, and a multiplier. The multiplier is set by law and may vary depending on when the member first joined the TRS.

Early Retirement: Some members may be eligible for early retirement with reduced benefits if they meet certain age and service requirements. Early retirement typically results in a reduction in the monthly pension benefit compared to the benefit received at normal retirement age.

Disability Benefits: The TRS also provides disability benefits to members who become permanently disabled while in service. Disability benefits are typically calculated based on the member's service credit and final average salary.

Survivor Benefits: In the event of a member's death, survivor benefits may be available to eligible beneficiaries, such as spouses or dependent children.

Cost-of-Living Adjustments (COLAs): The TRS may provide cost-of-living adjustments to retired members' pensions to help them keep pace with inflation. The COLAs are subject to legislative approval and may vary over time.

Administration: The TRS is administered by a board of trustees responsible for managing the pension fund, including investment decisions and benefit disbursements.

It's essential for educators who are members of the Illinois Teacher Pension System to understand the specific rules, contribution rates, and benefit calculations that apply to their individual circumstances. Additionally, pension benefits are subject to state laws, which can change over time, so staying informed about updates and changes to the pension system is crucial for members.