What is the pay period or the pay schedule?

In the context of military pay, the pay period refers to the timeframe over which military personnel receive their pay. Military pay is typically distributed on a monthly basis, and the specific pay schedule may vary based on the branch of the military and the individual's pay grade. Here are some key points to understand about military pay periods:

Monthly Pay:

- Military personnel generally receive their pay on a monthly basis. This means that they are paid once a month for their service.

Pay Grade and Rank:

- The pay period and amount are influenced by the individual's pay grade or rank. Higher-ranking officers typically receive higher base pay.

Active Duty and Reserve Components:

- Active duty military personnel, as well as members of the Reserve and National Guard, receive pay based on their service status and the number of days served in a given month.

Direct Deposit:

- Military pay is often distributed through direct deposit, where the funds are electronically transferred to the individual's bank account.

Pay Schedule:

- The specific pay schedule can vary, but in general, military personnel are paid on the 1st and 15th of each month. If those dates fall on a weekend or holiday, the pay may be distributed on the business day preceding the weekend or holiday.

Leave and Special Pay:

- Military members may receive additional pay for special circumstances, such as hazardous duty, deployment, or other special assignments. Leave (vacation) taken during a pay period can also affect the amount of pay received.

LES (Leave and Earnings Statement):

- Military members can access their pay information through the Leave and Earnings Statement (LES), which provides a detailed breakdown of their pay, allowances, deductions, and other financial information.

Tax Considerations:

- Military pay is subject to federal income tax, but certain allowances and benefits may be tax-exempt. Each individual's tax situation may vary, and it's advisable to consult with a tax professional for guidance.

It's important for military personnel to be aware of their pay schedule, especially when planning financial matters. If there are any questions or concerns about military pay, individuals can contact their unit's finance office or refer to official military pay resources for accurate and up-to-date information. Military pay policies may be subject to change, so individuals should stay informed about any updates or revisions to the pay system.

Sure, here is a comprehensive explanation of pay periods, pay schedules, pay frequency, pay dates, and earnings calculations:

Understanding Pay Periods and Pay Schedules

Pay Period:

A pay period is the specific time frame for which employees earn wages and are subsequently paid. It represents the interval between the first day of the period and the last day before the next pay period begins.

Pay Schedule:

A pay schedule is a predetermined plan that outlines how often employees are paid and the specific dates on which they receive their paychecks. It establishes a consistent and predictable pattern for employee compensation.

Types of Pay Periods and Pay Schedules:

Common pay periods include:

Weekly: Employees are paid once a week, typically on Fridays.

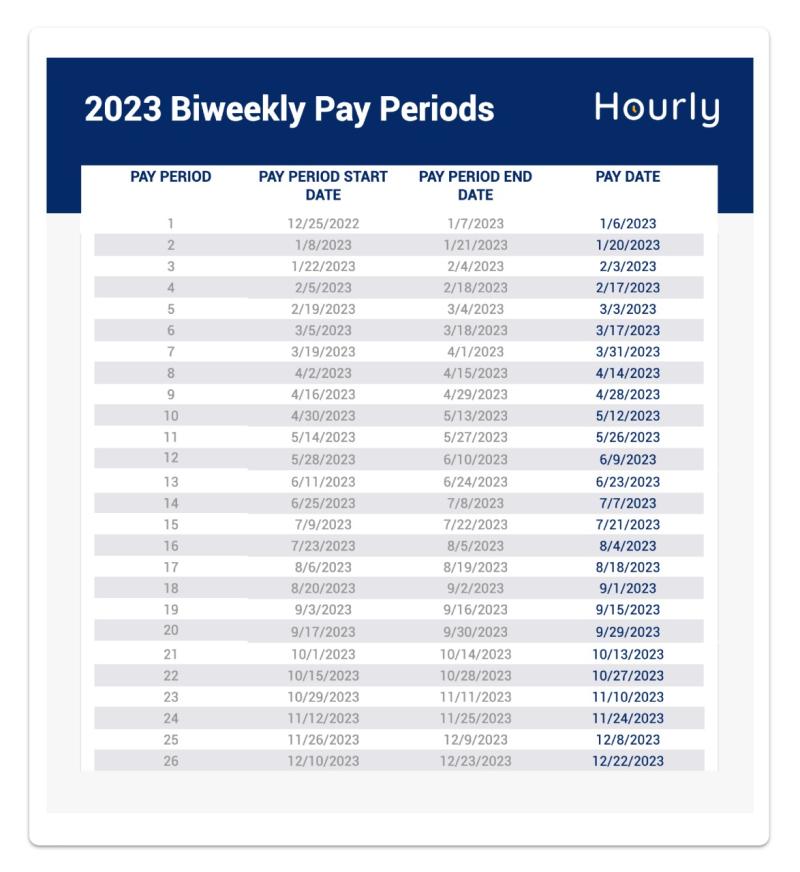

Bi-Weekly: Employees are paid every other week, usually on Fridays or Wednesdays.

Semi-Monthly: Employees are paid twice a month, typically on the 15th and last days of the month.

Monthly: Employees are paid once a month, on a specific day.

Determining Pay Frequency and Pay Dates

Pay Frequency:

Pay frequency refers to the number of times an employee is paid within a designated period, such as a year or a month. It indicates the regularity of employee compensation.

Pay Dates:

Pay dates are the specific days on which employees receive their paychecks. They are typically determined by the pay schedule and the pay period.

Examples of Pay Frequency and Pay Dates:

Weekly pay: Employees are paid 52 times a year (assuming 52 weeks), with pay dates every Friday.

Bi-weekly pay: Employees are paid 26 times a year (assuming 26 bi-weekly periods), with pay dates every other Friday or Wednesday.

Semi-monthly pay: Employees are paid 24 times a year (assuming 12 months and 24 pay periods), with pay dates on the 15th and last days of each month.

Monthly pay: Employees are paid 12 times a year (assuming 12 months), with pay dates on a specific day of each month (e.g., the 1st or 15th).

Calculating Earnings and Net Pay based on Pay Periods

Earnings:

Earnings refer to the gross amount of money an employee is paid before any deductions are taken. It represents the total compensation for the pay period.

Net Pay:

Net pay is the amount of money an employee receives after deductions for taxes, benefits, and other withholdings are subtracted from their gross earnings. It represents the actual take-home pay.

Calculating Net Pay:

Net pay = Gross earnings - Total deductions

Total deductions include:

Federal income tax: A mandatory tax withheld from employee paychecks to fund the federal government.

State income tax: Depending on the state, state income tax may also be withheld from employee paychecks.

Social Security tax: A tax that funds Social Security retirement and disability benefits.

Medicare tax: A tax that funds Medicare healthcare benefits for seniors.

Additional deductions: These may include health insurance premiums, retirement savings contributions, and union dues.

Example of Calculating Net Pay:

Suppose an employee's gross earnings for a bi-weekly pay period are $1,500. Their federal income tax deduction is $120, state income tax deduction is $50, Social Security tax deduction is $90, and Medicare tax deduction is $31.50. Their additional deductions for health insurance are $100.

Net pay = $1,500 - $120 - $50 - $90 - $31.50 - $100 = $1,108.50

In this example, the employee's net pay, after all deductions, is $1,108.50.