Is a UCC Bill a negotiable instrument?

A UCC Bill is not typically considered a negotiable instrument itself, but it may relate to negotiable instruments in the context of commercial transactions governed by the Uniform Commercial Code (UCC).

The Uniform Commercial Code (UCC) is a set of laws in the United States that regulates various aspects of commercial transactions. The UCC covers topics such as sales of goods, secured transactions, and negotiable instruments. Negotiable instruments, under the UCC, include items like promissory notes, checks, and certificates of deposit, which have specific characteristics that make them transferable and enforceable.

A UCC Bill, often referred to as a UCC financing statement, is a document filed to establish a security interest in personal property, such as equipment, inventory, or accounts receivable. It is not a negotiable instrument itself. Instead, it is a record that provides notice of a security interest in certain assets. These filings help establish a creditor's claim to collateral in the event of a default by the debtor.

In summary, UCC Bills, in the context of UCC financing statements, are not negotiable instruments. Negotiable instruments are a separate category of financial instruments with specific characteristics, while UCC Bills serve a different purpose related to securing interests in personal property.

UCC Bill as a Negotiable Instrument: Understanding the Connection

In the realm of commerce and finance, negotiable instruments play a crucial role in facilitating transactions and streamlining the exchange of value. These instruments, governed by the Uniform Commercial Code (UCC), serve as transferable representations of a monetary obligation, allowing for their easy circulation among parties. UCC bills, a specific type of negotiable instrument, hold a significant position in this framework.

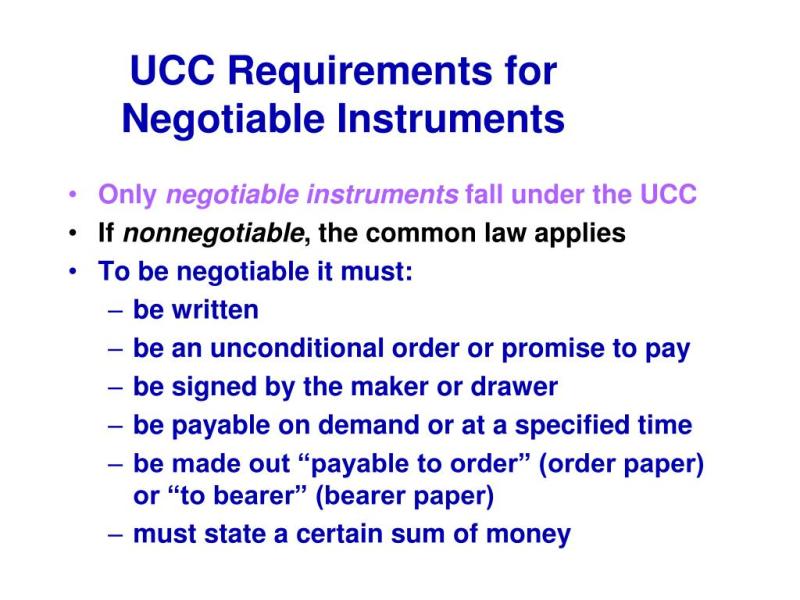

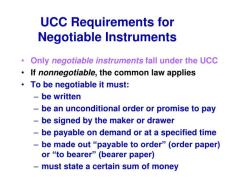

To comprehend the connection between UCC bills and negotiable instruments, it's essential to grasp the defining characteristics of both. A negotiable instrument, as outlined in Article 3 of the UCC, is a written promise or order to pay a certain sum of money at a specified time or on demand. It possesses unique features that distinguish it from other financial documents, such as unconditional payment terms, transferability, and the ability to be held by a holder in due course.

UCC bills, specifically, are a type of draft, which is a negotiable instrument that orders a drawee to pay a specified amount of money to a named payee or bearer. They are commonly used in commercial transactions, particularly in international trade, where they facilitate the exchange of goods and services across borders.

The Role of UCC Bills in Negotiable Instruments

UCC bills play a multifaceted role in the world of negotiable instruments. Their primary function is to act as a payment mechanism, allowing for the transfer of funds between parties involved in a commercial transaction. They simplify the process of exchanging goods and services, eliminating the need for direct cash transfers.

Beyond their role as payment instruments, UCC bills also serve as a form of credit. When a drawer issues a UCC bill, they are essentially extending credit to the drawee, who is obligated to honor the bill upon presentation. This credit arrangement facilitates trade and commerce, allowing businesses to purchase goods and services without immediate payment.

Moreover, UCC bills possess significant legal implications. As negotiable instruments, they are subject to the provisions of the UCC, which govern their issuance, negotiation, and enforcement. These provisions provide a framework for ensuring the rights of all parties involved in a UCC bill transaction.

UCC Bills and Their Legal Status as Negotiable Instruments

The legal status of UCC bills as negotiable instruments is firmly established within the UCC. Article 3 of the UCC explicitly defines negotiable instruments and outlines their characteristics, including the requirement for unconditional payment terms, transferability, and the ability to be held by a holder in due course. UCC bills meet all of these criteria, solidifying their classification as negotiable instruments.

As negotiable instruments, UCC bills carry specific legal implications. Their transferability allows them to be easily circulated among parties, and holders in due course acquire the instrument free from most defenses that could be raised against the original payee. This feature enhances the security and reliability of UCC bills as payment instruments.

In conclusion, UCC bills play a vital role in the realm of negotiable instruments. Their ability to facilitate payments, extend credit, and serve as a form of secure financial instrument makes them indispensable tools in commercial transactions. Their legal status as negotiable instruments, governed by the UCC, further reinforces their significance in modern commerce.