What qualifies as a hardship withdrawal?

Hardship withdrawals from retirement accounts, such as 401(k) plans, are withdrawals made before the account holder reaches the eligible retirement age. These withdrawals are generally allowed in specific circumstances and are subject to certain criteria and considerations. The specific rules can vary depending on the retirement plan provider and the terms of the plan, but here are some common situations that may qualify for a hardship withdrawal:

Medical Expenses: Some plans allow hardship withdrawals to cover unreimbursed medical expenses for the account holder, their spouse, children, or dependents.

Home Purchase or Avoiding Eviction/Foreclosure: Withdrawals might be permitted for buying a primary residence or preventing eviction or foreclosure on the account holder's principal residence.

Education Expenses: Hardship withdrawals could be allowed to cover tuition, fees, or educational expenses for the account holder, their spouse, children, or dependents.

Funeral Expenses: Some plans permit withdrawals to cover funeral or burial expenses for immediate family members.

Financial Hardship: Other financial hardships not covered by the above categories might also qualify, though these are often more restricted and subject to stricter scrutiny.

It's important to note that hardship withdrawals are typically subject to income tax and, if taken before age 59½, may be subject to an additional 10% early withdrawal penalty imposed by the IRS unless an exception applies.

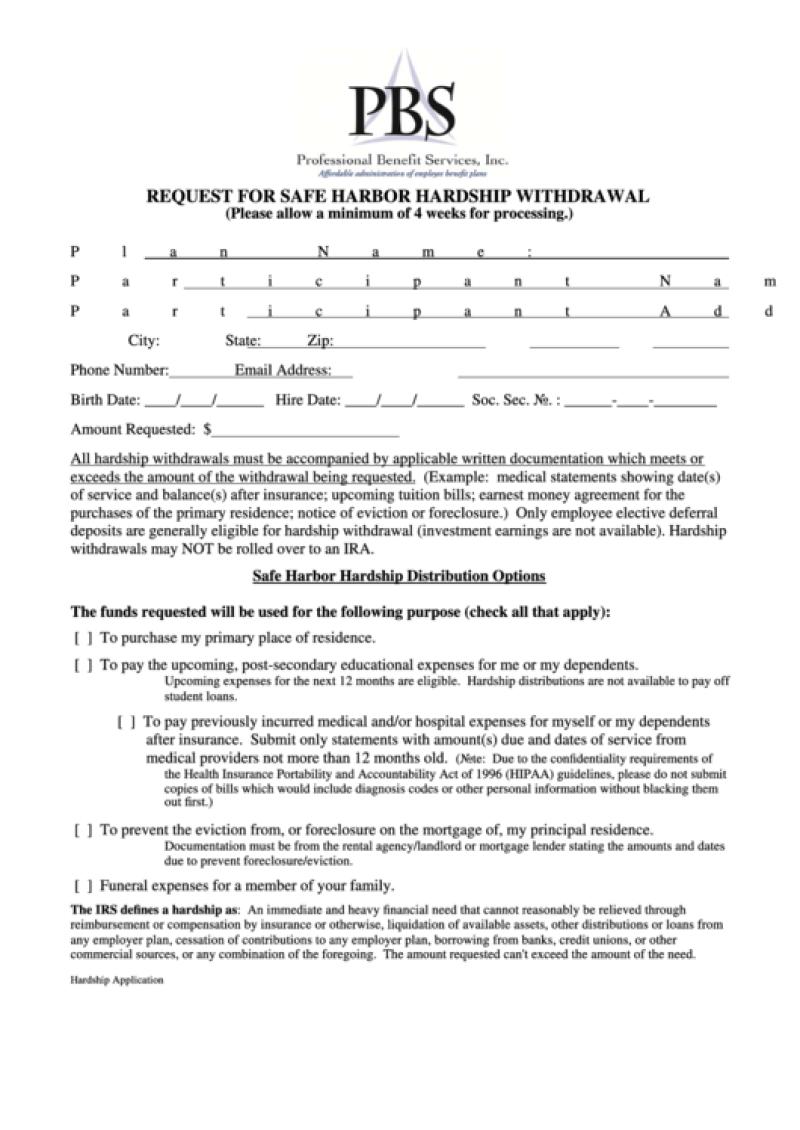

Additionally, not all retirement plans allow for hardship withdrawals, and those that do may have specific documentation requirements to prove the financial need for the withdrawal. It's crucial to review the plan's summary plan description or contact the plan administrator to understand the specific rules, limitations, and procedures for requesting a hardship withdrawal.

In many cases, financial advisors recommend exploring other options before resorting to a hardship withdrawal, such as taking out a loan against the retirement account (if permitted by the plan), seeking financial assistance, or considering other sources of funds, as hardship withdrawals can impact long-term retirement savings and come with tax implications.

1. Circumstances Qualifying as a Hardship for Loan Withdrawal

Hardship withdrawals from loans are typically allowed only in extreme circumstances that cause significant financial hardship. The specific circumstances that qualify as a hardship vary by lender, but some common examples include:

Unforeseen medical expenses: If you have a sudden and significant medical expense, such as a hospital stay, surgery, or ongoing treatment for a chronic condition, you may be eligible for a hardship withdrawal.

Loss of income: If you experience a sudden loss of income due to job loss, layoff, or disability, you may be eligible for a hardship withdrawal.

Natural disasters: If you suffer property damage or loss due to a natural disaster, such as a hurricane, flood, or fire, you may be eligible for a hardship withdrawal to cover essential expenses.

Death of a family member: If you incur significant expenses related to the death of a close family member, such as funeral costs or travel expenses, you may be eligible for a hardship withdrawal.

2. Applying for a Hardship Withdrawal from a Loan

The process for applying for a hardship withdrawal varies by lender. However, the general steps typically involve:

Contacting your lender: Inform your lender of your financial hardship and your intention to request a hardship withdrawal.

Explaining your hardship: Provide a detailed explanation of the hardship you are experiencing, including the specific circumstances and the financial impact.

Submitting documentation: Gather and submit supporting documentation to verify your hardship, such as medical bills, layoff notices, disaster insurance claims, or death certificates.

Review and decision: Your lender will review your request and documentation and make a decision on whether to approve your hardship withdrawal.

3. Limitations or Restrictions on the Amount Eligible for a Hardship Withdrawal

Lenders typically set limits or restrictions on the amount you can withdraw through hardship provisions. These limits may be based on the type of hardship, the severity of the financial impact, and the borrower's overall financial situation.

In some cases, lenders may limit hardship withdrawals to a certain percentage of the loan balance or restrict withdrawals to specific expenses, such as medical bills or funeral costs.

4. Impact of a Hardship Withdrawal on Loan Repayment Terms

A hardship withdrawal may temporarily defer or reduce your loan payments, providing some relief during the hardship. However, it is important to understand how this will affect your overall loan repayment terms.

Deferment: If your loan payment is deferred, you will not be required to make payments during the deferment period. However, the accrued interest will continue to accumulate, and the deferment period will be added to the total loan term.

Reduction: If your loan payment is reduced, you will pay a lower amount each month. However, this will also extend the total loan term and may increase the overall amount of interest paid over the life of the loan.

5. Documentation or Evidence Required to Support a Hardship Withdrawal Request

The specific documentation required to support a hardship withdrawal request varies by lender. However, some common types of documentation include:

Medical bills or insurance statements: If you are requesting a withdrawal due to medical expenses, provide proof of the medical treatment and the associated costs.

Layoff notices or unemployment benefits statements: If you are requesting a withdrawal due to loss of income, provide documentation of your job loss or unemployment benefits.

Insurance claims or disaster relief documentation: If you are requesting a withdrawal due to a natural disaster, provide proof of the damage or loss and any insurance claims or disaster relief assistance received.

Obituaries or death certificates: If you are requesting a withdrawal due to a death in the family, provide proof of the death and any related expenses.

It is crucial to provide accurate and complete documentation to support your hardship withdrawal request. The lender will review the documentation to assess the severity of your hardship and make a determination on whether to approve your request.