How to pay off your mortgage by selling your house?

Paying off your mortgage by selling your house is a common approach that homeowners use to eliminate their mortgage debt. Here's a step-by-step guide on how to do it:

Determine the Current Market Value: Start by getting a professional appraisal or consulting with local real estate agents to determine the current market value of your home. This will give you an idea of how much you can sell your house for.

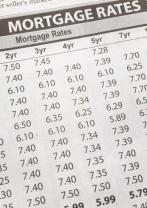

Calculate Your Outstanding Mortgage Balance: Contact your mortgage lender to obtain the exact amount required to pay off your mortgage in full. This figure includes the principal balance, accrued interest, and any prepayment penalties, if applicable.

Hire a Real Estate Agent: Consider hiring a real estate agent who specializes in your local market. They can help you navigate the selling process, set the right price, and market your property effectively.

Prepare Your Home for Sale: Make necessary repairs, clean, declutter, and stage your home to make it more appealing to potential buyers. First impressions matter, and a well-presented home can sell faster and at a better price.

List Your Home: Work with your real estate agent to list your home on the local Multiple Listing Service (MLS) and various online platforms, including real estate websites and social media.

Market Your Property: Promote your home through open houses, online listings, and traditional marketing methods to attract potential buyers.

Negotiate Offers: When you receive offers from buyers, work with your real estate agent to negotiate the terms, including the sale price and any contingencies.

Accept an Offer: Once you accept an offer, the buyer's lender will typically conduct an appraisal and inspection of the property. Be prepared to address any issues that may arise during the inspection.

Close the Sale: The closing process involves completing all necessary paperwork, transferring ownership, and settling the financial aspects of the sale. Your mortgage lender will provide a payoff statement, and the sale proceeds will be used to pay off your mortgage in full. Any remaining funds will be disbursed to you.

Pay Off Your Mortgage: After closing, your mortgage lender will process the payoff, and your mortgage will be marked as paid in full.

Hand Over Possession: Give possession of the property to the new owner as specified in the closing documents.

Move Out: Plan your move to your new residence, if applicable.

It's important to note that selling your home to pay off your mortgage is a significant financial transaction, and there may be associated costs such as real estate agent commissions, closing costs, and potential capital gains taxes (depending on your specific situation). Be sure to consult with professionals, including a real estate agent and tax advisor, to fully understand the implications and benefits of this approach.