Is contract of indemnity a void agreement?

A contract of indemnity is not necessarily a void agreement. In most legal systems, including common law systems, a contract of indemnity is generally considered valid and enforceable, provided that it meets the basic requirements of a valid contract. However, the legality and enforceability of a contract of indemnity may depend on various factors and circumstances.

A contract of indemnity is a type of contract in which one party (the indemnifier) agrees to compensate or reimburse another party (the indemnitee) for any losses, damages, or liabilities that the indemnitee may incur in the future. These contracts are often used to allocate risk and protect one party from financial harm.

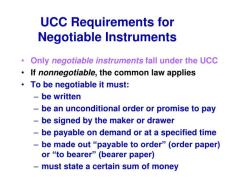

To be legally valid, a contract of indemnity, like any other contract, should satisfy the following fundamental elements:

Offer and Acceptance: There must be a clear offer by one party and acceptance of that offer by the other party.

Intention to Create Legal Relations: Both parties must intend for the contract to create legally binding obligations.

Legal Capacity: Both parties must have the legal capacity to enter into the contract. This generally means they are of sound mind and of legal age.

Lawful Purpose: The contract's purpose must be lawful and not violate any laws or public policy.

Certainty and Possibility of Performance: The contract terms should be clear and capable of being performed.

A contract of indemnity can be void or unenforceable under specific circumstances, such as when:

- It violates the law or public policy (e.g., it seeks to indemnify a party for intentional harm or criminal conduct).

- It lacks consideration (i.e., something of value exchanged between the parties).

- It is found to be unconscionable or obtained through duress or fraud.

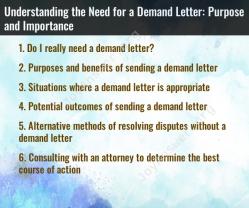

It's essential to consult with a qualified attorney or legal expert in your jurisdiction to assess the specific terms of the contract of indemnity and determine its validity and enforceability. The interpretation of contracts can vary based on local laws, and there may be case-specific factors that influence the outcome.

Contract of Indemnity: Understanding the Basics

A contract of indemnity is a legal agreement between two parties, in which one party (the indemnifier) agrees to reimburse the other party (the indemnitee) for any losses or damages incurred as a result of a specific event or act.

Indemnity contracts are commonly used in a variety of industries, including construction, manufacturing, and insurance. For example, a construction contractor may agree to indemnify the property owner for any damages caused to the property during construction.

Void Agreements and the Concept of Indemnity

A void agreement is a contract that is not legally binding. There are a number of reasons why an agreement may be void, including:

- Lack of consent: One or both parties may not have freely consented to the agreement.

- Illegality: The agreement may be for an illegal purpose.

- Fraud or misrepresentation: One party may have fraudulently induced the other party to enter into the agreement.

If an indemnity agreement is void, the indemnifier will not be liable to reimburse the indemnitee for any losses or damages incurred.

The Legality and Enforceability of Contract of Indemnity

The legality and enforceability of a contract of indemnity will depend on the specific terms of the agreement and the laws of the jurisdiction in which it is made.

In general, however, most indemnity agreements will be enforceable as long as they are fair and reasonable, and do not violate any public policy concerns.

Key Provisions and Obligations in Indemnity Contracts

Indemnity contracts should typically include the following provisions:

- A clear definition of the events or acts that are covered by the indemnity agreement.

- A description of the losses or damages that the indemnifier is liable to reimburse.

- The obligations of each party in the event of a claim.

- A provision for how the agreement can be changed or amended.

- A signature from each party.

It is important to have an indemnity agreement reviewed by a lawyer to ensure that it is enforceable and meets your individual needs.

Legal Implications of Indemnity in Various Industries

Indemnity contracts have a number of legal implications in various industries. For example, in the construction industry, indemnity agreements can help to protect contractors from liability for damages caused to the property owner or other parties during construction.

In the manufacturing industry, indemnity agreements can help to protect manufacturers from liability for injuries or damages caused by their products.

In the insurance industry, indemnity agreements are used to define the scope of coverage under an insurance policy.

Overall, indemnity contracts can be a valuable tool for managing risk and allocating liability in a variety of industries. However, it is important to understand the legal implications of indemnity agreements before entering into one.

Here are some additional examples of how indemnity contracts are used in various industries:

- Real estate: A buyer of real estate may agree to indemnify the seller for any liens or encumbrances on the property.

- Product liability: A manufacturer of a product may agree to indemnify the retailer of the product for any liability arising from injuries or damages caused by the product.

- Professional services: A professional services provider, such as a lawyer or accountant, may agree to indemnify their client for any losses or damages incurred as a result of their services.

It is important to note that indemnity agreements cannot be used to indemnify a party for their own negligence or willful misconduct.