What is the IFAC Code of ethics for Professional Accountants?

The International Federation of Accountants (IFAC) has established a comprehensive Code of Ethics that outlines ethical principles and guidelines for professional accountants. This guide provides insight into the IFAC Code of Ethics, emphasizing the importance of ethical conduct in the accounting profession.

Introduction to the IFAC Code of Ethics

The IFAC Code of Ethics sets forth fundamental principles that guide professional accountants in making ethical decisions and fulfilling their responsibilities.

Key Ethical Principles

The IFAC Code of Ethics is built on several fundamental principles:

- Integrity: Upholding honesty and truthfulness in all professional and business relationships.

- Objectivity: Remaining impartial and not allowing biases or conflicts of interest to compromise professional judgment.

- Professional Competence and Due Care: Maintaining a high level of expertise and performing diligently to ensure quality services.

- Confidentiality: Safeguarding confidential information obtained during professional engagements.

- Professional Behavior: Acting in a manner that reflects positively on the accounting profession.

Application of the Code

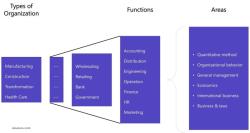

The IFAC Code of Ethics applies to all professional accountants, including auditors, tax advisors, and management accountants.

Addressing Ethical Dilemmas

Professional accountants often encounter ethical dilemmas. The IFAC Code of Ethics provides guidance on how to navigate such situations:

- Identify the Issue: Recognize the ethical problem at hand.

- Obtain Relevant Facts: Gather necessary information to understand the context.

- Consider Ethical Principles: Analyze the situation using the fundamental ethical principles.

- Make a Decision: Choose the course of action that aligns with ethical standards.

Independence and Objectivity

Ensuring independence and objectivity is of utmost importance for professional accountants, particularly for auditors:

- Financial Interests: Avoid financial interests that could impair objectivity.

- Close Relationships: Manage relationships that could influence independence.

Conclusion

The IFAC Code of Ethics serves as a guiding framework for professional accountants, promoting ethical behavior, integrity, and excellence. By adhering to the key principles and guidelines outlined in the Code, professional accountants contribute to maintaining trust, credibility, and transparency in financial reporting and the broader business environment.