Are college students eligible for government benefits programs?

Yes, college students may be eligible for certain government benefits programs depending on their financial circumstances, family situation, and other factors. Here are some government benefits programs that college students may be eligible for:

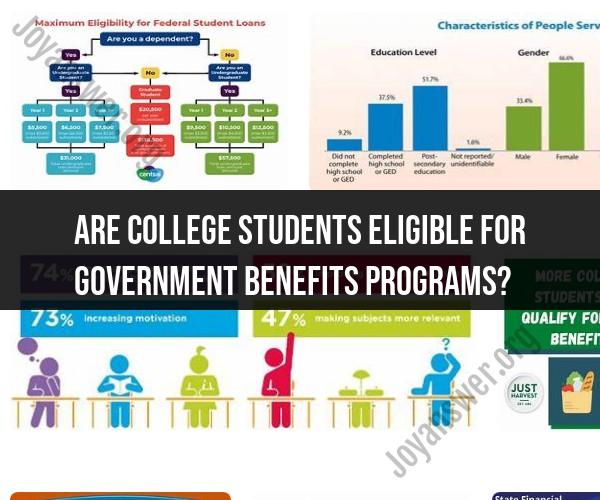

Federal Student Aid (FAFSA): Most college students are eligible to apply for federal financial aid by completing the Free Application for Federal Student Aid (FAFSA). This application determines eligibility for grants, work-study programs, and federal student loans. Grants like the Pell Grant are need-based and can provide financial assistance to low-income students.

Supplemental Nutrition Assistance Program (SNAP): College students who meet specific criteria may be eligible for SNAP benefits (formerly known as food stamps). Eligibility may be based on factors such as income, work-study status, and household size.

Child Care Assistance: Students who are parents and need child care while attending college may be eligible for child care assistance programs offered by their state or local government.

Unemployment Benefits: In certain situations, college students who lose their jobs or experience a reduction in work hours may be eligible for unemployment benefits. Eligibility varies by state, and students typically need to meet specific criteria.

Housing Assistance: Some college students may qualify for housing assistance programs, especially if they have dependents or face housing insecurity.

Low-Income Energy Assistance: Programs like LIHEAP provide assistance with energy bills, including heating and cooling costs. Eligibility is based on income and household size.

Medicaid: College students who meet income and other eligibility requirements may be eligible for Medicaid, which provides health insurance coverage. Eligibility rules vary by state.

Temporary Assistance for Needy Families (TANF): Students who meet income and family composition criteria may be eligible for TANF benefits, which provide financial assistance to low-income families.

It's important to note that eligibility for government benefits can vary widely depending on factors such as income, family size, and the specific requirements of each program. Additionally, the rules governing student eligibility for certain benefits, such as SNAP, can be complex and may vary by state.

When seeking government benefits as a college student, it's essential to:

Complete the FAFSA: Start by completing the FAFSA to determine your eligibility for federal student aid, including grants, work-study programs, and student loans.

Contact Your College's Financial Aid Office: Speak with your college's financial aid office for guidance on available financial assistance programs and resources.

Check Eligibility Criteria: Research the eligibility criteria for specific government benefits programs and apply accordingly. Be prepared to provide necessary documentation to support your application.

Stay Informed: Keep up-to-date with changes in eligibility criteria and program requirements, as they can evolve over time.

Seek Guidance: If you have questions about your eligibility or the application process, consider seeking guidance from a financial aid counselor or a social services agency.

Remember that government benefits programs are subject to change, and eligibility can be affected by various factors. It's essential to thoroughly research the programs that may be relevant to your situation and follow the application procedures outlined by the relevant agencies or offices.

Government Benefit Programs for College Students

The government offers a variety of benefit programs to help college students pay for their education and living expenses. Some of the most common government benefit programs for college students include:

- Pell Grants: Pell Grants are need-based grants that do not need to be repaid. They are available to undergraduate students who have not yet earned a bachelor's degree.

- Federal Supplemental Educational Opportunity Grants (FSEOGs): FSEOGs are need-based grants that are awarded to undergraduate students with exceptional financial need.

- Work-Study: The Work-Study program allows students to earn money to help pay for their education by working part-time jobs on or off campus.

- Direct Loans: Direct Loans are low-interest loans that are available to undergraduate and graduate students. Direct Loans are subsidized for students with financial need, which means that the government pays the interest on the loans while the student is in school and for six months after graduation.

- Parent PLUS Loans: Parent PLUS Loans are available to parents of undergraduate students. Parent PLUS Loans are not subsidized, which means that the interest on the loans accrues from the day the loans are disbursed.

Financial Aid Options Beyond Scholarships and Loans for Students

In addition to scholarships and loans, there are a number of other financial aid options available to college students, including:

- Grants: Grants are financial aid awards that do not need to be repaid. There are a variety of grants available, including government grants, private grants, and grants from colleges and universities.

- Work-Study: The Work-Study program allows students to earn money to help pay for their education by working part-time jobs on or off campus.

- Tuition waivers: Tuition waivers are financial aid awards that cover the cost of tuition. Tuition waivers are often awarded to students who have demonstrated academic excellence or who are involved in certain extracurricular activities.

- Payment plans: Many colleges and universities offer payment plans that allow students to pay for their tuition and fees in installments.

Eligibility and Application Process for Government Assistance Programs in College

To be eligible for government assistance programs in college, students must typically be U.S. citizens or eligible noncitizens and must be enrolled in an eligible degree program at an accredited college or university. Students must also demonstrate financial need.

To apply for government assistance programs in college, students must complete the Free Application for Federal Student Aid (FAFSA). The FAFSA is used to determine a student's financial need and to determine their eligibility for government assistance programs.

Students can learn more about government assistance programs for college students by visiting the Federal Student Aid website.

Tips for Applying for Government Financial Aid

Here are some tips for applying for government financial aid:

- Start early. The FAFSA becomes available on October 1st each year for the following academic year.

- Complete the FAFSA accurately. Be sure to answer all of the questions on the FAFSA accurately and completely.

- Submit all required documentation. Some schools may require students to submit additional documentation to verify their financial aid eligibility.

- Follow up after you apply. It is important to follow up with the financial aid office at your school to make sure that they have received all of your required documentation and to check on the status of your application.

Government assistance programs can be a valuable resource for college students. By following the tips above, students can increase their chances of receiving financial aid.