Which car loan is best?

The best car loan for your needs depends on various factors, including your financial situation, credit score, and personal preferences. Here are some steps to help you find the best car loan:

Assess Your Financial Situation:

- Determine how much you can afford to spend on a car and how much of a down payment you can make. Consider your monthly budget, including insurance, maintenance, and fuel costs.

Check Your Credit Score:

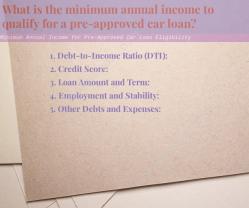

- Your credit score plays a significant role in the type of loan and interest rate you can secure. A higher credit score generally leads to better loan terms. Review your credit report for accuracy and address any issues if necessary.

Compare Loan Types:

- There are various types of car loans, including:

- New car loans: Designed for new vehicles and often have lower interest rates.

- Used car loans: Tailored for used cars and may have slightly higher interest rates.

- Pre-approved loans: You can get pre-approved for a loan from a bank or credit union before shopping for a car, which can help you set a budget.

- Dealership financing: Dealerships often offer financing options, but rates may vary, so compare them with other lenders.

- There are various types of car loans, including:

Shop Around for Lenders:

- Don't settle for the first loan offer you receive. Research and compare loan terms, interest rates, and fees from multiple lenders, including banks, credit unions, online lenders, and dealership financing.

Consider Loan Term:

- Decide on the length of the loan term (e.g., 36 months, 48 months, 60 months). Longer terms may result in lower monthly payments but can cost more in interest over time.

Factor in Interest Rates:

- The interest rate significantly affects the total cost of your loan. Lower interest rates can save you money, so try to secure the best rate possible based on your credit score and financial history.

Understand Total Loan Costs:

- Be aware of all the costs associated with the loan, including origination fees, prepayment penalties, and any add-ons offered by the lender.

Read the Fine Print:

- Carefully review the loan agreement, including the terms and conditions, to ensure you understand all the terms, responsibilities, and potential fees.

Negotiate and Compare Offers:

- Don't hesitate to negotiate with lenders for better terms. Also, use the offers from different lenders to your advantage when negotiating.

Consider Refinancing:

- If you're not satisfied with your current car loan terms, you may have the option to refinance at a later date if your credit score improves or interest rates decrease.

Seek Professional Advice:

- If you're unsure about the best car loan for your situation, consider consulting a financial advisor or credit counselor for personalized guidance.

Ultimately, the best car loan is one that aligns with your financial goals, offers competitive terms and interest rates, and fits comfortably within your budget. Careful research and comparison shopping can help you find the loan that best suits your needs.

The Road to Auto Financing: Comparing Car Loans for the Best Fit

When it comes to buying a car, financing can be one of the most important factors to consider. After all, you want to make sure you're getting the best possible deal on your loan so you're not overpaying in the long run.

There are a few different ways to finance a car loan. You can get a loan from a bank, credit union, or online lender. You can also get financing from the dealership where you're buying the car.

When you're comparing car loans, it's important to consider the following factors:

- Interest rate: The interest rate is the percentage of the loan amount that you'll pay in interest over the life of the loan. A lower interest rate will save you money in the long run.

- Loan term: The loan term is the length of time you have to repay the loan. A shorter loan term will mean higher monthly payments, but you'll pay less in interest overall. A longer loan term will mean lower monthly payments, but you'll pay more in interest overall.

- Down payment: A down payment is a percentage of the purchase price of the car that you'll pay upfront. A higher down payment will lower your monthly payments and the total amount of interest you'll pay over the life of the loan.

Finding the Perfect Ride: How to Choose the Best Car Loan

Once you've considered all of the factors above, you can start comparing car loans from different lenders. It's important to get pre-approved for a loan before you start shopping for a car. This will give you an idea of how much you can afford to spend and what your monthly payments will be.

When you're comparing car loans, be sure to get multiple quotes from different lenders. This will help you ensure that you're getting the best possible deal.

Car Loans Decoded: Selecting the Optimal Auto Financing Option

The optimal auto financing option for you will depend on your individual circumstances. If you have good credit and can afford a large down payment, you may be able to qualify for a low interest rate loan. If you have bad credit or can't afford a large down payment, you may need to consider a higher interest rate loan or a loan with a longer term.

No matter what your credit situation is, there are car loan options available to you. It's important to do your research and compare loans from different lenders to find the best deal for you.

Here are some additional tips for choosing the best car loan:

- Be honest with yourself about your budget. How much can you afford to spend on a monthly car payment?

- Consider your credit score. A good credit score will qualify you for lower interest rates.

- Get pre-approved for a loan before you start shopping for a car. This will give you an idea of how much you can afford to spend.

- Shop around and compare loans from different lenders.

- Read the fine print before you sign any loan agreement.

Choosing the right car loan can save you a lot of money in the long run. By following the tips above, you can find the best loan for your individual circumstances.