Where can you find work in corporate finance?

Corporate finance professionals work in a variety of industries and organizations, as their expertise is essential for managing financial matters and strategic decisions. Here are some common places where you can find work in corporate finance:

Publicly Traded Companies:

- Many large, publicly traded companies have in-house corporate finance teams responsible for managing financial planning, analysis, and reporting. Job opportunities can be found in roles like financial analyst, financial manager, or finance director.

Private Companies:

- Private companies, ranging from small startups to large enterprises, often hire corporate finance professionals to handle financial strategy, budgeting, and decision-making. Roles can include financial analysts, CFOs, and finance managers.

Investment Banks:

- Investment banks offer a range of corporate finance services, such as mergers and acquisitions (M&A) advisory, capital raising, and financial restructuring. Positions in investment banking may include investment bankers, analysts, and associates.

Consulting Firms:

- Management consulting firms, including the "Big Four" (Deloitte, PwC, EY, and KPMG), provide corporate finance services to clients. Jobs in corporate finance consulting involve financial analysis, valuation, and strategic financial planning.

Asset Management Firms:

- Asset management firms, which oversee investment portfolios for clients, often employ corporate finance professionals to analyze and manage investments. Common roles include portfolio managers, research analysts, and financial planners.

Private Equity and Venture Capital Firms:

- Private equity and venture capital firms invest in companies and often require corporate finance expertise to assess investment opportunities, conduct due diligence, and manage portfolio companies. Jobs can include private equity analysts and associates.

Real Estate and REITs:

- Real estate companies and real estate investment trusts (REITs) have corporate finance teams to manage property acquisitions, financing, and asset management. Positions include real estate analysts, financial managers, and asset managers.

Financial Services Companies:

- Financial institutions, such as banks and insurance companies, have corporate finance divisions responsible for risk management, capital allocation, and financial analysis. Job opportunities can be found in roles like risk analysts, financial planners, and finance managers.

Energy and Utilities Companies:

- Energy and utilities firms often have corporate finance teams to manage capital projects, mergers and acquisitions, and regulatory compliance. Positions can include energy finance analysts and financial directors.

Healthcare Organizations:

- Healthcare providers and pharmaceutical companies employ corporate finance professionals to manage budgets, financial planning, and mergers and acquisitions. Job titles may include healthcare financial analysts and finance managers.

Manufacturing Companies:

- Manufacturing companies hire corporate finance experts to oversee budgeting, cost control, and supply chain finance. Job roles include manufacturing finance analysts and controllers.

Tech and IT Companies:

- Technology and IT companies require corporate finance professionals for financial planning, budget management, and strategic investment analysis. Positions can include technology finance analysts and financial directors.

Non-Profit Organizations:

- Non-profits often have finance departments that manage budgets and financial planning. Opportunities exist for roles like non-profit finance managers and financial analysts.

To find work in corporate finance, you can search for job openings on company websites, job search platforms, and professional networking sites like LinkedIn. Networking within your industry and leveraging your educational background and certifications can also be valuable for landing corporate finance positions. Additionally, consider working with recruitment agencies that specialize in finance and corporate finance placements.

Exploring Career Opportunities in Corporate Finance

Corporate finance professionals are responsible for managing a company's financial resources. They play a vital role in helping businesses to grow and succeed.

There are a variety of career opportunities available in corporate finance. Here are a few examples:

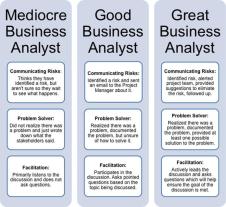

- Financial analyst: Financial analysts are responsible for analyzing financial data and preparing reports to help businesses make informed financial decisions.

- Investment banker: Investment bankers work with companies to raise capital and advise them on mergers and acquisitions.

- Corporate controller: Corporate controllers are responsible for overseeing a company's accounting and financial reporting functions.

- Treasurer: Treasurers are responsible for managing a company's cash flow and investments.

- Financial planning and analysis (FP&A) analyst: FP&A analysts are responsible for forecasting a company's financial performance and developing financial plans.

Job Roles and Specializations in Corporate Finance

There are a number of different job roles and specializations within corporate finance. Some of the most common specializations include:

- Capital markets: Capital markets specialists are responsible for raising capital for businesses through debt and equity offerings.

- Mergers and acquisitions (M&A): M&A specialists advise businesses on mergers and acquisitions.

- Financial modeling: Financial modeling specialists develop and use financial models to forecast a company's financial performance.

- Risk management: Risk management specialists identify and manage financial risks.

- Corporate treasury: Corporate treasury specialists manage a company's cash flow and investments.

Job Search Strategies and Resources for Corporate Finance Positions

There are a number of ways to find corporate finance jobs. Here are a few tips:

- Network with people in the industry: Attend industry events, reach out to people on LinkedIn, and talk to your friends and family to see if they know anyone who works in corporate finance.

- Search online job boards: There are a number of online job boards that list corporate finance jobs.

- Contact corporate finance recruiters: Corporate finance recruiters can help you to find jobs and negotiate salaries.

Preparing for Interviews and Advancing in Corporate Finance Careers

When preparing for a corporate finance interview, be sure to research the company and the position you are interviewing for. You should also be prepared to answer common interview questions, such as "Tell me about yourself" and "Why are you interested in this position?"

To advance in your corporate finance career, it is important to stay up-to-date on the latest trends and developments in the industry. You should also continue to develop your skills and knowledge. One way to do this is to pursue professional certifications, such as the Chartered Financial Analyst (CFA) designation.

Real-Life Success Stories in Corporate Finance Employment

There are many successful people who work in corporate finance. Here are a few examples:

- Warren Buffett: Warren Buffett is one of the most successful investors in the world. He is the chairman and CEO of Berkshire Hathaway, a multinational conglomerate holding company.

- Jamie Dimon: Jamie Dimon is the chairman and CEO of JPMorgan Chase, one of the largest banks in the world.

- Mary Barra: Mary Barra is the chairman and CEO of General Motors, one of the largest automakers in the world.

These are just a few examples of the many successful people who work in corporate finance. If you are interested in a career in corporate finance, there are many opportunities available. By following the tips and advice above, you can put yourself on the path to success.