How much does car insurance for renters cost?

The cost of car insurance for renters can vary widely based on several factors. Car insurance premiums are determined by various considerations, including the individual's driving history, location, type of vehicle, coverage levels, and insurance company. Here are some of the key factors that can influence the cost of car insurance for renters:

Driving Record: Your driving history plays a significant role in determining your insurance premium. Drivers with a clean record and no accidents or traffic violations typically pay lower premiums than those with a history of accidents or violations.

Location: The area where you live or plan to rent a vehicle can impact your insurance cost. Insurance rates are often higher in densely populated urban areas or regions with higher rates of accidents or theft.

Type of Vehicle: The make, model, and year of the vehicle you plan to rent can affect insurance costs. Generally, more expensive or high-performance cars tend to have higher insurance premiums.

Coverage Levels: The type and amount of coverage you choose will directly impact your premium. Basic liability insurance is usually less expensive than comprehensive coverage, which offers broader protection.

Deductibles: Your choice of deductibles (the amount you pay out of pocket before insurance coverage kicks in) can influence your premium. Higher deductibles often result in lower premiums, but you'll pay more in the event of a claim.

Age and Gender: Younger drivers, especially teenagers, and males typically pay higher insurance rates because they are statistically more likely to be involved in accidents.

Credit Score: In some states, insurance companies use credit scores as a factor in determining rates. A higher credit score may lead to lower premiums.

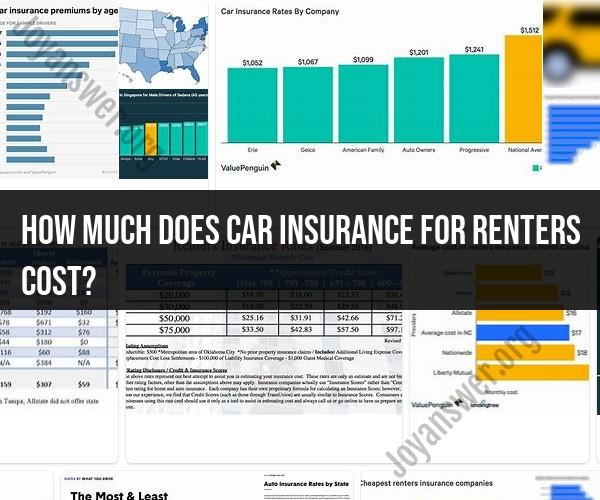

Insurance Company: Different insurance providers have varying pricing structures and may offer discounts or incentives based on your circumstances. It's advisable to obtain quotes from multiple insurance companies to compare rates.

Discounts: Many insurance companies offer discounts for factors such as safe driving, completing defensive driving courses, bundling renters and auto insurance, and having anti-theft devices in the vehicle.

Annual Mileage: The number of miles you drive annually can affect your insurance rate. Drivers who use their rented vehicle for shorter commutes or limited mileage may pay lower premiums.

To estimate the cost of car insurance for renters, you should contact insurance providers and request quotes based on your specific circumstances. Be prepared to provide information about your driving history, the vehicle you plan to rent, the coverage levels you desire, and any other relevant details. Keep in mind that the cost can vary significantly from person to person, so it's essential to shop around and compare quotes to find the best coverage at a competitive price.