Does KBB price include sales tax?

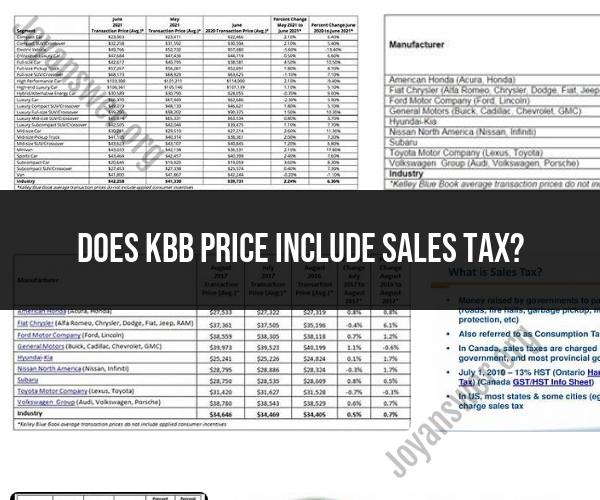

Kelley Blue Book (KBB) provides pricing information for vehicles, but it typically does not include sales tax in its listed prices. The prices you see on KBB, whether for new or used cars, are usually the estimated values of the vehicles themselves before taxes, fees, or additional costs.

When you purchase a car, sales tax is generally applied separately to the final sale price. The sales tax rate can vary significantly depending on your location, as it is typically determined by state and sometimes local governments. Additionally, there may be other fees and costs associated with the purchase, such as registration fees, dealer fees, and any optional add-ons or warranties.

It's important to keep in mind that when you use KBB or similar car valuation tools, you should consider sales tax and other associated costs when budgeting for your car purchase. You can contact your local Department of Motor Vehicles (DMV) or a tax authority to find out the exact sales tax rate applicable to your area, as it can vary even within the same state.

When negotiating the purchase of a vehicle, it's a good practice to discuss the total "out-the-door" price with the seller or dealership, which includes all applicable taxes and fees, to ensure you have a clear understanding of the final cost.

Does the KBB Price Include Sales Tax in Car Valuations?

No, the KBB price does not include sales tax in car valuations. Sales tax is a state and local tax that is assessed on the purchase price of a car. The sales tax rate varies from state to state, so you will need to factor it in when calculating the total cost of buying a car.

Understanding the Components of Kelley Blue Book (KBB) Vehicle Values

Kelley Blue Book (KBB) vehicle values are calculated based on a variety of factors, including:

- Make, model, and year: The make, model, and year of a car have a significant impact on its value. Some makes and models of cars hold their value better than others.

- Mileage: The higher the mileage on a car, the lower its value will be.

- Condition: The overall condition of a car, including its interior and exterior condition, will also affect its value. Cars with damage or excessive wear and tear will be worth less than cars that are in good condition.

- Maintenance history: A car with a well-documented maintenance history will be worth more than a car with no maintenance history. This is because a well-maintained car is less likely to have problems and will last longer.

- Features and modifications: Any additional features or modifications that a car has may also affect its value. For example, a car with a sunroof, navigation system, or aftermarket sound system may be worth more than a car without these features.

- Economic conditions: The overall economic conditions can also affect car values. For example, when the economy is strong, car values tend to be higher.

Navigating Taxes and Fees When Buying or Selling a Car

When you buy or sell a car, there are a number of taxes and fees that you will need to pay. These taxes and fees can vary from state to state, so it is important to check with your local DMV or tax office for more information.

Some of the most common taxes and fees associated with buying or selling a car include:

- Sales tax: This is a tax that is assessed on the purchase price of a car. The sales tax rate varies from state to state.

- Registration fees: These fees are paid to register your car with the state. The registration fees typically include a plate fee, a title fee, and a registration fee.

- Transfer fees: These fees are paid to transfer the title of the car to your name. The transfer fees vary from state to state.

- Documentary fees: These fees are typically charged by car dealerships to cover the cost of processing paperwork. The documentary fees vary from dealership to dealership.

It is important to note that these are just some of the most common taxes and fees associated with buying or selling a car. There may be other taxes and fees that apply, depending on your state and local laws.

Here are some tips for navigating taxes and fees when buying or selling a car:

- Do your research: Before you buy or sell a car, take the time to research the taxes and fees that you will need to pay. This will help you to budget for the total cost of the transaction.

- Shop around: If you are buying a car from a dealership, be sure to shop around and compare the documentary fees charged by different dealerships.

- Ask about discounts: Some states offer discounts on sales tax for certain types of vehicles, such as electric cars and hybrid cars. Be sure to ask your local DMV or tax office about any discounts that may be available.

- Factor in the taxes and fees: When you are budgeting for the cost of buying or selling a car, be sure to factor in the taxes and fees that you will need to pay. This will help you to avoid any surprises down the road.