How are they determining whether student loan will be forgiven?

The eligibility for student loan forgiveness in the United States is determined based on several specific forgiveness programs, each with its own set of criteria and requirements. The most common student loan forgiveness programs in the U.S. include:

Public Service Loan Forgiveness (PSLF):

- To be eligible for PSLF, you must:

- Work for a qualifying public service organization, such as a government or non-profit entity.

- Have qualifying federal student loans.

- Make 120 qualifying payments under a qualifying repayment plan while working full-time for a qualifying employer.

- To be eligible for PSLF, you must:

Teacher Loan Forgiveness:

- Eligibility for teacher loan forgiveness is based on factors like your teaching service, the subject you teach, and the location of your school. Some key requirements include:

- Teaching for five consecutive years in a low-income school or educational service agency.

- Holding certain types of federal loans.

- Eligibility for teacher loan forgiveness is based on factors like your teaching service, the subject you teach, and the location of your school. Some key requirements include:

Income-Driven Repayment Plan Forgiveness:

- Borrowers on income-driven repayment plans (e.g., Income-Based Repayment, Pay As You Earn, Revised Pay As You Earn) may be eligible for loan forgiveness after making a specific number of payments (typically 20 or 25 years, depending on the plan).

- The amount forgiven depends on your repayment plan and income.

- Borrowers on income-driven repayment plans (e.g., Income-Based Repayment, Pay As You Earn, Revised Pay As You Earn) may be eligible for loan forgiveness after making a specific number of payments (typically 20 or 25 years, depending on the plan).

Closed School Discharge:

- If your school closes while you're enrolled, you may be eligible for a full discharge of your federal loans or a partial discharge if you transfer credits to a different institution.

Borrower Defense to Repayment:

- If you believe your school misled you, engaged in illegal conduct, or violated certain laws, you can apply for loan forgiveness under this program.

Total and Permanent Disability Discharge:

- If you are totally and permanently disabled and unable to work, you can apply for a discharge of your federal student loans.

Other State and Institutional Forgiveness Programs:

- Some states and institutions offer their own loan forgiveness programs based on various criteria, such as working in specific fields or regions.

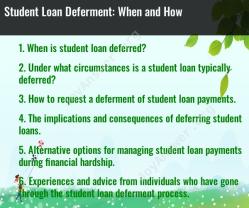

It's important to note that eligibility requirements may change, and additional programs may be introduced. To determine your eligibility for student loan forgiveness, consider the following steps:

- Review the specific requirements of the forgiveness program that may apply to you.

- Confirm that your loans are eligible (not all types of federal loans qualify for every program).

- Make sure you meet any employment or service criteria required by the program.

- Ensure that you are on a qualifying repayment plan if necessary.

- Maintain accurate records and documentation of your employment and payments.

For the most accurate and up-to-date information, consult the U.S. Department of Education's Federal Student Aid website, your loan servicer, or a financial aid advisor. Keep in mind that applying for student loan forgiveness can be a complex process, and it's important to follow the guidelines and meet all requirements to maximize your chances of having your loans forgiven.

Understanding the Criteria for Student Loan Forgiveness

Student loan forgiveness programs provide relief to borrowers who meet specific criteria, typically related to their employment, income, or disability. These programs aim to alleviate debt burdens for those struggling to repay their student loans and make higher education more accessible.

Common Criteria for Student Loan Forgiveness:

Employment: Public service loan forgiveness (PSLF) is available to those who work full-time for qualifying public service employers, such as government agencies or non-profit organizations. Teacher loan forgiveness programs exist for teachers who work in low-income schools.

Income: Income-driven repayment (IDR) plans can lead to loan forgiveness after a certain number of years of payments, based on a percentage of the borrower's income.

Disability: Borrowers who become totally and permanently disabled may qualify for loan forgiveness through the Total and Permanent Disability (TPD) discharge.

How Loan Forgiveness Programs Are Administered

Student loan forgiveness programs are administered by the U.S. Department of Education, primarily through its Federal Student Aid (FSA) office. Borrowers typically apply for forgiveness through the FSA website or by contacting their loan servicer.

Key Steps in the Forgiveness Process:

Identify Eligibility: Determine if you meet the criteria for a specific loan forgiveness program by carefully reviewing the program's guidelines and requirements.

Gather Documentation: Collect all necessary documentation, such as employment verification, income records, or disability certification, to support your eligibility claim.

Submit Application: Complete the application form for the chosen loan forgiveness program accurately and provide all required documentation.

Review and Approval: The FSA or loan servicer will review your application and determine your eligibility. If approved, your loan balance will be forgiven accordingly.

Documenting Eligibility for Student Loan Forgiveness

Proper documentation is crucial for demonstrating eligibility for student loan forgiveness programs. The specific documents required may vary depending on the program, but common requirements include:

Employment Verification: For employment-based programs, provide letters from current and previous qualifying employers confirming your employment dates and position.

Income Records: For income-driven repayment forgiveness, submit tax returns or other documents verifying your income history.

Disability Certification: For TPD discharge, obtain a certification from a qualified medical professional confirming your total and permanent disability.

Changes and Updates to Student Loan Forgiveness Policies

Student loan forgiveness programs are subject to change, and it's essential to stay informed about any updates or modifications. The FSA regularly publishes updates and announcements regarding its loan forgiveness programs.

Sources for Staying Informed:

FSA Website: Regularly check the FSA website for the latest updates and announcements on student loan forgiveness programs.

Loan Servicer Communications: Stay informed by reviewing communications from your loan servicer, as they may provide updates on program changes or application processes.

News and Information Sources: Follow news outlets and reliable sources that cover student loan news and updates to stay informed about policy changes and developments.

Navigating the Application Process for Loan Forgiveness

The application process for student loan forgiveness can be complex, and it's advisable to seek assistance if needed. Here are some tips for navigating the application process:

Start Early: Begin researching and preparing for the application process well in advance to gather necessary documentation and ensure timely submission.

Seek Guidance: Consult with a financial aid advisor, student loan counselor, or attorney who specializes in student loan issues to get personalized guidance and support.

Be Thorough and Accurate: Complete the application form carefully and provide all requested information accurately and completely to avoid delays or processing issues.

Follow Up: Stay in touch with your loan servicer or the FSA to track the progress of your application and address any questions or concerns promptly.