What is a HTS code?

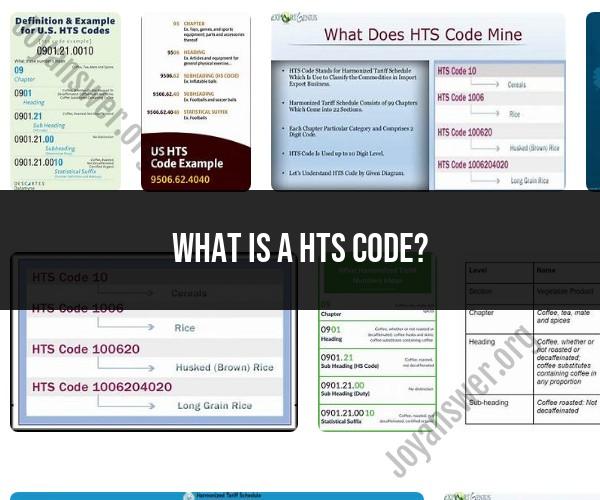

HTS stands for Harmonized Tariff Schedule. An HTS code, also known as a Harmonized System code or HS code, is an international nomenclature (classification) for the classification of products and goods in international trade. HTS codes are used by customs authorities, importers, and exporters to classify and identify products for the purpose of imposing tariffs, calculating duties, and facilitating international trade.

The HTS code system is standardized worldwide and was developed and is maintained by the World Customs Organization (WCO). It consists of a series of numbers and, in some cases, letters that represent specific categories of products and their characteristics. The code is structured hierarchically, with broader categories at the beginning of the code and more detailed subcategories as you move further into the code.

An HTS code typically includes the following elements:

Chapter: The first two digits represent the chapter, which broadly categorizes products based on their characteristics or materials.

Heading: The next two digits specify a more specific category within the chapter.

Subheading: The following two digits provide even more detail about the product.

Subheading Description: This is often a short description of the product.

Additional Codes: In some cases, additional digits or letters may be added to further specify the product or to indicate exemptions, restrictions, or special requirements.

For example, an HTS code for "Fresh Apples" might look like this:

- Chapter: 08 (Edible Fruit and Nuts; Peel of Citrus Fruit or Melons)

- Heading: 08.01 (Oranges)

- Subheading: 08.01.10 (Fresh or Chilled)

- Subheading Description: Fresh Apples

HTS codes are essential in international trade because they help customs authorities classify and assess duties and taxes on imported and exported goods accurately. They also provide a standardized way to track and report trade statistics worldwide. Importers and exporters must correctly determine and declare the HTS code for their products to comply with customs regulations and to ensure smooth and legal international trade transactions.

Demystifying HTS Codes: What Is a Harmonized Tariff Schedule Code?

A Harmonized Tariff Schedule (HTS) code is a 10-digit code that is used to classify goods for international trade purposes. It is based on the Harmonized System (HS), which is an international system of nomenclature for goods. The HS is used by over 200 countries and territories, and it covers over 98% of all traded goods.

The HTS code is used to determine the duty rate and other trade requirements for goods being imported into or exported from the United States. The duty rate is the tax that is paid on imported goods. The HTS code is also used to collect trade statistics and to track the movement of goods across borders.

HTS Code Essentials: Understanding Its Significance

HTS codes are important for a number of reasons. First, they help to ensure that goods are classified correctly for trade purposes. This is important for ensuring that the correct duty rate is applied and that trade statistics are accurate.

Second, HTS codes help to facilitate trade. By using a common system of nomenclature, countries can more easily communicate with each other about the goods that they are trading. This can help to reduce trade barriers and make trade more efficient.

Third, HTS codes can be used to identify and track potential security threats. For example, HTS codes can be used to identify goods that may be used for terrorist purposes or that may be counterfeit.

Navigating Trade: What You Need to Know About HTS Codes

If you are importing or exporting goods, it is important to know the HTS code for the goods that you are trading. You can find the HTS code for a particular product by searching the USITC's online HTS database.

Once you have the HTS code for your product, you can use it to determine the duty rate and other trade requirements for your shipment. You can also use the HTS code to track your shipment and to get information about the clearance process.

Here are some additional tips for navigating trade and using HTS codes:

- Use a qualified customs broker to help you with your import and export shipments. A customs broker can help you to identify the correct HTS code for your products and to ensure that your shipments comply with all applicable trade regulations.

- Stay up-to-date on changes to the HTS code. The HTS code is updated on a regular basis to reflect changes in technology and trade patterns. You can check the USITC's website for the latest updates to the HTS code.

- Be prepared to provide documentation to support your HTS code classification. If you are asked by Customs and Border Protection (CBP) to provide documentation, you should be able to provide documentation that supports your classification of the goods.

By following these tips, you can navigate trade and use HTS codes more effectively.