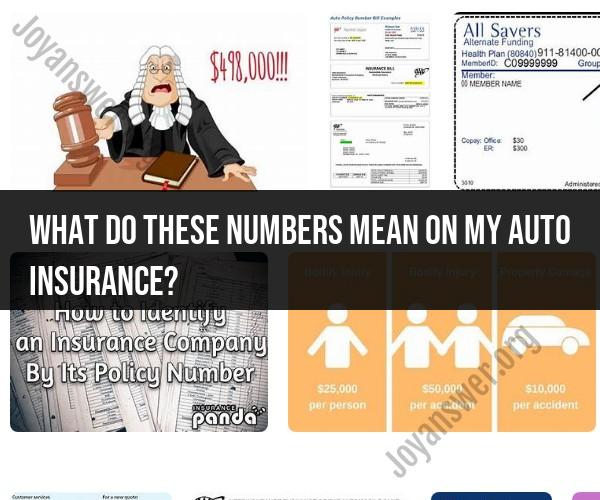

What do these numbers mean on my auto insurance?

The numbers on your auto insurance policy contain essential information about your coverage and policy details. Understanding these numbers is crucial for making informed decisions and ensuring you have the coverage you need. Here's a breakdown of what some of these key numbers mean:

Policy Number: This is a unique identifier for your auto insurance policy. It helps your insurance company track your policy and manage your account.

Coverage Types and Limits: Your policy will specify various types of coverage, each with a corresponding limit. For example:

- Bodily Injury Liability: The maximum amount your insurance will pay for injuries to others in an accident.

- Property Damage Liability: The maximum amount your insurance will pay for damage to others' property.

- Uninsured/Underinsured Motorist Coverage: The maximum your insurance will pay if you're in an accident with a driver who has little or no insurance.

- Comprehensive Coverage: The maximum amount your insurance will pay for non-accident-related damages, like theft or vandalism.

- Collision Coverage: The maximum amount your insurance will pay for damages to your car in an accident.

Deductible Amount: This is the amount you are responsible for paying out of pocket before your insurance coverage kicks in. For example, if you have a $500 deductible for collision coverage and you file a claim for $2,000 in damages, you would pay $500, and your insurance would cover the remaining $1,500.

Premium Amount: This is the amount you pay for your insurance coverage. It can be paid in different intervals, such as monthly, quarterly, or annually.

Effective Date: This is the date your insurance policy goes into effect, and it marks the beginning of your coverage.

Expiration Date: This is the date when your policy expires, and your coverage ends unless you renew it.

Named Insured: This is the primary policyholder, the person responsible for the policy and premium payments.

Additional Insureds or Drivers: If you have other people covered under your policy, their names and details may be listed here.

Vehicle Information: Details about the vehicles covered by your policy, such as the make, model, year, and Vehicle Identification Number (VIN).

Policy Endorsements: If you have any optional endorsements or riders, they will be listed. These could include added coverage for specific situations.

Policy Exclusions: Any specific situations or conditions that are not covered by your policy will be listed here.

Insurance Company Information: The name and contact details of your insurance provider.

Agent or Broker Information: If you have an insurance agent or broker, their contact information may be included.

Policy Terms and Conditions: Information about the terms and conditions of your policy, including how to file a claim and the process for making changes to your policy.

To gain a full understanding of your auto insurance policy, it's essential to review it carefully and discuss any questions or concerns with your insurance agent or provider. This will help you ensure you have the right coverage for your needs and are aware of your policy's limitations and obligations.

Demystifying the Numbers on Your Auto Insurance Policy

Car insurance policies can be confusing, especially when it comes to the numbers. However, understanding the numbers on your policy is important so that you know what you're covered for and how much it will cost.

What do the numerical codes on your car insurance documents signify?

The numerical codes on your car insurance documents typically represent different aspects of your policy, such as:

- Policy number: This is a unique number that identifies your policy.

- Coverage types and limits: These numbers indicate the types of coverage you have and the maximum amount of money your insurance company will pay for each type of coverage.

- Deductibles: These numbers indicate the amount of money you have to pay out of pocket before your insurance company starts paying.

- Premium: This is the amount of money you pay for your insurance policy.

How to interpret and utilize the numerical information in your auto insurance policy?

To interpret and utilize the numerical information in your auto insurance policy, you should first understand the different types of coverage that are available. The most common types of auto insurance coverage include:

- Liability coverage: This coverage pays for bodily injury and property damage that you cause to others in an accident.

- Collision coverage: This coverage pays for damage to your own vehicle in an accident, regardless of who is at fault.

- Comprehensive coverage: This coverage pays for damage to your vehicle caused by events other than collisions, such as theft, vandalism, and weather damage.

Once you understand the different types of coverage, you can look at the numerical information in your policy to determine what coverage you have and how much it will cost. For example, if you have liability coverage with limits of $100,000/$300,000/$50,000, this means that your insurance company will pay up to $100,000 for bodily injury to one person, up to $300,000 for bodily injury to all people in one accident, and up to $50,000 for property damage in an accident.

Are there specific codes that relate to coverage types or endorsements?

Yes, there are specific codes that relate to coverage types and endorsements. For example, the code "1" may represent liability coverage, while the code "2" may represent collision coverage. Endorsments are additional coverage options that you can add to your policy, such as rental car reimbursement or roadside assistance. The codes for endorsements will vary from company to company.

How do these numbers impact your auto insurance claims and premiums?

The numbers on your auto insurance policy can have a significant impact on your claims and premiums. For example, if you have a high deductible, you will have to pay more out of pocket before your insurance company starts paying. If you have a high premium, you will be paying more for your insurance policy.

It is important to understand the numbers on your auto insurance policy so that you can make informed decisions about your coverage. You should review your policy regularly to make sure that you have the right coverage for your needs and that you are paying the best possible price.

Here are some tips for understanding the numbers on your auto insurance policy:

- Read your policy carefully. Your policy will explain the different types of coverage you have, the limits of your coverage, and your deductibles.

- Talk to your insurance agent. If you don't understand something in your policy, ask your insurance agent to explain it to you.

- Shop around for insurance. Compare rates from different insurance companies to make sure you're getting the best possible price.

By following these tips, you can understand the numbers on your auto insurance policy and make sure that you are getting the right coverage for your needs at the best possible price.