What is a fiscal law?

Fiscal law encompasses the legal framework governing government finances, revenue, and expenditure. It includes laws, regulations, and principles that dictate how public funds are managed, allocated, collected, and spent. Fiscal laws are essential for maintaining financial discipline, ensuring transparency, and preventing misuse or mismanagement of public funds. These laws often cover aspects such as taxation, budgeting, public debt, accounting standards, and financial reporting. They vary from country to country but generally serve to establish guidelines for fiscal responsibility and proper financial governance within a government or a public entity.

How is fiscal law defined within legal and financial contexts?

Fiscal Law: A Bridge Between Law and Finance

Fiscal law occupies a unique space at the intersection of law and finance, governing the collection, spending, and management of public funds. Here's how it's defined within both contexts:

Legal Context:

- Constitutional Foundation: Fiscal law draws its fundamental legitimacy from the constitution, granting the power to tax, borrow, and appropriate funds to legislative bodies. In the US, for example, Article I of the Constitution empowers Congress with these capabilities.

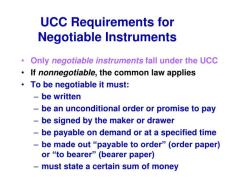

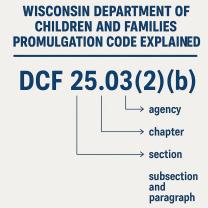

- Statutory Regulations: Beyond the constitution, specific statutes enacted by legislatures further define the framework for fiscal activity. These laws regulate everything from budget processes and tax codes to public debt management and government procurement.

- Administrative Oversight: Various institutions, like the Government Accountability Office (GAO) in the US, are tasked with monitoring compliance with fiscal laws and regulations. Additionally, courts play a crucial role in interpreting and enforcing fiscal law through judicial review.

Financial Context:

- Public Resource Management: Fiscal law dictates how governments collect and allocate resources generated through taxes, fees, and other means. This ensures responsible financial management that balances public needs with fiscal sustainability.

- Taxation System: Fiscal law defines the types, rates, and bases of taxes levied on individuals and businesses. It also establishes structures for tax collection and administration, aiming for fairness and efficiency.

- Budgeting and Spending: Fiscal law sets parameters for government budgeting, including appropriation processes, spending limitations, and controls over budget execution. This ensures responsible allocation of resources towards public services and programs.

- Public Debt Management: When necessary, governments borrow funds through debt instruments. Fiscal law governs the issuance, management, and repayment of this debt, aiming for fiscal prudence and debt sustainability.

Overall, fiscal law acts as a crucial framework for responsible public finance by:

- Ensuring transparency and accountability in the use of public funds.

- Balancing competing demands for public services and fiscal responsibility.

- Promoting efficient and equitable allocation of resources for the benefit of society.

I hope this provides a comprehensive overview of how fiscal law is defined within the legal and financial contexts. Feel free to ask any further questions you might have!