How to create a financial business plan?

Creating a financial business plan is a crucial step in establishing and growing a successful business. It helps you outline your financial goals, projections, and strategies. Here's a comprehensive guide on how to create a financial business plan:

1. Executive Summary:

- Objective: Provide a brief overview of your business, its mission, and the purpose of the financial plan.

- Include:

- Business name and location.

- Mission statement.

- Brief description of products or services.

2. Business Description:

- Objective: Detail the nature of your business, industry, and your unique value proposition.

- Include:

- Industry overview.

- Legal structure (e.g., LLC, corporation).

- Business history and milestones.

3. Market Analysis:

- Objective: Analyze your target market, competition, and industry trends.

- Include:

- Target market demographics.

- Competitive analysis.

- Industry trends and forecasts.

4. Organization and Management:

- Objective: Outline your organizational structure and key team members.

- Include:

- Organizational chart.

- Key management personnel and their roles.

5. Products or Services:

- Objective: Provide details about your offerings.

- Include:

- Description of products/services.

- Unique selling propositions.

- Pricing strategy.

6. Marketing and Sales Strategy:

- Objective: Describe how you plan to market and sell your products or services.

- Include:

- Marketing channels.

- Sales strategy.

- Advertising and promotional activities.

7. Funding Request:

- Objective: If seeking funding, specify the amount and how you intend to use it.

- Include:

- Funding amount requested.

- Use of funds.

- Repayment plan (if applicable).

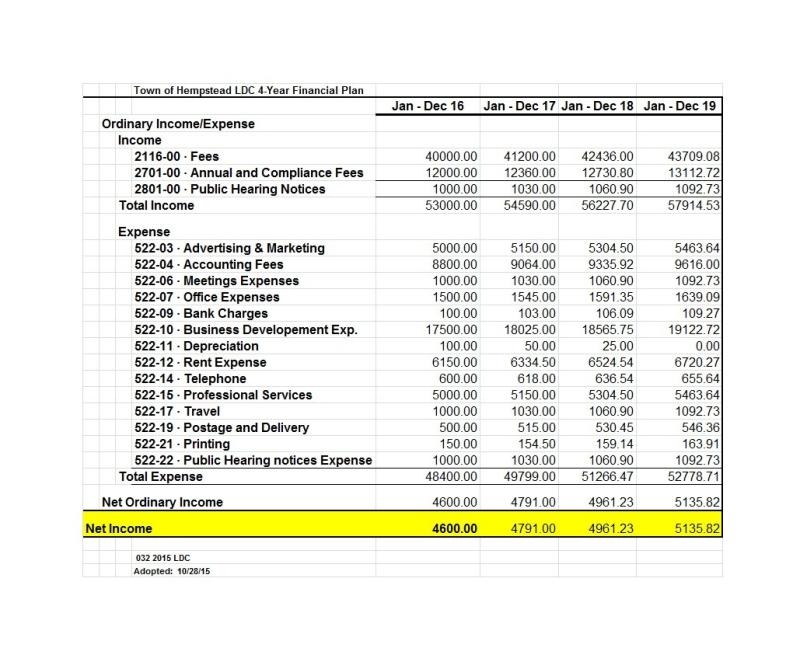

8. Financial Projections:

- Objective: Provide detailed financial forecasts for the next 3-5 years.

- Include:

- Sales forecasts.

- Income statements.

- Cash flow projections.

- Balance sheets.

9. Risk Analysis:

- Objective: Identify potential risks and how you plan to mitigate them.

- Include:

- Market risks.

- Operational risks.

- Financial risks.

10. Appendix:

- Objective: Include any additional information that supports your plan.

- Include:

- Resumes of key team members.

- Market research data.

- Any additional financial information.

Tips for Creating an Effective Financial Business Plan:

Be Realistic: Ensure your financial projections are based on realistic assumptions and market research.

Update Regularly: A business plan is a dynamic document. Regularly update it to reflect changes in the market, industry, or your business.

Seek Professional Assistance: If needed, consult with financial experts or business consultants to ensure the accuracy and viability of your financial plan.

Be Concise: While it's important to be comprehensive, avoid unnecessary jargon or overly complex language. Keep it clear and concise.

Review and Revise: Periodically review and revise your financial plan to adapt to changes in your business environment.

Creating a financial business plan is a thoughtful process that requires time and attention to detail. It serves as a roadmap for your business's financial success and can be a valuable tool for attracting investors or lenders.

How to create a comprehensive financial business plan

A comprehensive financial business plan is a document that outlines your company's financial goals and strategies for achieving them. It is an essential tool for any business, regardless of size or industry.

To create a comprehensive financial business plan, you will need to:

Define your financial goals. What do you want to achieve with your business? Do you want to increase revenue, expand into new markets, or acquire another company? Once you know your goals, you can develop strategies to achieve them.

Analyze your current financial situation. This includes understanding your revenue, expenses, assets, and liabilities. You will also need to project your future financial performance.

Develop financial strategies. Based on your analysis, develop strategies to achieve your financial goals. This may include strategies for increasing revenue, reducing expenses, or raising capital.

Write your financial business plan. The plan should be clear, concise, and well-organized. It should include the following elements:

- Executive summary: This is a one-page overview of your business plan that highlights the key points.

- Company overview: This section provides a detailed description of your business, including your products or services, target market, and competitive landscape.

- Financial statements: This section includes your financial statements, such as your income statement, balance sheet, and cash flow statement.

- Financial projections: This section includes your projections for future financial performance.

- Financial strategies: This section outlines your strategies for achieving your financial goals.

Review and update your financial business plan regularly. As your business grows and changes, you will need to update your financial business plan to reflect those changes.

Key elements of a financial business plan

A comprehensive financial business plan should include the following key elements:

- Executive summary: This is a one-page overview of your business plan that highlights the key points.

- Company overview: This section provides a detailed description of your business, including your products or services, target market, and competitive landscape.

- Financial statements: This section includes your financial statements, such as your income statement, balance sheet, and cash flow statement.

- Financial projections: This section includes your projections for future financial performance.

- Financial strategies: This section outlines your strategies for achieving your financial goals.

Templates and tools for drafting a financial business plan

There are a number of templates and tools available to help you draft a financial business plan. Some popular options include:

- SCORE: SCORE is a non-profit organization that provides free business mentoring and counseling. They offer a number of templates and resources for creating a financial business plan.

- Small Business Administration (SBA): The SBA offers a number of resources for small businesses, including templates and guides for creating a financial business plan.

- Business plan software: There are a number of business plan software programs available that can help you create a comprehensive financial business plan. Some popular options include LivePlan, Palo Alto Software, and Enloop.

It is important to note that there is no one-size-fits-all financial business plan. The specific elements that you need to include in your plan will vary depending on your business and your industry. However, the templates and tools listed above can provide a good starting point.