What are the requirements for a college grant?

The specific requirements for college grants can vary widely depending on the grant program, the funding source, and the college or organization offering the grant. However, some general requirements and factors commonly considered for college grant eligibility include:

Financial Need:

- Many grants, especially need-based grants, consider your financial need. This is typically determined by completing the Free Application for Federal Student Aid (FAFSA) or an institution's own financial aid application. Factors such as your family's income, assets, family size, and the cost of attending college play a significant role in assessing financial need.

Academic Achievement:

- Some grants are awarded based on academic merit. Your high school GPA, standardized test scores (e.g., SAT or ACT), class rank, or other academic achievements may be considered.

Admission to a College or University:

- Most grants require that you are admitted or enrolled in a specific college or university. Each institution may have its own criteria for awarding grants.

Citizenship or Residency Status:

- Some grants are available only to U.S. citizens, while others may be open to eligible non-citizens or international students. Your residency status can impact your grant eligibility.

Major or Field of Study:

- Certain grants are available to students pursuing specific majors or fields of study, such as STEM disciplines or education. Your choice of major or career goals may affect eligibility.

Enrollment Status:

- Grants may be available to full-time or part-time students. Some grant programs require that you enroll as a full-time student, while others accommodate part-time or online students.

Satisfactory Academic Progress:

- To maintain grant eligibility, you may need to meet and maintain specific academic standards, such as a minimum GPA or a certain number of completed credit hours.

Community or Service Involvement:

- Some grants consider your involvement in community service, extracurricular activities, or leadership roles as part of the eligibility criteria.

Demographic Factors:

- Certain grants are targeted at specific demographic groups, such as first-generation college students, underrepresented minorities, or individuals with disabilities.

Military or Veteran Status:

- If you are a veteran, active-duty military service member, or a dependent of a military service member, you may be eligible for grants through military-related programs.

Special Circumstances:

- There are grants available for students facing special circumstances, such as foster youth, individuals experiencing homelessness, or students with unique challenges.

State Residency:

- Some state grant programs are available only to residents of that specific state. You may need to prove your state residency to qualify for these grants.

Application Deadlines:

- Be aware of application deadlines for grant programs, as missing the deadline can affect your eligibility.

It's essential to thoroughly research and understand the specific requirements for the grants you are interested in. Start by visiting the financial aid websites of the colleges you are applying to, as well as state and federal financial aid websites, to gather information about grant opportunities and their respective eligibility criteria. Completing the FAFSA is also a critical step for determining your eligibility for many federal and state grant programs. Additionally, you should reach out to the college's financial aid office for guidance and assistance in navigating the grant application process.

What are the requirements for obtaining a college grant?

The requirements for obtaining a college grant vary depending on the specific grant. However, most grants require students to:

- Be enrolled in a college or university

- Be a U.S. citizen or permanent resident

- Have a valid Social Security number

- Demonstrate financial need

- Meet the specific eligibility criteria of the grant

How can students apply for and secure grants for college education?

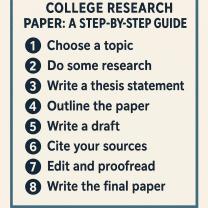

To apply for and secure grants for college education, students should:

- Complete the Free Application for Federal Student Aid (FAFSA). This application is used to determine a student's financial need, which is a factor that many grants consider.

- Research grants. Visit your college's financial aid website and use grant search websites to find grants that you may be eligible for.

- Gather your application materials. Many grants require you to submit an application form, transcripts, letters of recommendation, and other documentation.

- Submit your applications. Be sure to meet the deadline for each grant that you apply for.

Can you provide examples of different types of college grants and their eligibility criteria?

Here are some examples of different types of college grants and their eligibility criteria:

- Pell Grant: The Pell Grant is a federal grant that is awarded to students with low-income families. To be eligible for the Pell Grant, students must be enrolled in an undergraduate program at an accredited college or university.

- Federal Supplemental Educational Opportunity Grant (FSEOG): The FSEOG is a federal grant that is awarded to students with exceptional financial need. To be eligible for the FSEOG, students must be enrolled in an undergraduate program at an accredited college or university.

- Teacher Education Assistance for College and Higher Education (TEACH) Grant: The TEACH Grant is a federal grant that is awarded to students who plan to teach in a high-need area after graduation. To be eligible for the TEACH Grant, students must be enrolled in an undergraduate or graduate program at an accredited college or university.

- Gates Millennium Scholars Program: The Gates Millennium Scholars Program is a private grant that is awarded to African American, American Indian/Alaska Native, Asian Pacific American, and Hispanic American students. To be eligible for the Gates Millennium Scholars Program, students must be enrolled in an undergraduate or graduate program at an accredited college or university.

- The Coca-Cola Scholars Foundation: The Coca-Cola Scholars Foundation awards grants to high school seniors who are planning to attend college. To be eligible for a Coca-Cola Scholars Foundation grant, students must have a 3.5 or higher GPA, be involved in extracurricular activities, and demonstrate financial need.

What are the advantages of receiving grants for college expenses?

There are many advantages to receiving grants for college expenses, including:

- Grants do not need to be repaid. Unlike student loans, grants do not need to be repaid after graduation. This can save students a lot of money in the long run.

- Grants can help students pay for college without having to go into debt. This can give students a financial head start after graduation.

- Grants can be used to cover a variety of college expenses, including tuition, fees, books, and living expenses. This can make college more affordable for students.

How to maximize your chances of receiving college grants to fund your education?

Here are some tips for maximizing your chances of receiving college grants to fund your education:

- Start early. The earlier you start researching and applying for grants, the better your chances of receiving funding.

- Be organized. Keep track of all of the grants that you apply for and the deadlines for each grant.

- Write strong essays. Many grant applications require you to write essays about yourself, your goals, and why you deserve the grant. Be sure to write strong essays that highlight your strengths and accomplishments.

- Follow up. After you submit your grant applications, be sure to follow up with the grant makers to confirm that they have received your application and to answer any questions that they may have.

In addition to the above tips, you can also maximize your chances of receiving college grants by:

- Maintaining a high GPA. Many grants require students to have a minimum GPA.

- Participating in extracurricular activities. Many grants give preference to students who are involved in extracurricular activities.

- Demonstrating financial need. Many grants are awarded to students with financial need.