How much does car payment cost per month?

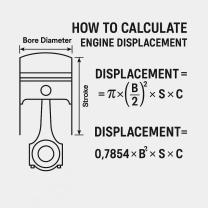

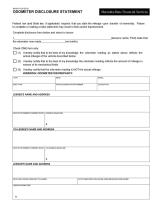

The monthly car payment cost can vary widely depending on several factors, including the total cost of the car, the interest rate, the length of the loan, and the down payment. To calculate your monthly car payment, you can use the following formula:

Where:

- is the monthly payment.

- is the principal amount (the price of the car minus the down payment).

- is the monthly interest rate (annual interest rate divided by 12 and expressed as a decimal).

- is the number of monthly payments (loan term in years multiplied by 12).

Here's a step-by-step guide to calculate your car payment:

Determine the Total Cost of the Car: This is the price of the car you want to buy, including any additional costs, taxes, and fees.

Calculate the Down Payment: Determine how much you can afford to pay upfront as a down payment. The down payment reduces the principal amount of the loan (P).

Determine the Annual Interest Rate: This is the annual interest rate offered by the lender or financing institution. Convert it to a decimal by dividing by 100 and then by 12 to get the monthly interest rate (r).

Choose the Loan Term: Decide on the length of the loan in years and convert it to the number of monthly payments (n).

Plug the Values into the Formula: Use the formula mentioned earlier to calculate the monthly car payment (M).

Consider Additional Costs: Remember that your monthly car payment is not the only cost associated with owning a car. You'll also need to budget for insurance, maintenance, fuel, and other expenses.

Shop Around for Loans: Consider obtaining loan quotes from different lenders to find the most favorable terms. The interest rate offered by the lender can significantly impact your monthly payment.

Budget and Financial Health: Ensure that the monthly car payment fits comfortably within your budget and won't strain your finances. Be mindful of your overall financial health and the impact of taking on a new monthly obligation.

It's important to choose a car and a financing plan that suits your budget and financial goals. The total cost of the car, the down payment, and the loan term are all variables that can be adjusted to arrive at a monthly payment that you find manageable.

Sure, here's a comprehensive explanation of the five topics you mentioned:

The Cost of Monthly Car Payments: Factors to Consider

The cost of monthly car payments is a significant financial commitment for many individuals and families. Several factors influence the amount of your monthly car payment:

Car price: The purchase price of the car is the primary determinant of monthly payments. A more expensive car will generally result in higher monthly payments.

Down payment: A larger down payment reduces the amount financed, lowering the loan amount and consequently the monthly payments.

Loan term: The length of the loan, typically expressed in months, affects the monthly payment amount. Shorter loan terms generally result in higher monthly payments but lower overall interest paid.

Interest rate: The interest rate is the percentage of the loan amount that borrowers pay as a fee for borrowing money. A higher interest rate leads to higher monthly payments.

Sales tax and registration fees: These additional costs are factored into the loan amount and can increase the monthly payment.

Monthly Car Payment Calculation Methods

Lenders use various methods to calculate monthly car payments. The most common method is the simple interest method, which calculates interest based on the outstanding loan balance at the beginning of each payment period. Another method is the compound interest method, which calculates interest on both the principal loan amount and accumulated interest.

Budgeting and Financial Planning for Car Payments

Before committing to a car purchase, it's crucial to assess your financial situation and determine if you can comfortably afford the monthly payments. Incorporating car payments into your budget involves considering:

Income and expenses: Calculate your net income and subtract essential expenses like housing, food, and utilities. The remaining amount represents your discretionary income, which should cover car payments, insurance, fuel, and maintenance.

Debt-to-income ratio (DTI): DTI is the percentage of your gross monthly income that goes towards debt payments. A DTI of 43% or lower is generally considered manageable.

Emergency fund: Maintain an emergency fund to cover unexpected expenses, ensuring car payments don't disrupt your financial stability.

Strategies for Managing and Reducing Car Payment Costs

Strategies to manage and reduce car payment costs include:

Negotiate the car price: Research fair market value and negotiate with the dealer to lower the purchase price, reducing the loan amount and monthly payments.

Consider a used car: Used cars often depreciate significantly, making them more affordable than new cars.

Opt for a shorter loan term: A shorter loan term may result in higher monthly payments but lowers overall interest paid.

Refinance the loan: If interest rates decline, refinancing the loan at a lower rate can reduce monthly payments.

Make extra payments: If your budget allows, consider making extra payments towards the principal, reducing the loan amount and saving on interest.

Online Tools and Calculators for Estimating Car Payments

Numerous online tools and calculators can help estimate monthly car payments based on the car price, down payment, loan term, and interest rate. These tools provide a quick and convenient way to compare payment options and make informed decisions.

Remember, car payments are a significant financial commitment, and it's essential to carefully consider your financial situation and affordability before making a purchase. By budgeting, negotiating, and exploring cost-saving strategies, you can manage car payments effectively and maintain financial stability.