What are the benefits of financial planning for a business?

Financial planning is a critical aspect of business management that offers several strategic advantages for businesses of all sizes and industries. Here are some of the key benefits of financial planning for a business:

Goal Clarity: Financial planning helps clarify and prioritize the organization's financial goals. It allows the business to set specific targets for revenue, profitability, growth, and other key performance indicators.

Resource Allocation: By creating a financial plan, businesses can allocate their resources (capital, labor, and materials) more effectively and efficiently. This ensures that resources are used to support the most critical activities and initiatives.

Risk Mitigation: Financial planning helps identify potential financial risks and uncertainties. By recognizing these risks in advance, businesses can develop strategies to mitigate them, reducing the impact of adverse events.

Cash Flow Management: Effective financial planning includes cash flow forecasting. This allows businesses to anticipate cash needs, manage working capital, and ensure that they have sufficient funds to cover operational expenses and investments.

Budgeting and Expense Control: Financial plans often include budgets that detail expected income and expenses. This helps businesses control costs, avoid overspending, and ensure that resources are used efficiently.

Capital Investment Planning: Businesses can use financial planning to evaluate potential capital investments, such as equipment purchases or facility expansions. This ensures that investments align with the company's strategic objectives and provide a favorable return on investment.

Debt Management: For businesses with debt obligations, financial planning helps manage and optimize debt. It ensures that repayments are made on time and that debt is used strategically to support growth.

Tax Planning: Financial planning includes tax planning strategies to minimize tax liabilities while remaining compliant with tax laws. This can lead to significant cost savings for the business.

Profitability Improvement: Financial planning allows for the identification of areas where profitability can be improved. By analyzing financial data, businesses can make informed decisions to boost margins and increase profits.

Long-Term Sustainability: Financial planning helps businesses establish a solid financial foundation and work towards long-term sustainability. It enables them to save for future investments, weather economic downturns, and achieve financial stability.

Investor and Lender Confidence: When businesses have well-developed financial plans, it instills confidence in investors and lenders. It demonstrates that the company is proactive in managing its finances, making it more attractive to external sources of funding.

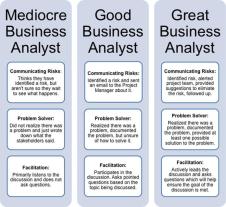

Strategic Decision-Making: Financial planning provides the data and insights needed for strategic decision-making. Whether it's entering new markets, launching new products, or expanding operations, having a financial plan ensures that decisions align with financial capabilities and objectives.

Performance Measurement: Financial planning includes key performance indicators (KPIs) that allow businesses to measure their performance against established goals. This enables continuous improvement and adjustment of strategies as needed.

Communication and Accountability: Financial planning promotes communication and accountability within the organization. Teams and departments understand their financial responsibilities and contribute to achieving the company's financial objectives.

Overall, financial planning is a fundamental tool for businesses to enhance their financial health, strategic positioning, and ability to thrive in a competitive environment. It provides a structured framework for managing finances and making informed decisions that drive growth and profitability.

Benefits of Financial Planning for Businesses: A Comprehensive Guide

Financial planning is the process of setting financial goals and developing a plan to achieve them. It is an essential part of running a successful business, as it can help you to:

- Make informed financial decisions: Financial planning helps you to understand your current financial situation and forecast your future financial performance. This information can help you to make informed decisions about where to allocate your resources and how to grow your business.

- Reduce risk: Financial planning can help you to identify and mitigate financial risks. For example, you can develop a contingency plan in case of unexpected events, such as a loss of revenue or a natural disaster.

- Improve cash flow: Financial planning can help you to manage your cash flow more effectively. By forecasting your cash flow needs, you can ensure that you have enough cash on hand to cover your expenses and invest in growth opportunities.

- Attract investors and lenders: Financial planning can help you to attract investors and lenders who are willing to support your business. A well-crafted financial plan shows that you have a clear understanding of your business and that you are serious about success.

Financial Planning's Role in Business Success: Advantages and Insights

Financial planning plays a vital role in business success. By developing and implementing a sound financial plan, businesses can:

- Set realistic and achievable goals: Financial planning helps businesses to define their goals and develop strategies to achieve them. By setting realistic and achievable goals, businesses are more likely to succeed.

- Make informed decisions: Financial planning provides businesses with the information they need to make informed decisions about their finances. This includes decisions about pricing, marketing, and investment.

- Manage their resources effectively: Financial planning helps businesses to allocate their resources effectively. By understanding their financial situation and forecasting their future needs, businesses can ensure that they are using their resources in the most efficient and effective way possible.

- Improve their profitability: Financial planning can help businesses to improve their profitability by identifying and eliminating waste and inefficiencies. It can also help businesses to identify new growth opportunities.

- Attract investors and lenders: A well-crafted financial plan can help businesses to attract investors and lenders. Investors and lenders are more likely to invest in businesses that have a clear understanding of their finances and that have a plan for success.

Securing the Future: Why Financial Planning Matters for Your Business

Financial planning is essential for any business that wants to secure its future. By developing and implementing a sound financial plan, businesses can:

- Ensure their long-term viability: Financial planning helps businesses to identify and mitigate financial risks. This ensures that businesses are more likely to remain viable in the long term.

- Support their growth plans: Financial planning helps businesses to allocate their resources effectively and to identify new growth opportunities. This supports businesses in achieving their growth goals.

- Increase their value: A well-crafted financial plan can increase the value of a business. This is because a financial plan shows that the business is well-managed and that it has a strong future ahead of it.

Overall, financial planning is an essential part of running a successful business. By developing and implementing a sound financial plan, businesses can improve their chances of success and secure their future.

Here are some tips for developing a financial plan for your business:

- Start by setting clear and achievable goals. What do you want to achieve with your business? Once you know your goals, you can start to develop a plan to achieve them.

- Identify your revenue streams and forecast your revenue. How will you generate revenue? Be sure to identify all of your potential revenue streams and forecast your revenue as accurately as possible.

- Estimate your expenses. What are your fixed and variable costs? Be sure to estimate all of your expenses as accurately as possible.

- Forecast your cash flow. Your cash flow forecast should show how much money you expect to come in and go out of your business over a period of time.

- Develop a strategic plan. Your strategic plan should outline your business goals and how you plan to achieve them.

- Seek professional help. If you need assistance developing a financial plan, consider seeking professional help from an accountant or financial advisor.