Unemployment Insurance in New York

This guide provides an interactive overview of New York State's Unemployment Insurance (UI) program. Use the tools below to understand eligibility, estimate your potential weekly benefits, and learn how to apply. This is for informational purposes only and is not legal advice.

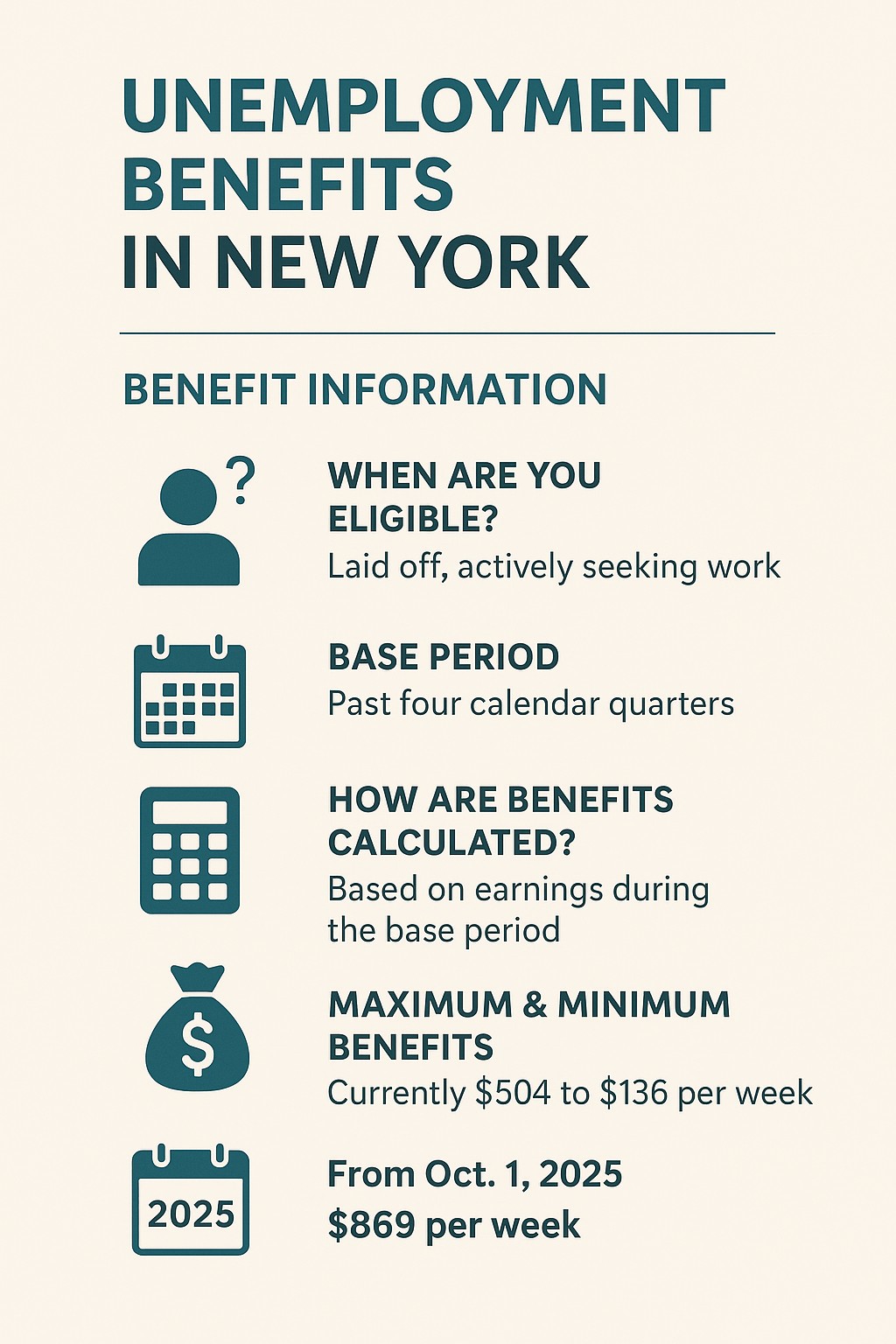

Maximum Weekly Benefit

$504

Minimum Weekly Benefit

$104

Maximum Duration

26 Weeks

Are You Eligible?

Eligibility for UI benefits depends on several factors. This interactive checklist helps you understand the main requirements. You must meet all three general conditions to be eligible.

Monetary Eligibility

You must have earned enough wages in covered employment during your base period (the first four of the last five completed calendar quarters) to establish a claim.

Reason for Separation

You must have lost your job through no fault of your own, such as a layoff or company closure. Quitting for good cause may also qualify.

Ready, Willing, and Able

You must be actively seeking work, and be ready, willing, and able to accept suitable employment each week you claim benefits.

Note: This is a simplified overview. The NYS Department of Labor makes the final determination on all claims.

Benefit Estimator

Your weekly benefit rate is generally calculated as 1/26th of your earnings in the highest-paid quarter of your base period. Enter your total earnings from your highest quarter below to get an estimate.

Your Estimated Weekly Benefit:

$0

How to Apply

Follow these steps to file a new claim for unemployment benefits in New York. The quickest way to apply is online.

Gather Your Documents

You will need your Social Security number, driver license or Motor Vehicle ID card number, complete mailing address, and work history for the last 18 months (employer names, addresses, and dates of employment).

Apply Online or by Phone

The fastest and easiest way is to apply online at the NYS Department of Labor website. You can also apply by calling the Telephone Claim Center at (888) 209-8124.

Certify for Benefits Weekly

After you apply, you must claim benefits for each week you are unemployed. This is called "certifying." You must do this every week online or by phone to receive payment.

Frequently Asked Questions

New York State has an unpaid waiting week. This means you will not be paid for the first full week you are found eligible for benefits. You must still claim benefits for this week. You will begin receiving payments for the second week you certify and meet the eligibility requirements.

Yes, you may be eligible for partial benefits if you work less than four days a week and earn $504 or less. Benefits are reduced based on the number of days you worked in a week, not the amount you earned. For each day you work, your weekly benefit rate is reduced by one-quarter.

Benefits are paid either through a direct deposit to your bank account or a debit card. You can choose your preferred payment method when you file your claim. Payments are typically issued two to three business days after you certify for benefits weekly.