Can you make monthly payments on used cars?

Yes, you can make monthly payments on used cars. When you purchase a used car through financing, you typically take out an auto loan from a lender, such as a bank, credit union, or dealership's financing department. This loan allows you to spread the cost of the used car over a period of time, often in the form of monthly payments.

Here are some key considerations when making monthly payments on a used car:

Interest Rate: The interest rate on your auto loan will affect the total cost of the car. A lower interest rate can result in lower monthly payments and reduced overall expenses.

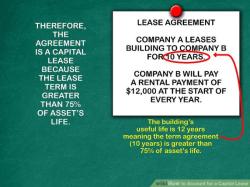

Loan Term: The loan term, or the length of the loan, can vary. Common loan terms for used cars are 36, 48, 60, or 72 months. Longer loan terms may lead to lower monthly payments but could result in higher overall interest costs.

Down Payment: Making a larger down payment upfront can reduce the amount you need to finance, potentially lowering your monthly payments and the total interest paid.

Budget: Consider your monthly budget and ensure that the car payment fits comfortably within it. It's important to account for not only the car payment but also related expenses like insurance, maintenance, and fuel.

Credit Score: Your credit score plays a significant role in determining the interest rate you qualify for. A higher credit score can lead to more favorable loan terms.

Preapproval: Before shopping for a used car, consider getting preapproved for an auto loan from a lender. Preapproval can give you a better idea of the loan amount you qualify for and the interest rate you can expect.

Negotiation: Negotiate the terms of the auto loan, including the interest rate and loan term, with the lender. Sometimes, you may be able to secure a better deal through negotiation.

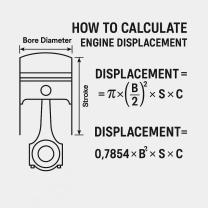

Total Cost: Calculate the total cost of the car over the life of the loan, including interest payments. This will give you a clear understanding of the financial commitment.

Early Payoff: If possible, consider making extra payments or paying off the loan early to reduce the overall interest expense.

It's important to shop around for financing offers and consider your financial situation carefully before committing to a used car loan. Additionally, read and understand the terms of the loan agreement, including any fees or penalties for early payment.

The monthly payments for a used car will vary depending on a number of factors, including the price of the car, the down payment, the interest rate, and the length of the loan term. However, there are a number of ways to make monthly payments for a used car more affordable.

Financing options for used cars:

There are a number of different financing options available for used cars. You can finance a used car through a bank, credit union, or car dealership. You can also get a loan from a private lender, such as a family member or friend.

How to make monthly payments for a used car more affordable:

Here are a few tips on how to make monthly payments for a used car more affordable:

- Make a large down payment. The larger the down payment, the lower the monthly payments will be.

- Get a shorter loan term. A shorter loan term will result in higher monthly payments, but you will pay less interest over the life of the loan.

- Shop around for the best interest rate. Compare interest rates from different lenders before you choose a loan.

- Consider refinancing your loan. If you have good credit, you may be able to refinance your loan at a lower interest rate.

Affordable auto ownership:

There are a number of ways to make auto ownership more affordable. Here are a few tips:

- Buy a used car. Used cars are typically much less expensive than new cars.

- Get insurance quotes from multiple companies. Compare insurance quotes from different companies before you choose a policy.

- Maintain your car regularly. Regular maintenance can help to prevent costly repairs down the road.

- Drive carefully. Driving carefully can help to reduce fuel costs and insurance premiums.

By following these tips, you can make monthly payments for a used car more affordable and make auto ownership more affordable.

Here are some additional tips:

- Consider buying a less expensive car. There are many affordable and reliable used cars on the market.

- Buy from a private seller. Private sellers often sell cars for less than dealerships.

- Negotiate the price. Don't be afraid to negotiate the price of the car with the seller.

- Get a pre-purchase inspection. This will help to identify any potential problems with the car before you buy it.

- Be prepared to walk away. If you don't feel comfortable with the deal, walk away. There are many other used cars on the market.